Key Findings

- Analysing unstructured VoC feedback alongside numerical scores will reveal key detail about critical issues that customers experience and highlight their impact scores

- When analysed at scale, feedback data reveals the root cause for customer issues, detailing risk factors causing churn and giving organisations the opportunity to detect operational bottlenecks, streamline processes and improve customer retention.

- A robust customer life cycle framework that is specifically trained to the complexities of your industry is critical for a successful customer experience improvement initiative

- Reporting consistent, relevent, and timely information to key stakeholders is the critical link between identifying and acting on customer pain points.

- Recognising the interconnected nature of customer experience for your industry (i.e. service, value, time for insurance) and investigate the relationships between these concrete stages will help your organisation identify issues that transcend individual interaction points.

Read the summary of the Hastings Direct VoC feedback analysis here.

Introduction

As an annual renewal product provider, customer longevity in your business is a priority. A customer’s need for cover changes as their lifestyle does, and as they move through different stages of the buying journey with your offering. In insurance for example, a customer who is looking for quotes to compare different insurance policies, for example, has different needs than one who is deciding whether to renew or switch providers.

Touchpoint Group’s AI Customer Analytics tool can analyse large volumes of unstructured text data such as VoC feedback through to public review comments. This, alongside a specially designed Customer Life Cycle Analysis specific to Touchpoint Group, will quickly identify key driving factors that contribute to customer churn, reveal bottlenecks in internal systems that have a customer facing impact, and uncover and leverage the positive factors that keep customers renewing their policies. In this case study, we’ll apply the Insurance Customer Life Cycle Analysis to publicly available review data to help Hastings Direct gain greater insight into potential performance improvements.

Focus Business: Hastings Direct (UK)

Hastings Direct Services Ltd. provides vehicle and home insurance, personal loans, as well as add-on services such as breakdown cover and substitute vehicle cover. Founded in 1996, Hastings has a revenue of £741.3 million and over 2.7 million active customer policies*. This case study focuses on:

Publicly available anonymised review data for all Hastings Direct products

59,168 reviews containing unstructured text feedback posted in a 12 month period**

Data containing comments, compiled from TrustPilot and Clearsurance for a selection of companies in the United States and the United Kingdom

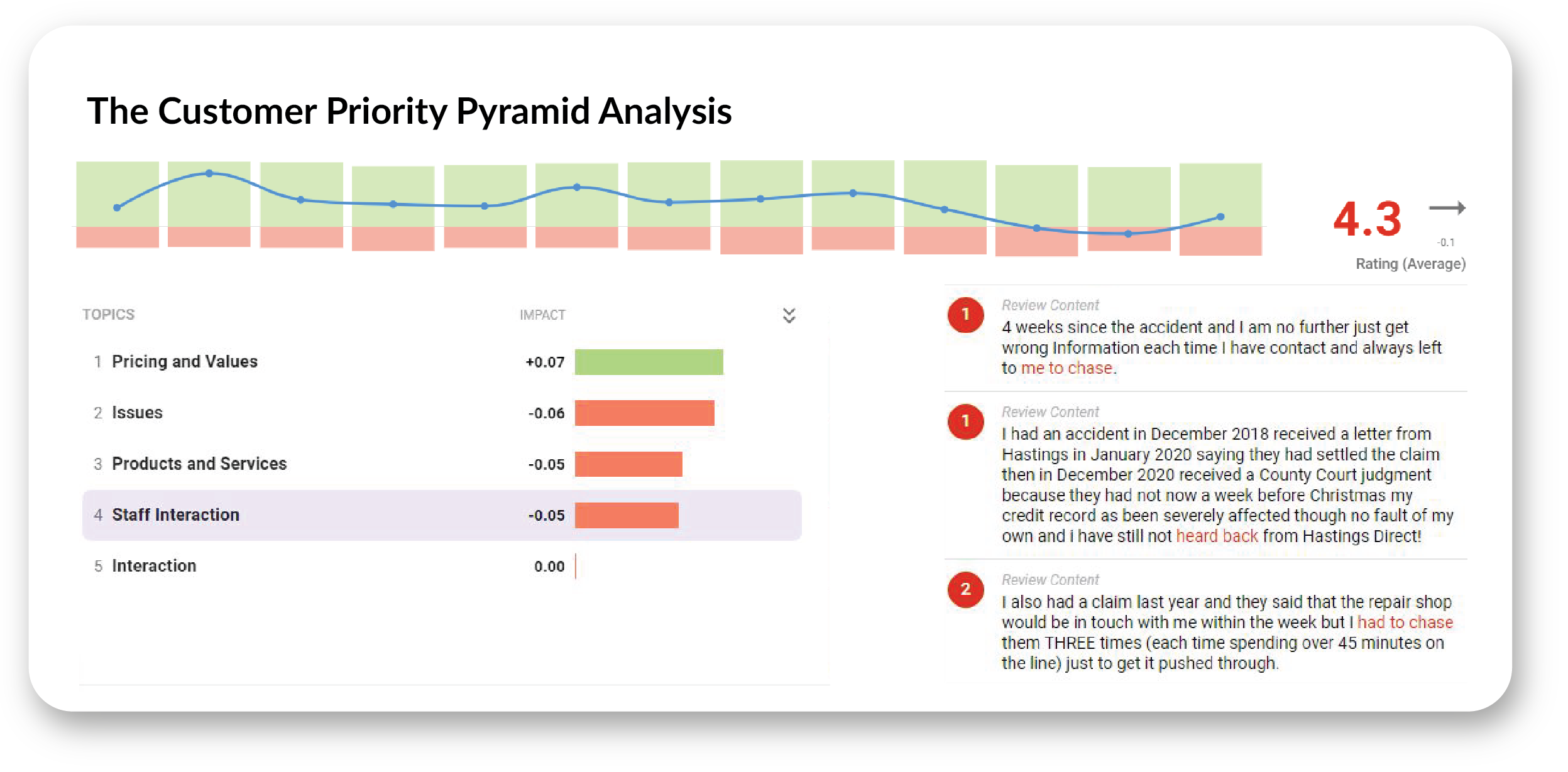

To determine the cause behind Hastings Direct’s score of 4.3, against the average sample score of 4.5 out of 5.

Key Objectives:

- Trend Analysis: Investigate strengths and weaknesses in trends and customer segments; rank them by impact to identify priorities and highlight red flags.

- The Insurance Customer Life Cycle: a unique framework which gives a clear picture of where issues arise within customer interactions and details opportunities to improve customer experience.

- Deep Dive Investigation: Identify granular insight behind issues and find ways to streamline internal processes, identify bottlenecks and create efficiencies that drive improved conversion and revenue.

- The Customer Relationship Pyramid: Identify the relationships between facets of a customer’s interaction with your business and areas of improvement

Identify strengths and weaknesses in your feedback data’s trends and segments to drive focus.

Analysing trends allows you to leverage date tracking to understand how customer issues change over time, giving your team the opportunity to solve issues before they become systemic problems, as well as providing a baseline to help inform decisions about what improvements are likely to have the biggest impact.

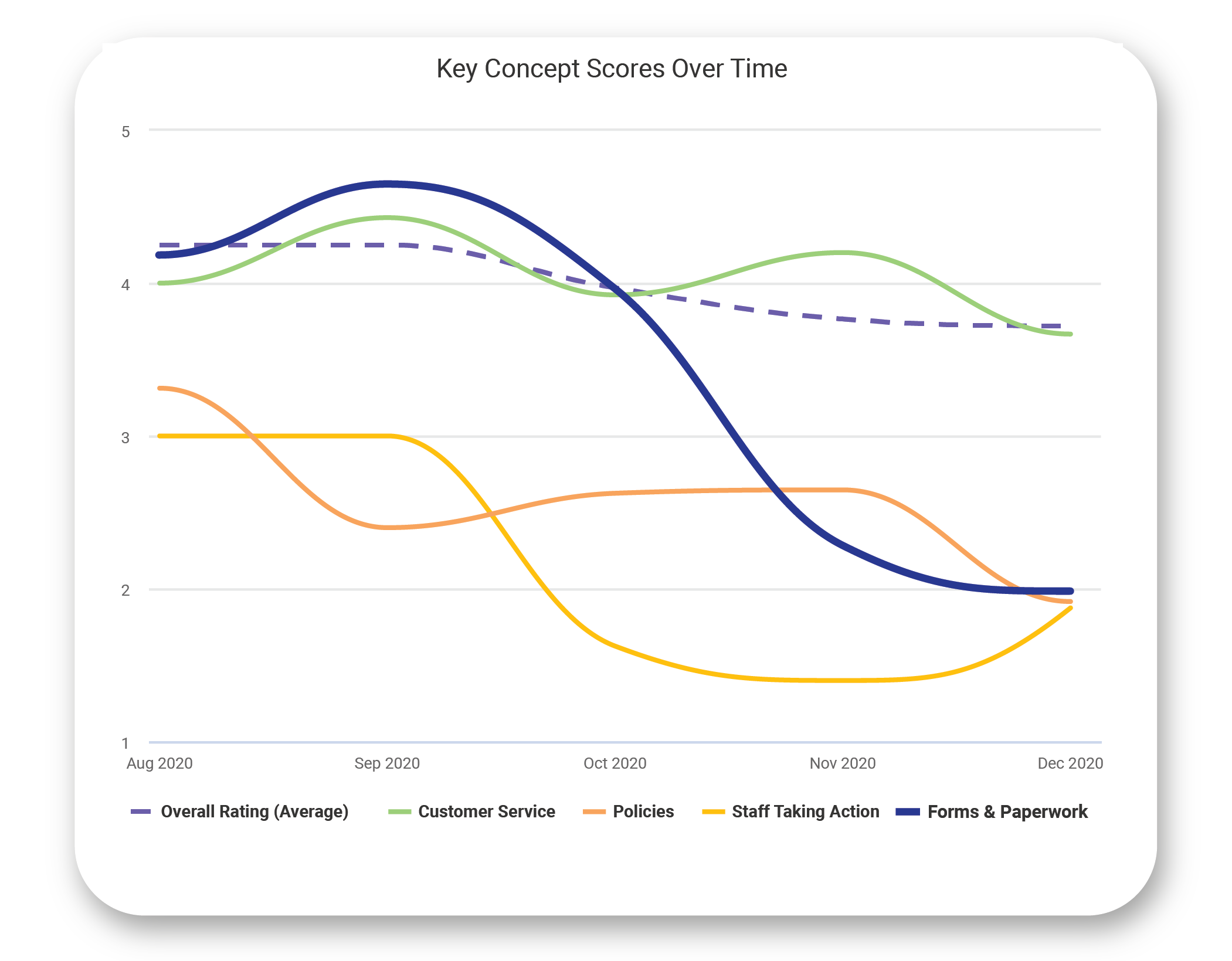

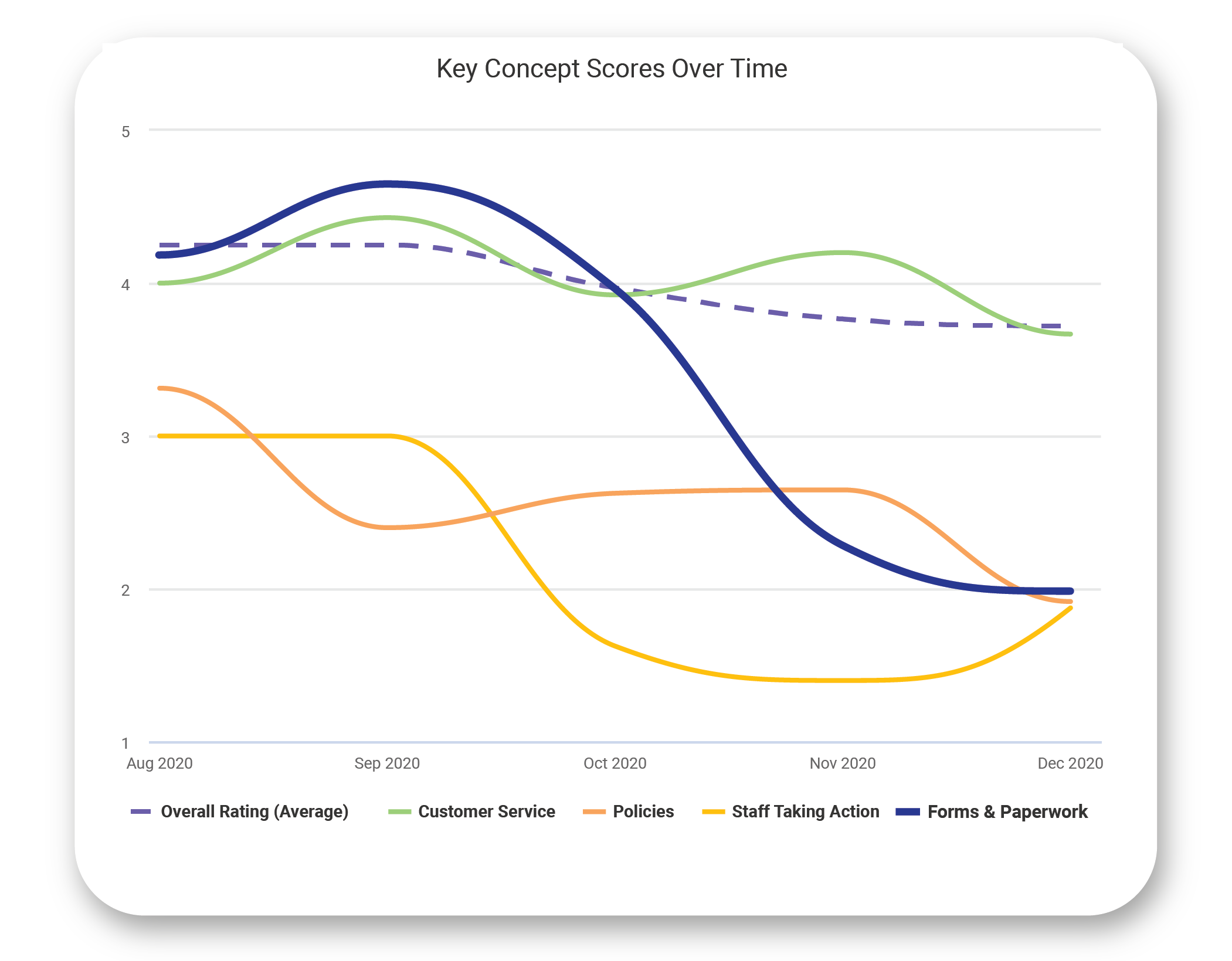

Here we investigate a selection of key concepts from Hastings Direct’s customer feedback to get a high-level understanding of how their experience has changed over the last six months.

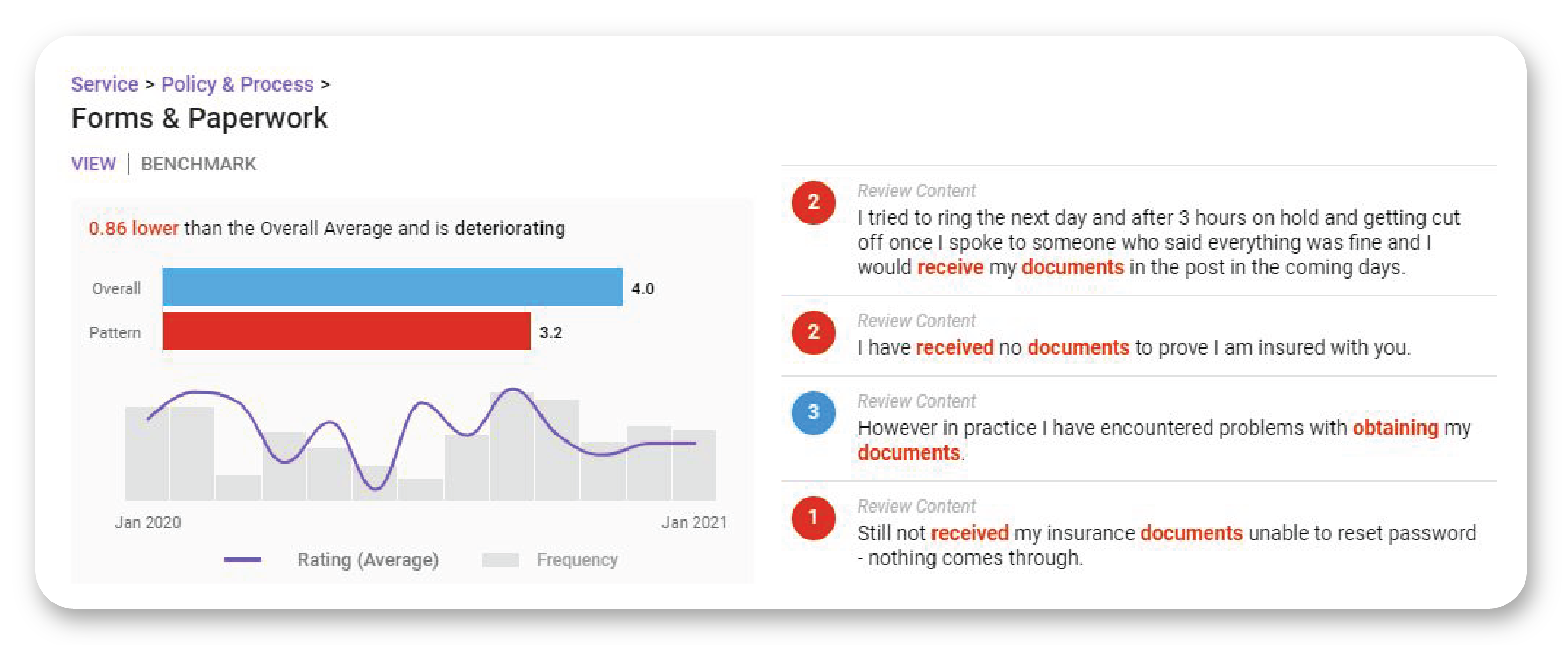

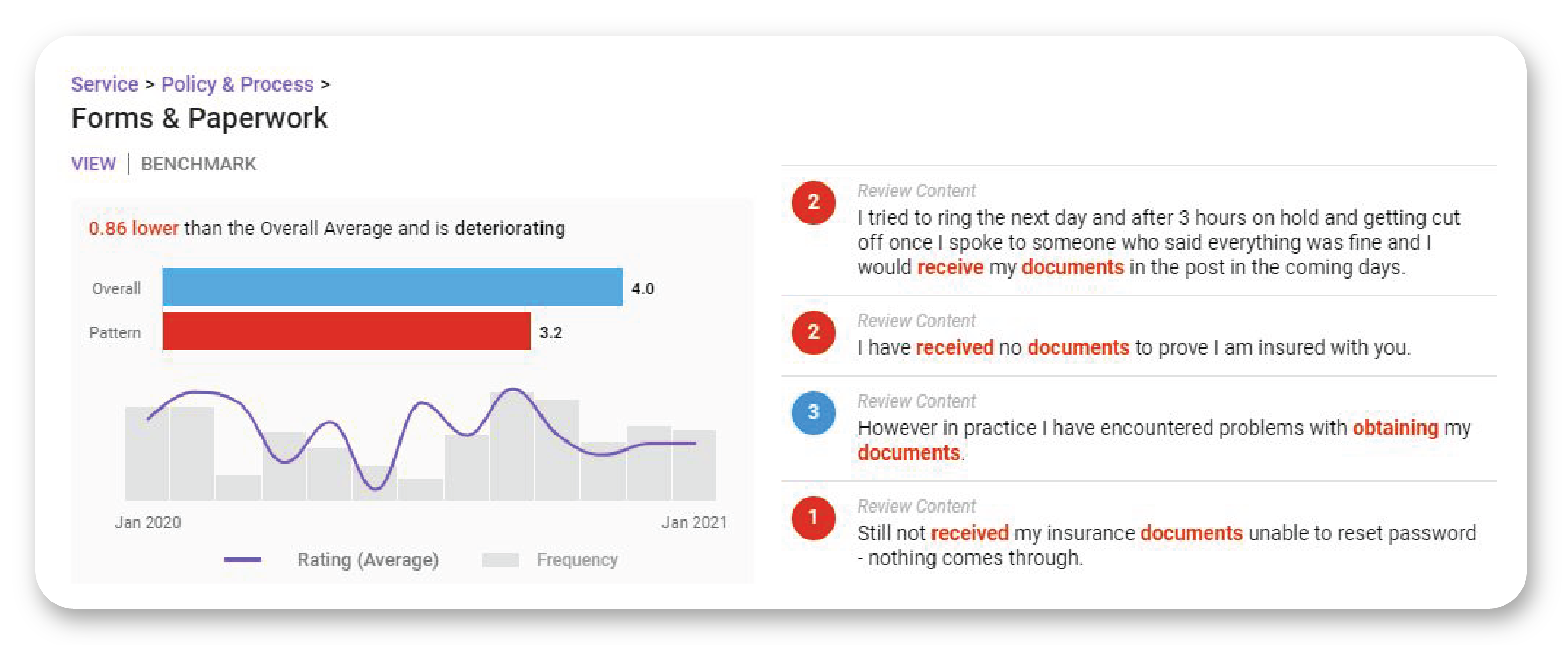

We can see that customers discussing “paperwork” rate Hastings Direct an average of 4.4 in the months leading up to September, but this score drops dramatically to an average of 2.2 in the months of October through December. Diving further into the feedback for these months - the issue increases in frequency starting in August, and is related to the mailing of physical copies of documents.

We can track positive topics we want to keep an eye on as well - you can see that despite the issues customers are having receiving their documents, they remain pleased with Hastings Direct’s customer service, and scores for this topic remain at or above Hastings Direct’s average score as well. As a critical aspect to maintaining customer retention, the Insurance Customer Life Cycle analysis includes a focus across all customer interaction points to ensure that issues are picked up quickly and customers maintain a positive and trusting impression of your company.

Recommendation

- Use a trend analysis to establish benchmarks and identify changes in customer feedback before they begin to have a negative impact. Track a vast selection of topics in different categories (such as engagement, processes, products, and more) to give breadth of the issue and detect correlation between customer experience and operations.

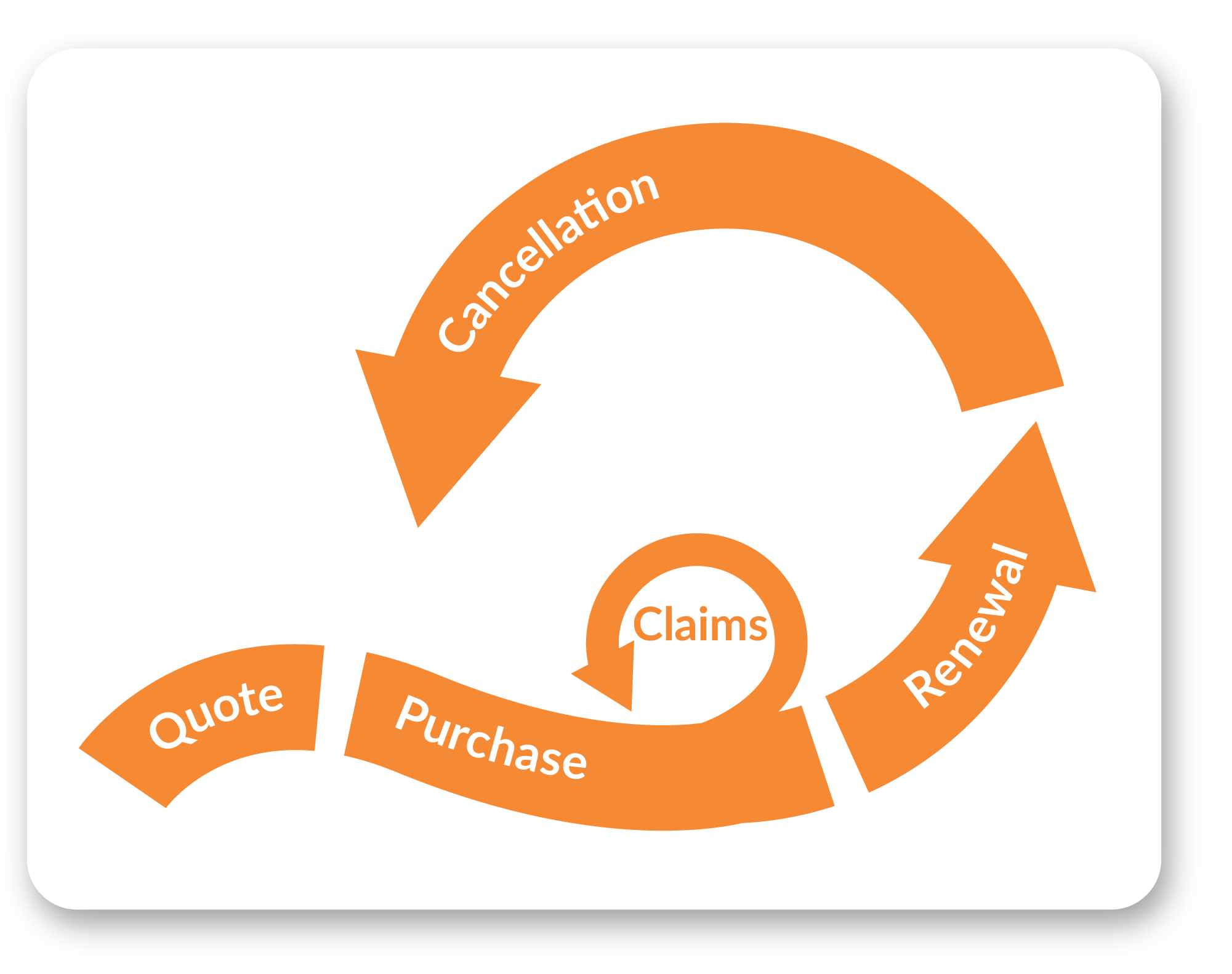

Use the Insurance Customer Life Cycle Analysis to identify bottlenecks, opportunities, and key stages of customer retention

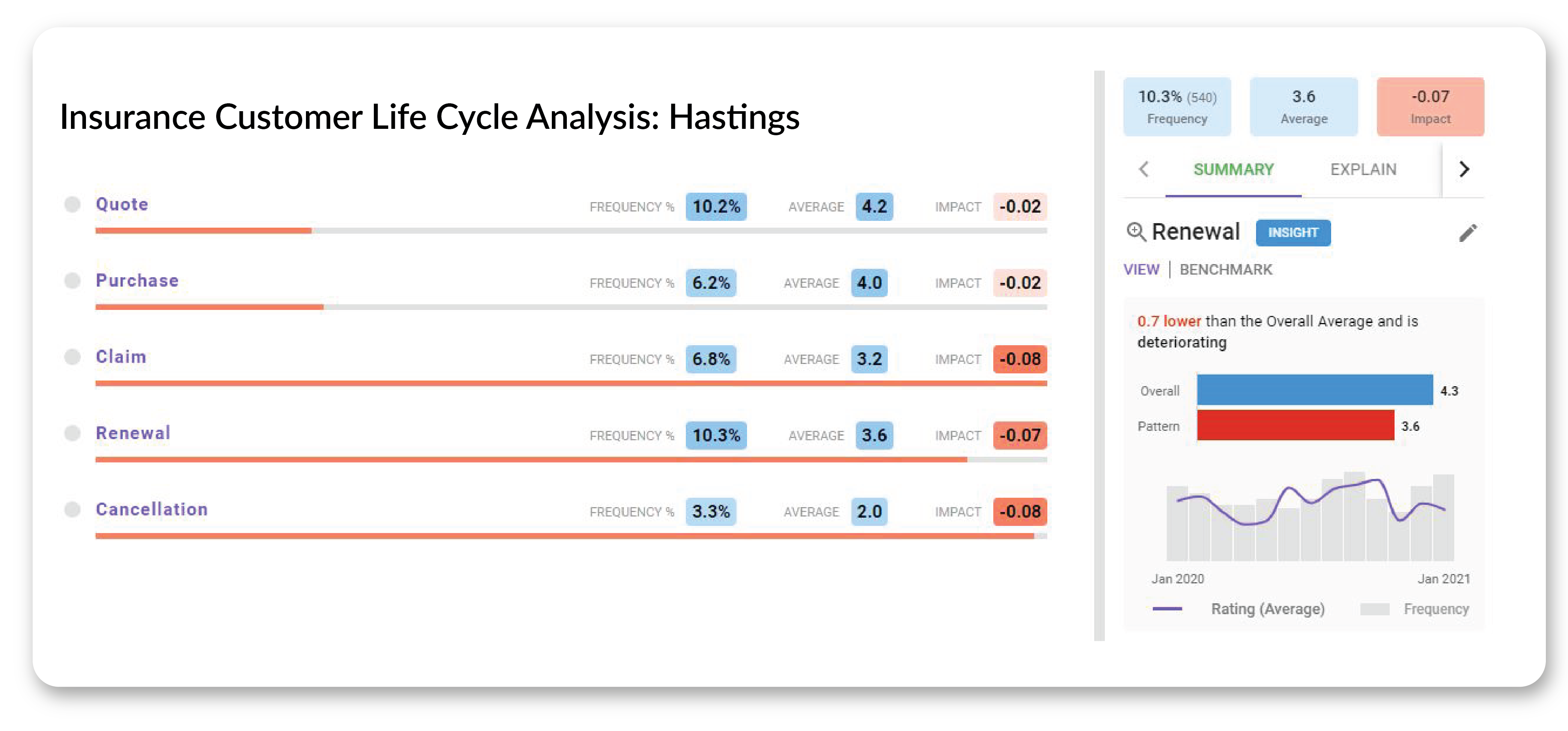

Touchpoint Group has developed this framework as a structured way to address the key focus areas that yield the best results for our clients in the Insurance industry, focusing on the five discrete stages of a policy holder’s relationship with their insurance provider.

Breaking down customer feedback into these classification stages helps your organisation - and the stakeholders who preside over each aspect - interpret feedback and implement solutions efficiently for minimal customer disruption. It also means that departmental stakeholders aren’t bogged down with information that isn’t relevant to them.

Recommendation

- Use a systemised framework for analysis that is designed specifically for your industry to ensure you are capturing and leveraging the relationships between categories and subtopics that customer pain points have across the customer journey.

Streamline and systemise high-impact areas of the customer life cycle process to drive retention and improve trust

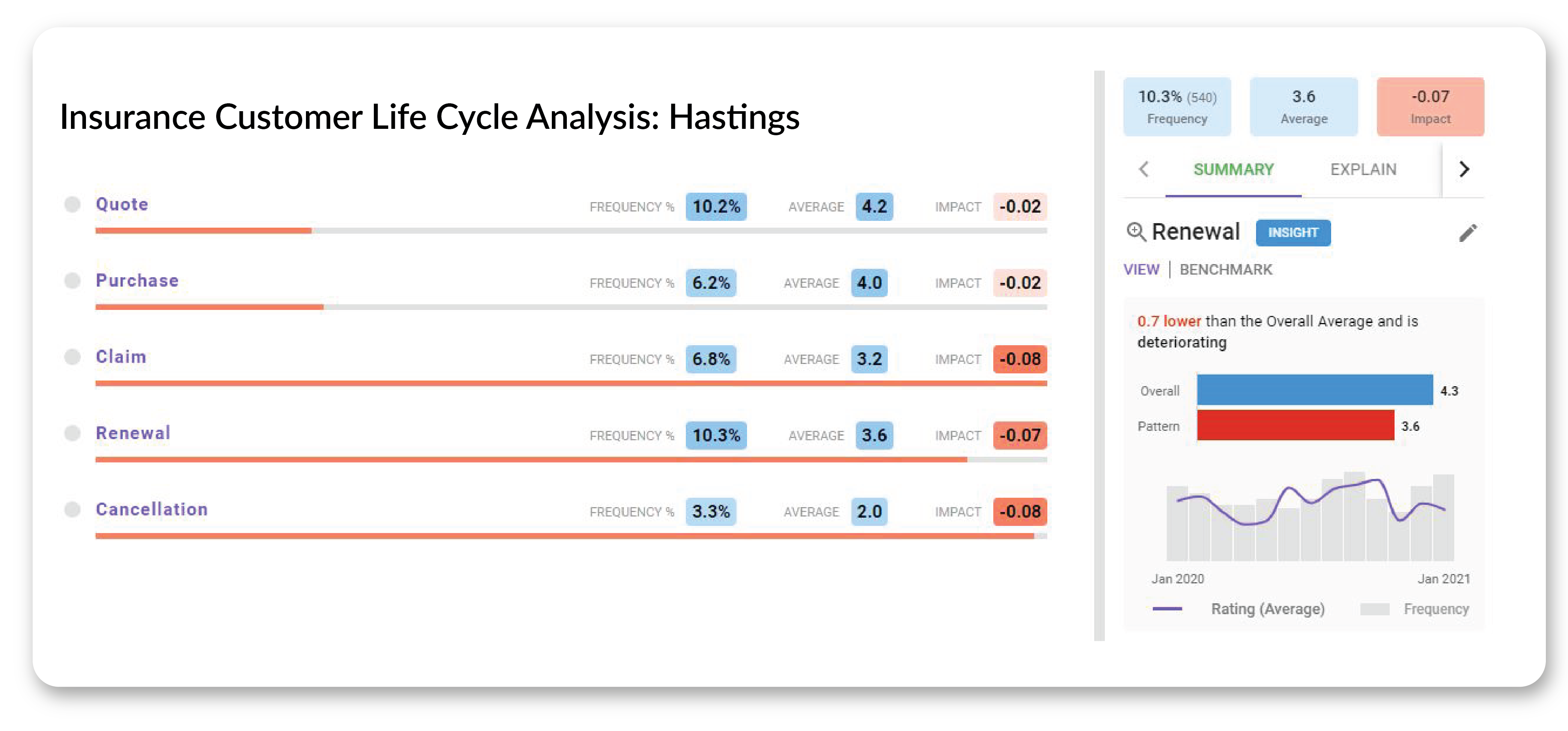

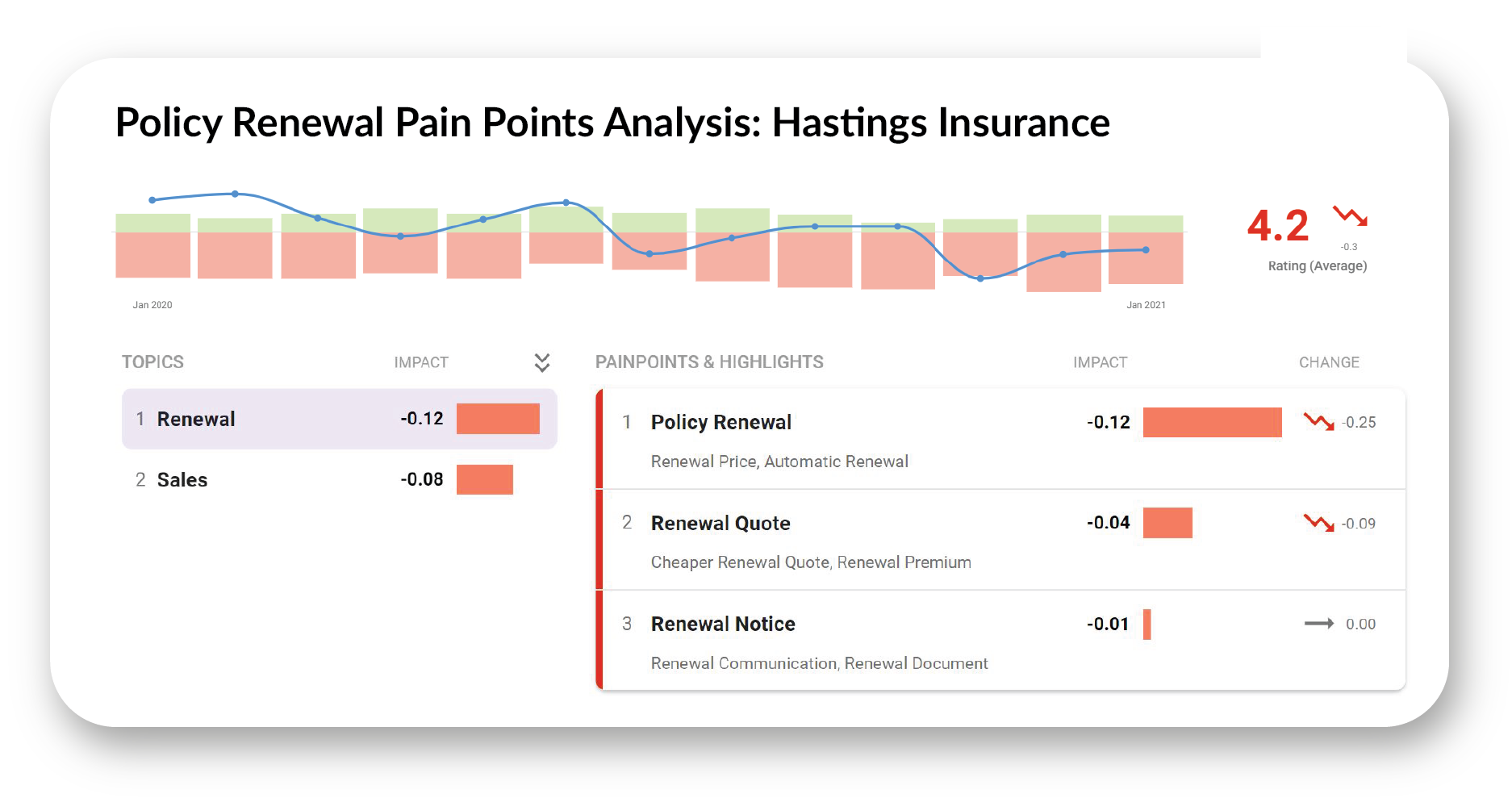

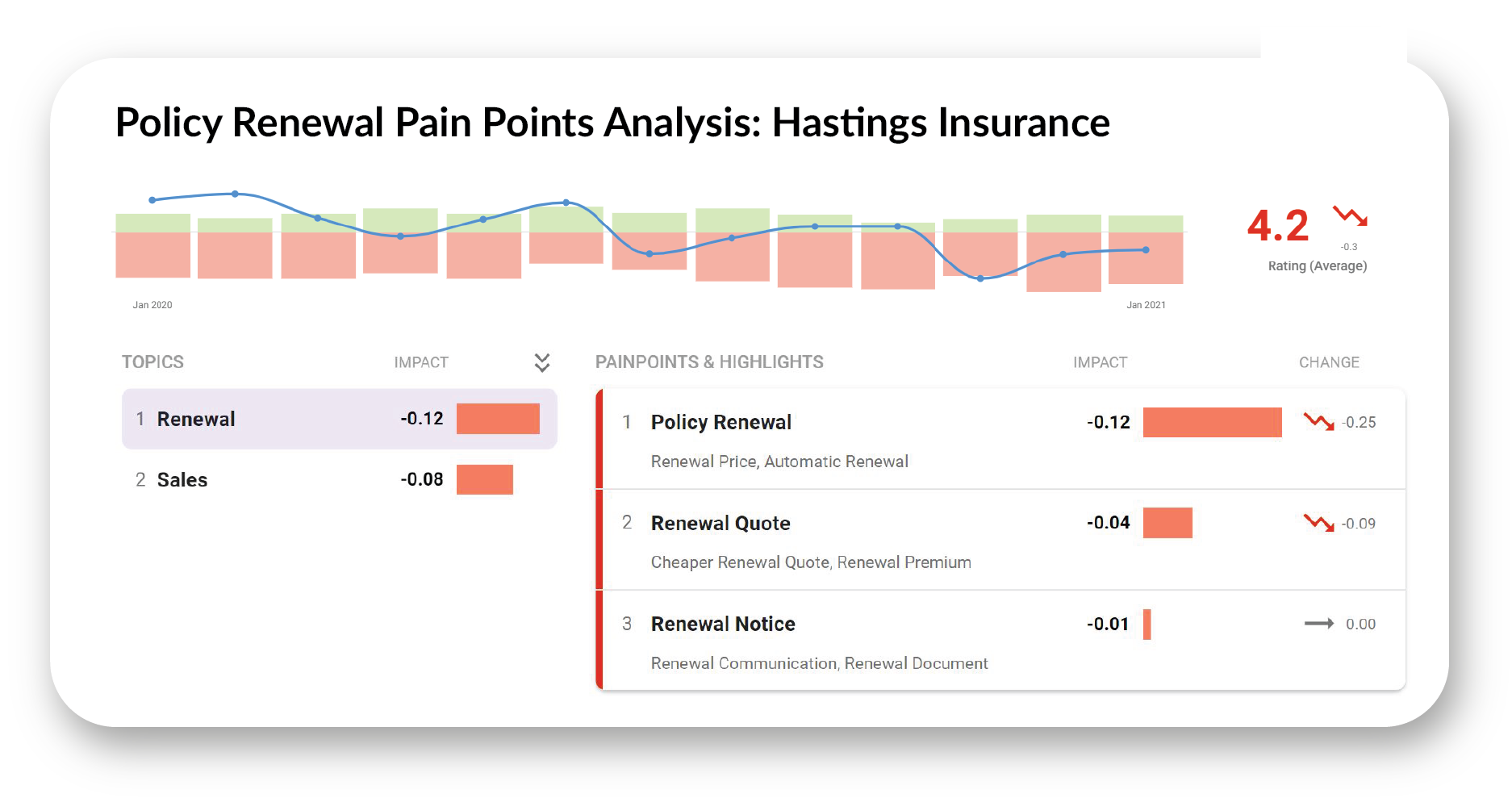

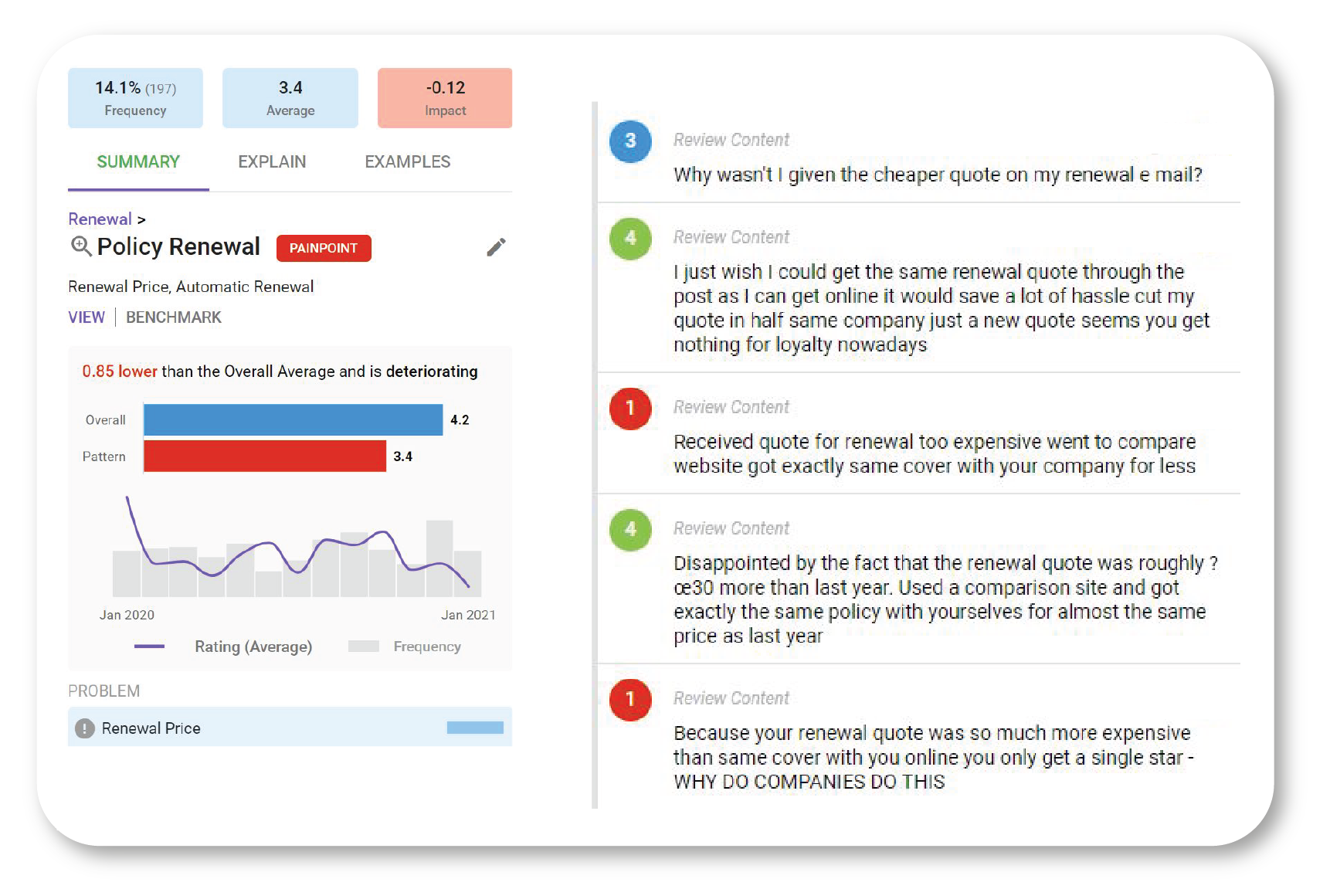

In addition to gaining a high-level understanding of performance across all aspects of your customer’s relationship with your organisation which is useful for measuring brand trust and overall performance, the Insurance Customer Life Cycle Analysis provides a “deep dive” into each discrete stage. For example, we can investigate subtopics within Renewals to identify the detail behind specific issues customers experience and how these issues contribute to churn.

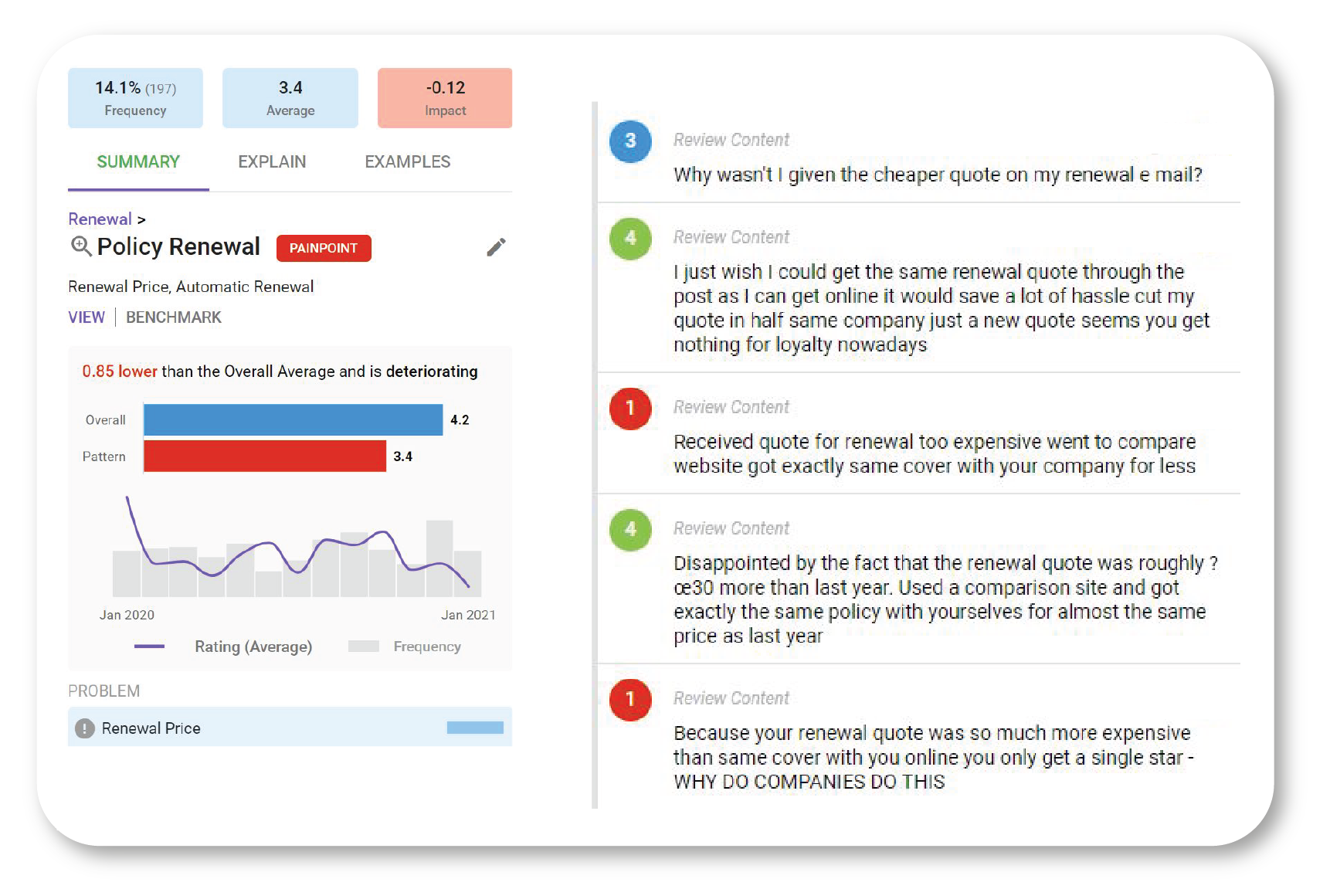

From here, we can explore the individual aspects of the renewal process in subtopics, and identify opportunities to streamline and provide operational efficiency as well as improving experience for customers. Issues that customers experience just as they’re preparing to renew their policies can easily sway a decision even if your service has been flawless up to this point. For example, we see a predictable trend as Hastings Direct customers are unpleasantly surprised that their premiums have gone up - but we can also identify an issue within this topic:

Some customers are being sent multiple renewal quotes at different prices, and are, as a result, questioning whether they want to continue to trust Hastings Direct to provide a competitive premium. By linking these customer reviews with your CMS, Touchpoint Group can identify the individual customer segments impacted so that communications around renewal prices can be streamlined and clarified for customers.

Recommendation

- Use customer feedback to direct and quantify decisions about how improvements can be made, and identify the relationships that issues have across the customer journey

Leverage the relationship between your brand, product, and service to drive retention where it counts for your business

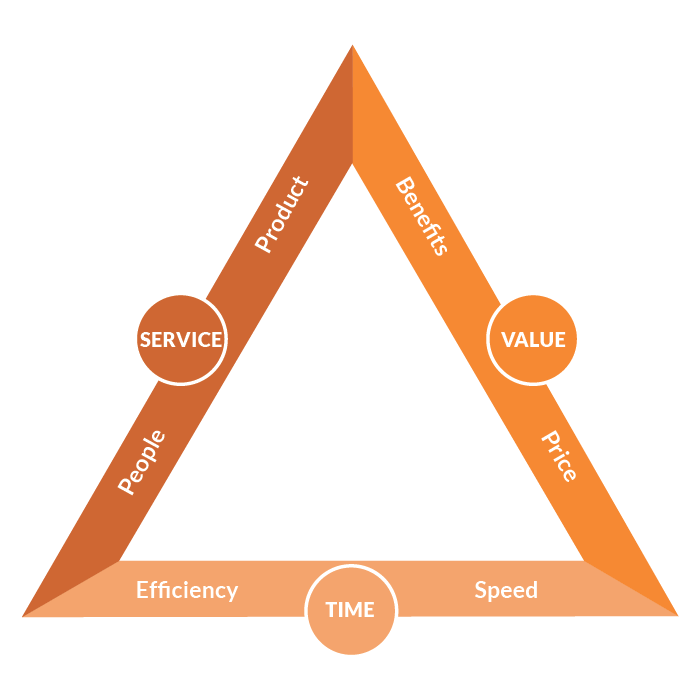

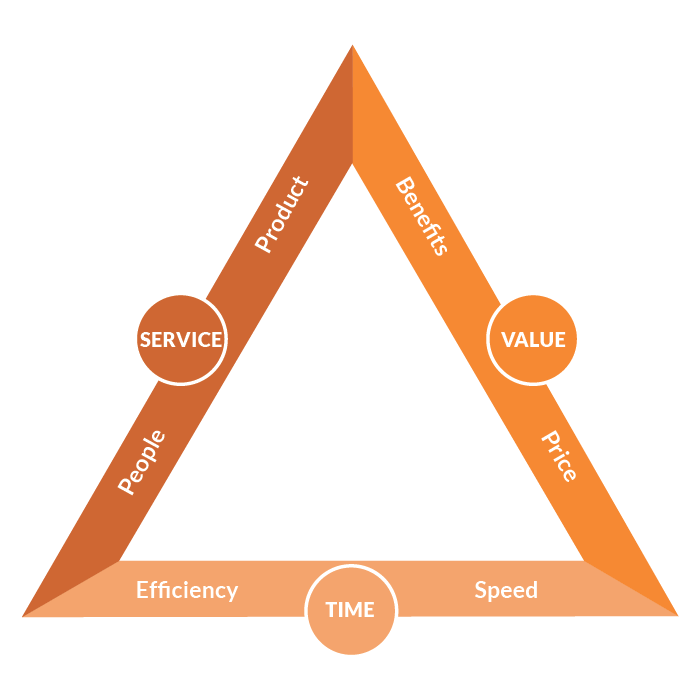

Breaking customer interaction and experience down into concrete stages helps your organisation systematically identify and resolve customer pain points, and tracking issues over time not only provides a reference point, it will also help you measure the success of improvements you have implemented by area. However, it is important to recognise the interconnected nature of customer experience - an investigation into the relationships between these concrete stages will help your organisation identify issues that transcend individual interaction points. A customer’s overall experience with your organisation can be broken down into three related parts:

An insurance customer’s three priorities when evaluating your organisation are ‘Service’, ‘Time’, and ‘Value’. By understanding the relationships between these priorities, you can identify and measure brand trust, understanding the key differentiating factors that your customers believe sets your organisation apart - either positively or negatively. Each one of these priorities overlaps with the other in order to create a complete picture for your customers.

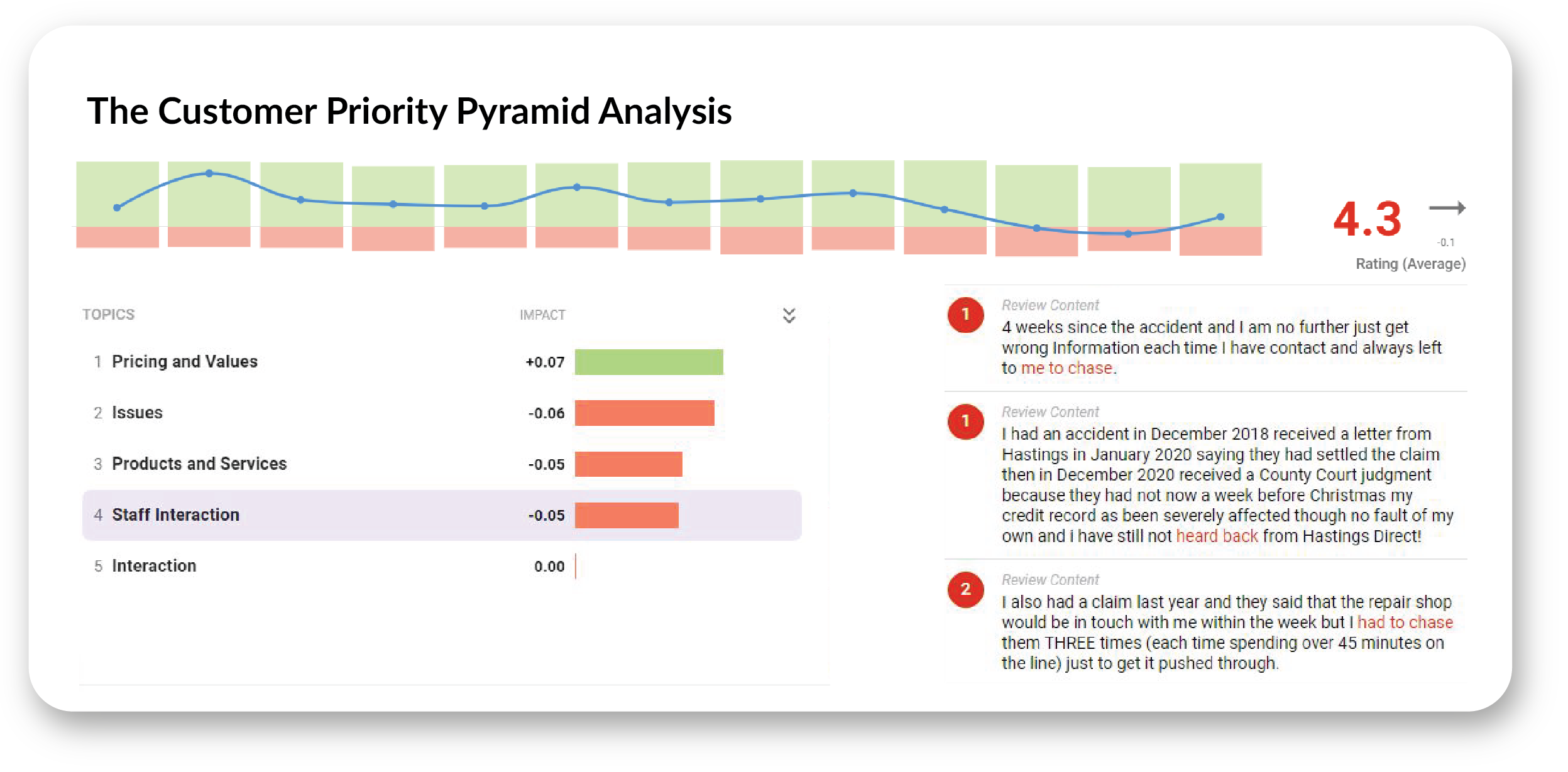

In this example, the ‘People’ component of ‘Service’ (the customer-facing call centre representatives and staff your customers interact with) and the ‘Efficiency’ component of ‘Time’ (the customer’s impression of how quickly their needs are met) overlap negatively for Hastings Direct - customers do not feel their interactions with staff are efficient, and they frequently report having to chase staff and call repeatedly to get updates.

While Hastings Direct performs extremely well in the Value priorities aspect of the pyramid, inefficiencies in the call centre rate Hastings Direct over two points lower than average - a significant margin for improvement. From here, We can further investigate the specific aspects of the call centre protocols that are causing customers to have this impression so that we can resolve them, repair customers’ impressions, and improve in-market brand trust by improving public reviews.

Recommendation

- Focus on customer solutions that provide a benefit for your business. Improving customer experience may sound vague, but streamlining inefficiencies will improve customer experience while also providing a business benefit.

Drive the right insights to the people who can fix them today.

Understanding the interactions your customers have with your business at each stage of the journey - from quote through to purchase, claims, renewals, and beyond, is critical to determining where you should focus your efforts for maximum revenue and retention. Additionally, ensuring that the right stakeholder has expedient access to the information they require will help them identify and resolve issues that customers face across all aspects of the customer journey, and proactively identify trends that may develop negatively so that they can be resolved before damaging your customer relationship or brand trust. Get in touch with our team of experts today to get started analysing your customer feedback data with Touchpoint Ipiphany.

*https://www.hastingsplc.com/about-us/who-we-are#:~:text=Founded%20in%201996%20in%20Bexhill,%2C%20Leicester%2C%20Gibraltar%20and%20London.

** The data used in this analysis was collected for a period of 12 months from January 2020 to 2021, from the public review sources Trustpilot and Clearsurance