Executive Summary

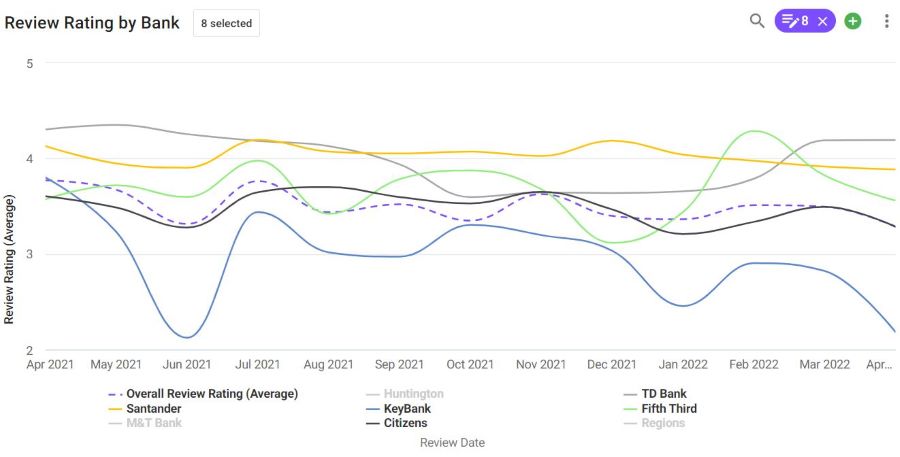

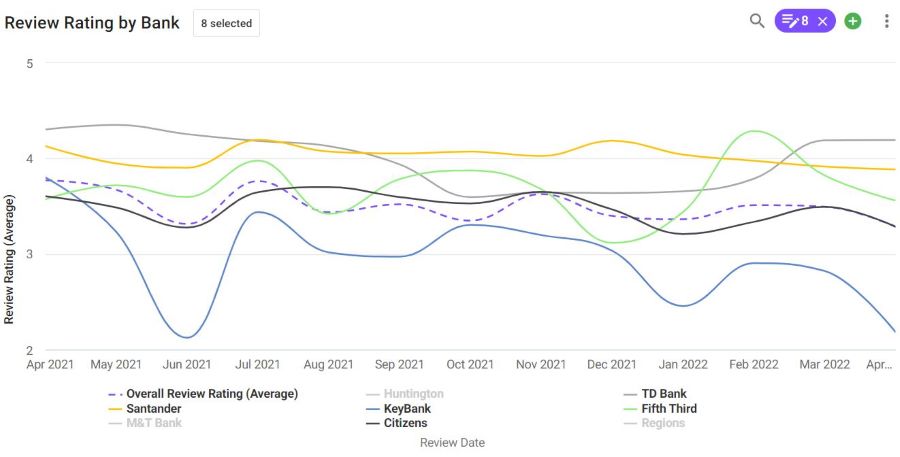

TD Bank has recovered well from the Oct 2021 - Feb 2022 drop in Engaged Customer Score (ECS).

Note: we covered the TD performance issues and start of the recovery in the March 2022 insights session.

M&T Bank were sitting above 3.5 ECS in April 2021 but have had a steady decline in their Engaged Customer Score since then. This reflects what can be a series of minor issues that continue to be either undetected or lacking priority that have the continued cumulative negative impact on customer experience and sentiment towards the app and bank. If the performance trend continues they are on track to go below 2.25 in May.

Deeper Dive Into The KeyBank Banking App Performance

KeyBank have had a tumultuous last 21 months with a big drop in postive customer sentiment in June 2021 but recovered very well in July showing they acted on the issue very quickly.

Another drop in January but a worrying trend of a gradual decline across time and a bigger drop in April which has brought the ECS rating down to around 2.2 which is a level where customers are very frustrated in general.

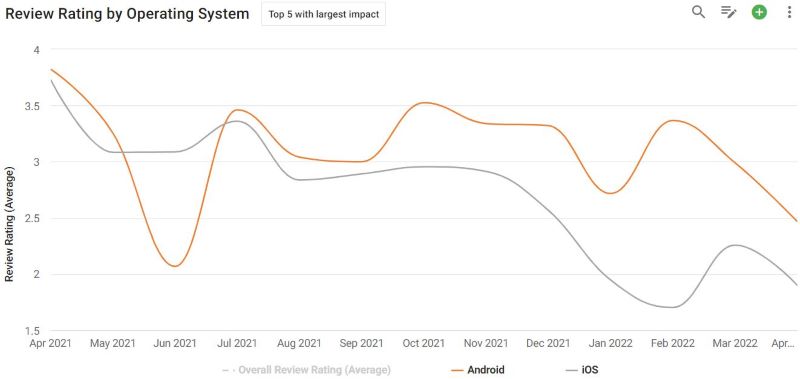

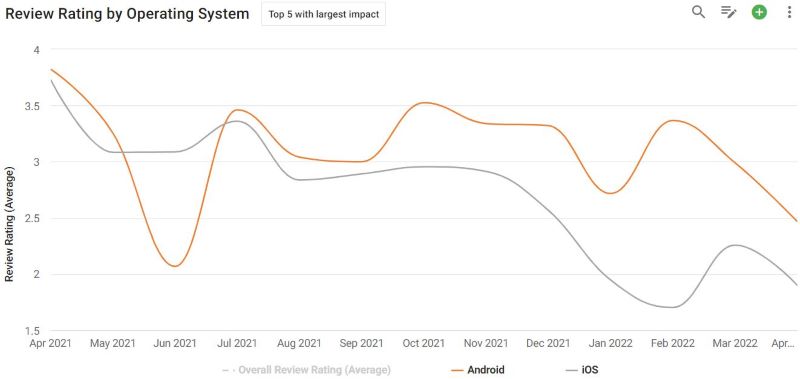

Looking at operating systems the trend is similar on both Android and iOS which shows it isn't an OS issue and indicates there are opportunities with both platforms to boost performance.

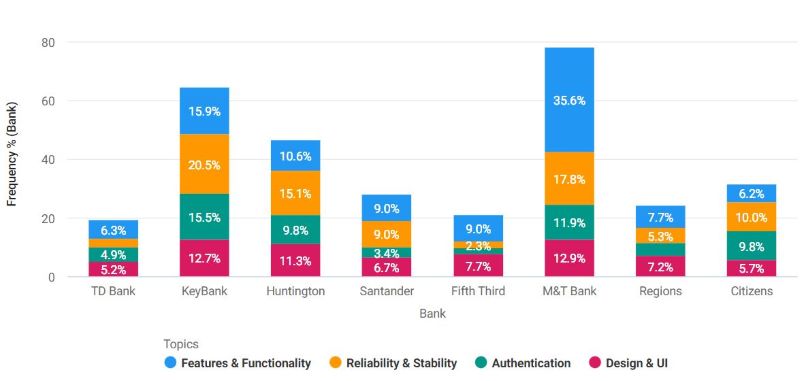

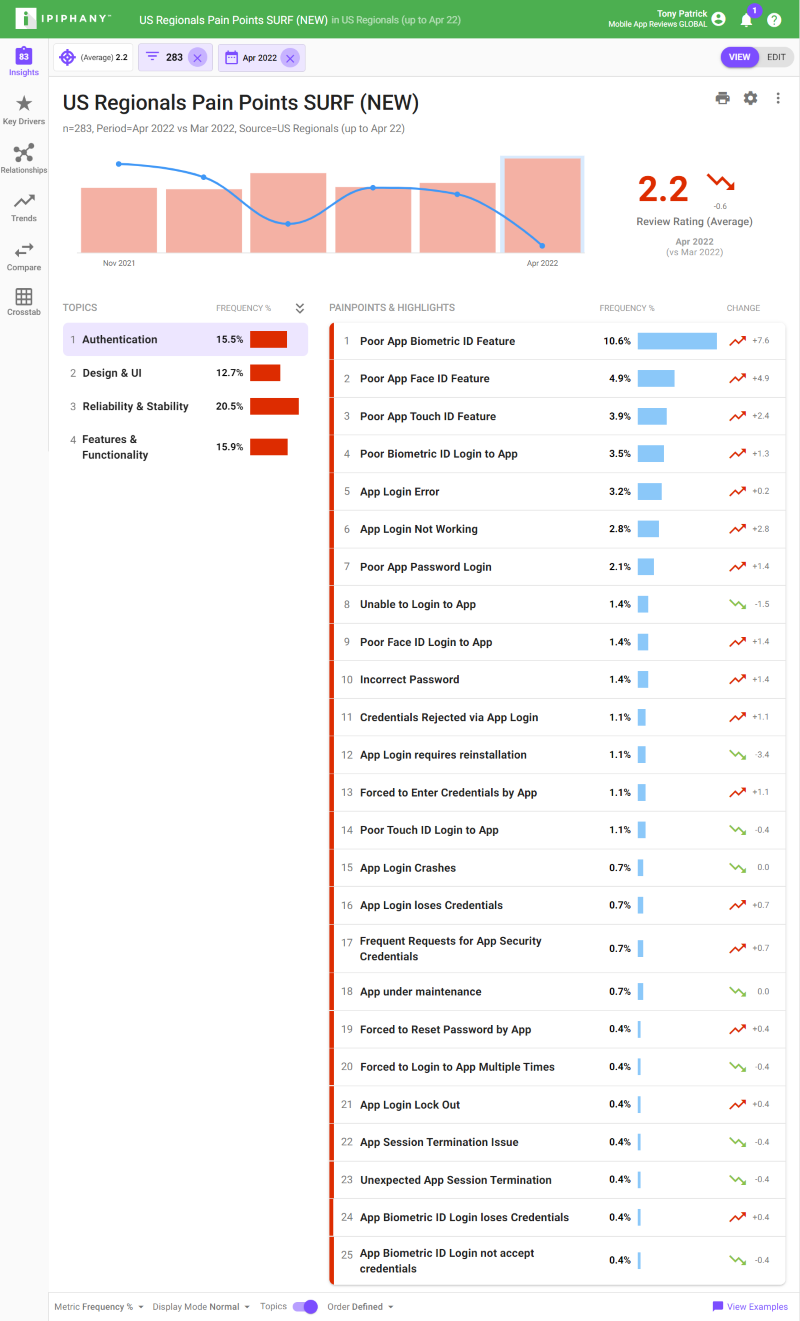

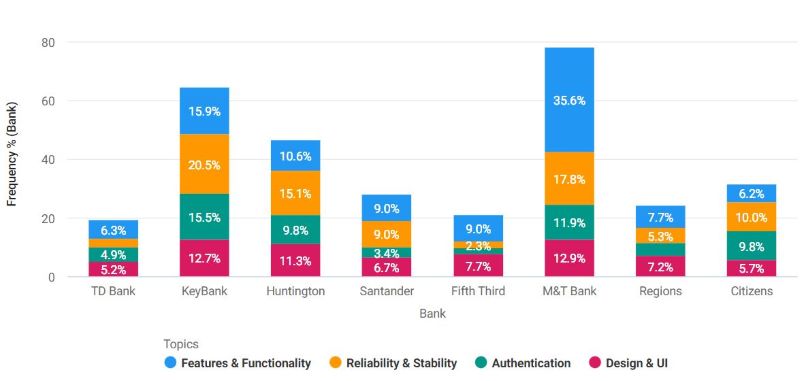

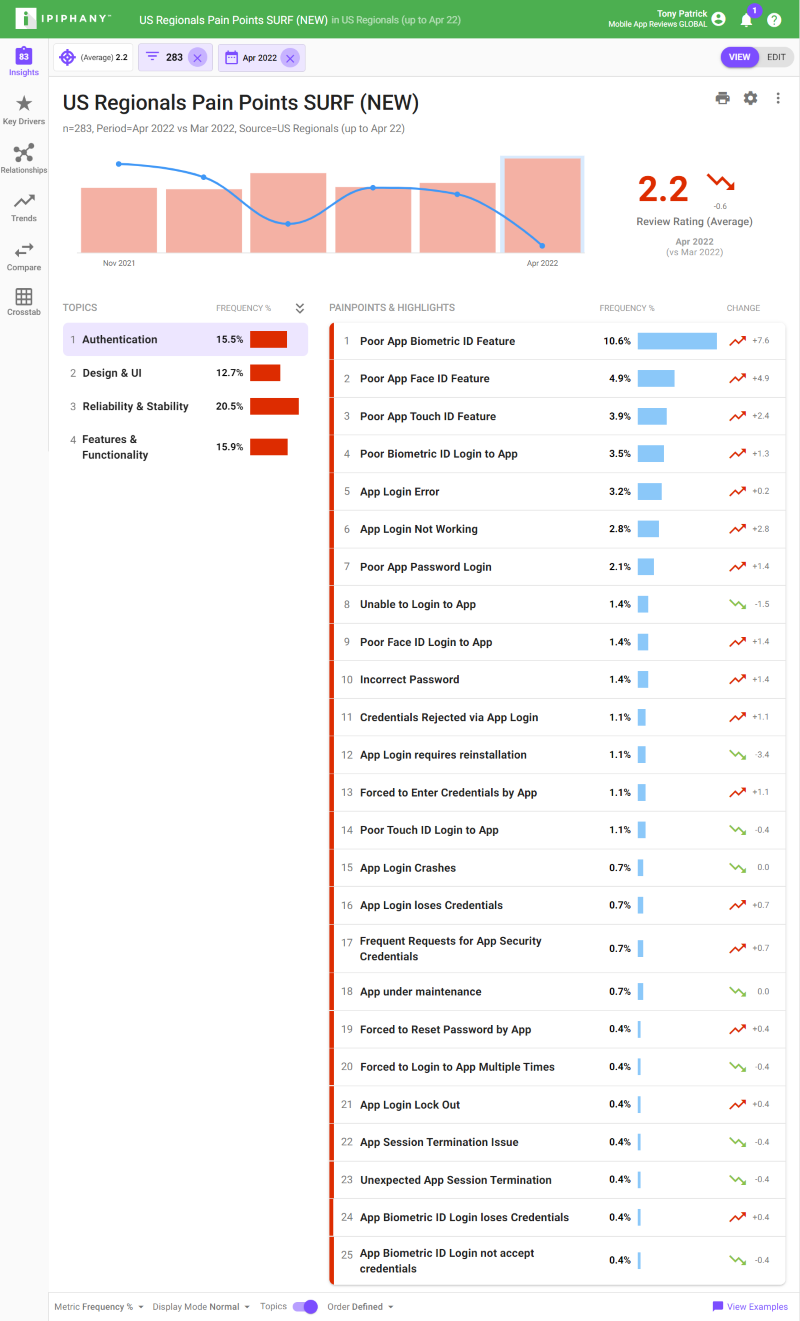

When we break it down to the SURF pillars (Security & Authentication, User Interface, Reliability and App Features) KeyBank have compounding issues across all four pillars.

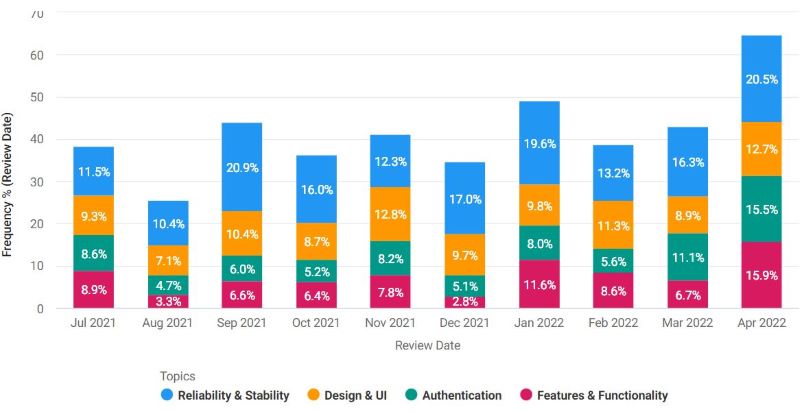

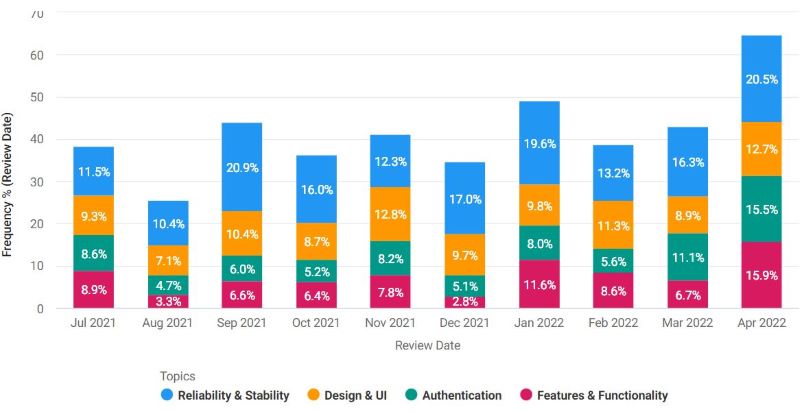

Comments relating to Security, Authenticaton & Reliability issues have doubled since February a large spike in April.

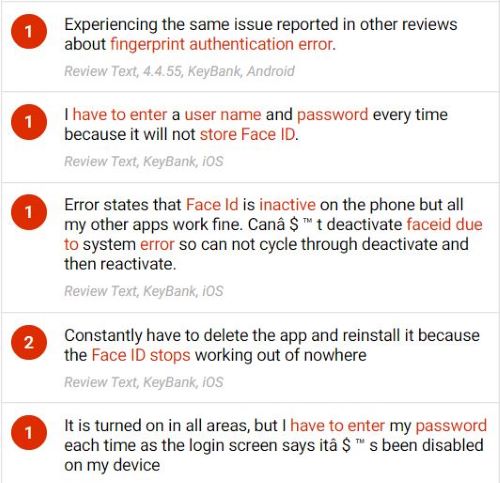

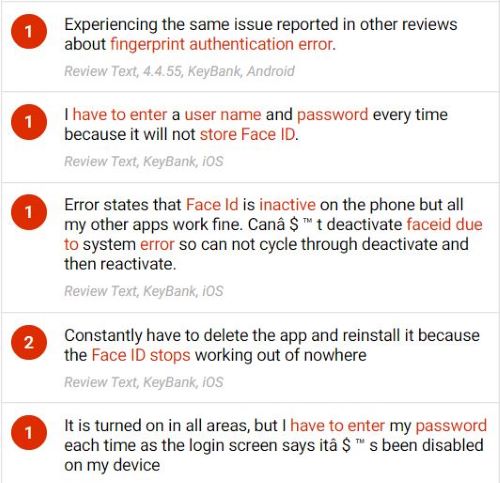

When we look deeper into reliability, comments relating to unreliable app have more than doubled, logging in issues are frequent and biometric ID features have been identified as a specific features that are impacting the customer experience.

Much of these issues seem to relate to app release 4.4.55 and this is an area they should prioritise.

Feel free to subscribe below for notifications of when we release the monthly performance snapshots relating to your market sector

Full Video Transcript:

00:00 Tony: Today we're looking at the US Regional Banks. You can see here that, that list of those, TD bank, and we're looking at KeyBank today, Santander, FifthThird, Regions, Huntington, M&T, and Citizens. Now, these are the ones we particularly look at. If you'd like us to focus on anything that, any bank that you're with, have a chat to us, but today let's have a look at these particular banks and see what they're up to.

I'll jump into there, and just see what's, let's have a look at this. There's a lot going on here, but I'll isolate some of these lines just to highlight what's going on. Now, as I mentioned with TD bank, I'll isolate that one. Just so you're aware of again, what the scores are, just to reiterate how important this actual score is. This is the Engaged Customer Score.

What that is, is anyone who in the App store or the Android store has given a score and a comment. So, these people are engaged. They've actually got something to say.

There's something important for them to say about your app. So, using that score, what that allows us to do is, to show really sensitive movements in the market.

If something is happening, if this score moves, we know something is going on, and so we can then detect what's going on with that as well. That's important to understand. Some of you may have seen, like the scores in the app stores for example, they will remain pretty much static over years because they're often based on years of data to produce that one point.

Actual changes in one month or a week will not change that score, or even over multiple months. If I look at this I can see that TD has had that drop that went into October, into February, but they did improve in March. We spoke about that last time. One of the great things they've done, they've had that improvement and they've maintained it.

Obviously there's probably things they can do to improve further, but that's a really nice example of what you can do if you focus and then do the right thing. So you're not just changing things that you think are wrong, you're changing things that customers think are wrong. Let's have a look at one of these other ones, which is M&T.

They were sitting above 3.5 in the middle of last year, but that decline is reasonably continuous. They had a bit of a jump up in October. There may have been some sort of major fix in some areas, but for me, what this means is that there's possibly not a major issue going on. There's probably, maybe, a handful of mid-level issues and it might be hard for the M&T team to detect. We can see that decline going across and we can see that's actually now below to around 2.25, and sort of bumping around with a few others at the bottom there, but if this continues, I expect that in May that M&T will go below 2.25.

That's obviously one of those things where across time you need to make sure you're not sort of dribbling away your score across time. One of the things I want to look at today is KeyBanks. They've had a bit of a, I suppose, a slightly tumultuous period, with a massive drop in June, which they actually did act on very fast, which was great, and a bit of a drop in January.

One of the things I can see here, this is a gradual decline across time as well. So, in particular has been a reasonable drop into April and it brings it down to that 2.2 level, which is, you know, you're sort of getting down to, you know, customers are pretty frustrated with what's going on.

Let's have a look then at what that looks like in terms of Android and iOS.

What we can see here is pretty much both of them are sort of running hand-in-hand. Although, iOS customers seem to be having a slightly worse experience.

We can see they sort of coincide. That drop into April has come across both versions, so it's important to understand that. It's not just one thing or it's not just an Android-specific thing in there as well. Let's jump forward and have a look at what the market looks like in April. Now, just a reminder of what we're looking at here.

This is our SURF analysis. It covers off the four key areas of Security and Authentication: so, logging in, Usability: which is our UI and design approach. Reliability: does it work as expected, and Functionality: are the actual features in your product working as expected.

Now, one of the things we'll see here is there's a few spikes in a few of these brands.

Remember, these are pain points, so lower is better. You want to squash this down as far as you can so you can get the fundamentals of your app working right, so the customers can have the ultimate experience with your app, but if this is too high, problems dominate the conversation. What I can see here is for example, we saw that TD bank had improved a lot.

They're up around, it's getting up around 30, 40% somewhere, but we do see in some of the Tier Ones and National Banks that if you get somewhere below 20% you start to dominate and lead, and if you maintain that level you can really consistently lead across time. Our focus today though is looking at KeyBank. We can see there. This is adding up to 150%, and that might seem a bit weird.

How can these categories add up to 150%? One of the things that happens is that people start to talk about multiple things, I had a problem logging in, and then, it crashed, and then, when I tried to transfer the funds it didn't work. So, three things are coming from one person, so that they'll be put into multiple categories, but also what you get is, is sort of a bleed across these categories.

So there's, if I'm having a crash while I'm logging in recorded across multiple areas sometimes. It means it's a big frustration for customers. When you hit above that 100% you start to go, there’s multiple things going on. It's a really big barrier for customers. So, that's where they're at currently in April, but where have they been historically, with KeyBank? Let's have a look.

If I look at this, let's put all of these in there. I've got all of my SURF areas and again, lower is better.

We can see there that spike in April, which has really picked it up a lot, and across time we can see one of the areas that I can isolate here is, if I look at Security and Authentication.

I can see that was sort of a bit of a problem when we hit sort of into November, it was improving, like that 4.6% in October is great, or it could be better, but it's still better than it is at the moment, and we can see that's one of the things that’s actually picked up over the past six months. A few other areas like Reliability has also shown a similar movement, particularly in this April area.

What I'd like to look at now, though, is let's, let's sort of jump into this space and I might actually just close off this right panel so we can focus on what's happening on the left. What we're seeing here is the movement in the score for KeyBank, which has moved down to 2.2 in April. That's this score, which was seen previously in that first chart, it's moving across time.

In red there, I can see the pain points and how they've moved, and overall we can see there's a pickup. It's sort of like a third higher than it was previously. So, obviously they go hand in hand, the more pain points, the lower your score. What I've got on the left here are those four key areas of Security and Authentication all the way down to Functionality.

We can see the percentages which we've seen previously in the previous chart and how these sort of lineup together. What I can see though, is there's a few things going on. I can have a look underneath each of these things. If I look under things like Reliability, what I can see is the very generic topic, Unreliable app is 53% in April. It's gone up by 20 points. It was around 33 in March, it’s jumped by 20 points.

That's a pretty major increase. It's not quite double, but it's getting close to that. There's major issues going on there, app not working has doubled, app bugs have doubled. Crashing isn't quite there. It's probably more about the bugs and the crashing. That's we can see what's going on in there.

One of the things that's also been a problem is around Security and Authentication, so, logging in issues. Broadly, there's a poor security feature has jumped from about 12 up to 18 so there’s a problem definitely in there. One of the things I can look at though, is look at the things like, Biometric ID down here has actually gone from about 3% up to about 11.

Let's jump into that one and understand what's going on in that area. This right panel comes open and I can actually see a bit of detail about what's going on. A lot of it's coming from, we can see here there's things like the face ID never works. We've got things, having trouble changing passwords is a Face ID login.

There's a lot of things like the fingerprint doesn't work, the Fingerprint Authentication and the Face ID is actually not being stored in some cases, and actually what we can see, this is the actual version of the app of Android in this case that’s causing an issue, 4.4.55, and that would have been the one released in April or late March.

That's causing an issue for KeyBank, but across the board, you can see there's lots of stuff going on, there's reliability issues, and apps, and crashes, and so on. So, KeyBank will need to isolate each of these and fix them hopefully at the same time, but have a look at these and fix them, because it's actually causing one of the major problems you can have.

If you can't log into your app, you cannot access any function of the app at all. So, it doesn't matter how good your features are, it's a bit of a waste of time if they can't log in. So, thanks Glenn

09:38 Glenn: Yet again, my friend, you blow me away with the level of granularity and how you can get down there and pin point such great insights. I suppose anybody can, if they're using the Ipiphany Product Suite.

If you want to hear more, give us a call, book a meeting.

If you want to get these insights on a monthly basis, you can actually subscribe to each of the individual different market segments that you're interested in, across the UK and the US.