Executive Summary

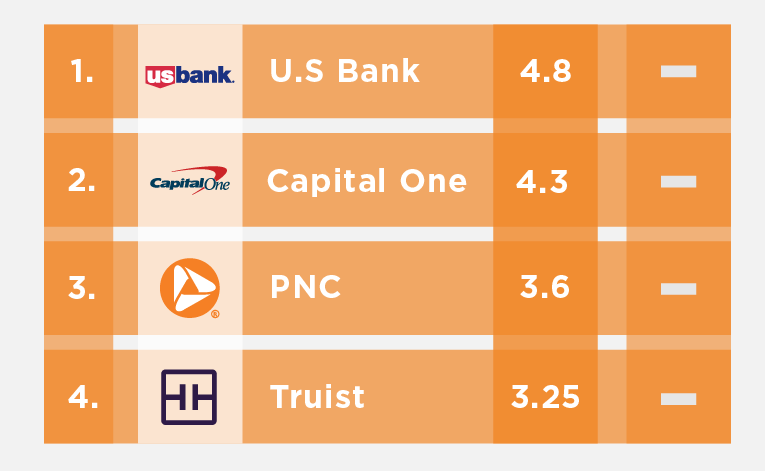

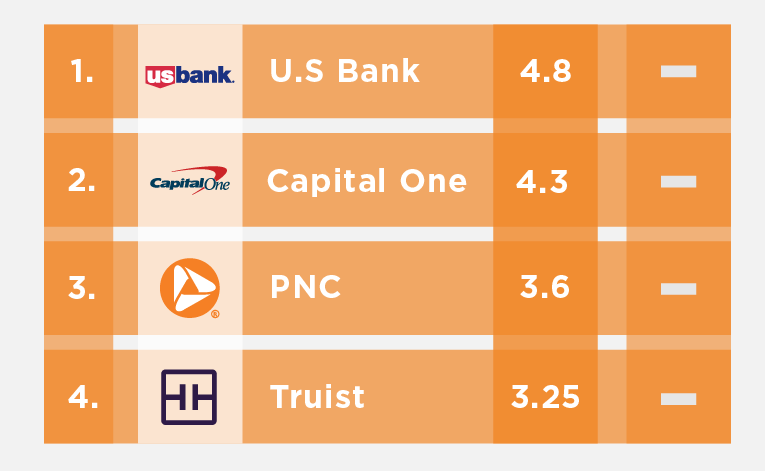

Truist has had a solid turnaround from the trouble from June to November last year. Previously sitting on an average of 1.5, they've made some changes in December into January and since then continued to pick up to 3.25. A massive improvement, and it's great to see that they've actually turned it around so fast.

So, while still the laggards in Engaged Customer Score performance, they have dramatically closed the gap on PNC and are on track to out rank them in the near future if the trend continues.

U.S. Bank and Capital One continue to show great consistency however, U.S. Bank is opening a gap at the top of the rankings.

U.S. Bank vs Capital One Performance Insights

The U.S. Bank Cheque Deposit functionality is a stand out performer and leading global rankings for engaged customer score. Capital One is not just lagging behind U.S. Bank in this area, it is being dominated, with U.S. Bank having an ECS of 4.6 and Capital One just 2.3.

While great news for U.S. Bank it also creates opportunity for Capital One. Logic dictates that there is little room for improvement in this area for U.S. Bank so if Capital One can prioritize this feature/journey development and learn from U.S. Bank, the gap can be closed relatively quickly.

Conversely the relative performance of the account balance features in each app perform relatively well closely for each bank. This may therefore be an area where Capital One can adopt a “maintain” approach to ensure resources are prioritized based on potential impact on customer experience.

This methodology of review can be expanded to all features and journeys and taken even deeper in analysis.

Tier One U.S. Banks Engaged Customer Score Performance Rankings May 2022

If you would like a free personal deep dive insights session on your banking app performance feel free to book a discovery call.

Full Video Transcript

00:00 Glenn: And welcome back everybody for another look at the US Banking App Market. This particular session is looking at the US Tier One banks, and in particular, we're going to look at what is making U.S. Bank the best of the best and standing out from the rest for May of 2022, and not just May 2022. Tony Patrick, they have been the standout performer forever pretty much, haven't they?

00:30 Tony: They sure have that way. They were doing very well at this about a year ago, or even before that, but they've just improved on that month-on-month so I'll just jump into it.

00:40 Glenn: Go for it.

00:41 Tony: Today we're looking at the US Tier One banks, and you can see here that we're looking at U.S. Bank, our focus today, Capital One, PNC and Truist.

So I might jump right into it. And the first port of call is obviously this one here. We look at the actual score across time. So if we look at this, one of the things before I jump into U.S. Bank, one of the things I can see is Truist so Truist had trouble. We can see there from June to November last year, Sitting in an average of 1.5 and below two on the average score, then they've made some changes in December into January and picked up up to 3.25 so massive improvement.

And it's great to see that they've actually turned it around so fast. A bit of a drop-off in, in February, but that's continuing improvement from that. So the next three points along there is now sitting at around 3.2, so really solid and getting to the point where it could overtake PNC at any point, if they continue the ride they're on.

So we might look at a different point about how a gradual improvement like that can actually make those changes. So what gradual improvements have they made. So one of the things we can see at the top though, which is our focus today is looking at U.S. Bank. So if I just put my mouse over here, I can see that there were sitting, with an Engaged Customer Score of 4.6.

Now, just so everyone's aware of what Engaged Customer Score is. It's those customers giving a score and a comment. By looking at it, then from that perspective, we can really sensitive in terms of movement. So these movements are real from a customer's perspective in terms of what's going on in the app market.

So sitting here at 4.6, we can see now, one of the things we see other brands doing, they often will have a problem and they'll dip down. They fix that and they dip back up. One of the things we're seeing U.S. Bank do, which we use as a bit of a benchmark, a global benchmark for best practice. They've actually got a teared improvement.

So it's 4.6, you think? Wow. How could they improve from there? Well, a few months later they did, they hit about 4.7 slight drop-off following month, then the hitting 4.7 again, and a slight drop-off and just above 4.7 into 4.8 into April and May. So look, how do they keep that going? Cause you're looking at Capital One and they're doing really well in their own, right.

Again, a sort of a global best player, but they've slightly dropped off in, in February and May and the gap now is about about 0.6 between the two of them actually in May it's about 0.4. So why is U.S. Bank doing so well? So let's investigate that. So one of the first point of call we often look at is what we call it our SURF Pillars. So in this case here, these are our surf pain points. Now surf represented by Security and Authentication, User Interface, Reliability and Features. So that just shows us across the board this gives us a great indication about where you're doing well and not so well now the lower here, the better.

So you don't, these are pain points be aware. So the lower, the better one of the standouts of course is U.S. Bank. Authentication only 0.7% of their comments are related to security and authentication. So that's, that is an amazing number. And again, they're very low on the user interface issues.

Reliability issues are about 2% and feature issues are around two and a half percent. So that's just a great perspective about what you should be doing from a best practice approach. Yeah, as compared to we saw that the choice is improving, but it's still, you can see still there's a lot of room to improvement for in to improve across all four areas here.

Let's have a look at. Now these are the same numbers, but just to stack a stacked bar chart, what we can see here is that U.S. Bank actually, in total it's pain points in these specific areas as sitting at below 10% and although Capital One's doing what very well and has just, it's just above 10, that gap is what's making that 0.4 difference in, in that score, that gap between about 8% at 12% here, we can see that a Truist still has a lot of room to improve, which means there's a good chance.

It could actually catch up to PNC in the next round. What I'll do now is have a look at Features. So what we're looking at here is actually some, some core features that are, that are used in these apps. And these are the things that are most important to customers. The things that the customers are doing all the time, the things they want to achieve with the banking app, one of the first ones isn't necessarily a core banking feature as soft as such app logging in.

But of course, it's vital if that doesn't happen, then nothing else could happen. So in this case here, we're looking at the score is actually is the average score when people talk about this particular topic. So the higher, the better in this case, and we can see U.S. Bank is standing out at 3.6 for logins. So as compared to Truist at 1.5, so Truist has a bit of a gap to close there to make that part of the customer journey a smooth one, the same way that the U.S. bank is. We see there that this is an order of the importance for a lot of these things. So check deposit feature is sitting at 4.5 and that's well above others. So that's sort of, you're sitting at sort of double what others are actually achieving. So they've actually hit the mark in that case.

So again, if you're going to sort of improve your check Deposit Feature, have a look at what U.S. Bank are doing cause they're the ones getting it right across the board. There were a few others where we see that we see that Capital One is actually sort of lining up to some extent and playing on a level playing field with a U.S. Bank.

What I want to do though is just have a look at those two side-by-side. So I'm looking here now at what am I do now though is actually have a look at these two, maybe over the past six months, not just, not just across all time. Let's look at this for the past six months and we can then see. What they've done recently.

Cause that's when that big gap was that 0.4 to 0.5 gap. That's continuous over that time period. So one of the things we can see is that capital one is underperforming on logging in and also check deposit. And we can see that the U.S. bank is doing really well. It's like, it's a 4.6. That's like when people use that feature they love it.

Now with this one here about Account Balance feature, we can see Capital One and U.S. Bank keep lining up pretty tightly. So, that's one area where Capital One might want to just say, look, let's maintain and maybe enhance that a little bit, but that's one thing we're doing well on so don't focus on that too much anymore.

Let's focus on this Check Deposit area because that's an important to customers. Let's focus on this payment feature and transferring funds because we're underperforming compared to the next best in this case. One of the things I'd like to look at though, is actually having a look at what are the, what's the difference in these two particular brands in terms of custom comments, these banks here.

So let's have a look first at the Transfer Funds feature and the comments coming through from customers. So broadly on the right, this is a bit of a concept cloud across to the right that you can see, it's all green. We're seeing there's a lot of comments there. It's all positive in terms of all the topics coming through.

And in my examples in Transferring Funds, I'm getting this one there around transfers are cumbersome, but in general, we're seeing a lot of positive stuff. So Zelle is easiest way to send money convenient way of sending money, convenient to transfer funds, a very, very positive across the board. Yeah, mostly fives, a few falls and a couple of people who have an issue.

So even they've got still ruined to improve. Let's contrast that with what we have for Capital One. So coming to one and doing reasonably well, but we can see there's some room for improvement. So first starting with the concept cloud, we can see there's a few red things there. So these things are dragging their score backwards, to some extent.

So you don't want a feature to be tracking your score backwards. What I can do then is actually have a look at the comments coming through here. So again, we don't see a whole lot of fives in here that are coming through so there's there's room, definitely to improve here as the payments are slow. People won't do real-time transfers, the Zelle options taking three days to send money.

So there's sort of issues there that we aren't seeing with, with U.S. Bank. So again, even even the best or the second best here has room to improve, to catch up to U.S. Bank. So thank you, Glenn.

08:59 Glenn: And again, another fantastic insight session, my friend. And if you're watching this and you were thinking, how do I get these sorts of insights for me and my bank?

You are more than welcome to come and check it out on our website, flick us an email, or even contact Tony or I on LinkedIn. And we can tee you up with a session, but thanks again. It was a great look at May and we will see you next month.