In this month’s look at UK Challenger banks Tony turns the spotlight on the underperformers. Monese is the one bank that is consistently underperforming, and they don't seem to be doing a heck of a lot about it.

The spotlight is on Monese and they’re not looking good.

Historically Monese has done well against the competition but for some time now their Engaged Customer Score (ECS) has sat at around 2.8. With no real movement in sight, we ask why nothing is being done?

In this video Tony reveals some of the main issues affecting Monese by comparing their Q3 2020 to Q2 2022 results with the use of a quick SURF analysis (Security, Usability, Reliability, and Functionality) to identify any obvious issues. With no real movement in the scores, Tony delves deeper to get a fuller picture of what’s really going on. What he uncovers is a customer service issue that extends far beyond the Monese app itself.

Monese isn't handling the pressure. With issues across multiple channels and customer feedback indicating abysmal customer service support Monese is leaving its customers out in the cold.

Can this digital bank that is built on ideals of simplicity and expediency turn things around?

As always, we’d love to hear from you about your thoughts, and if you would like a personalised look at your bank's performance and insight we can give you, feel free to contact Touchpoint Group today. We can organise a specific insights session just for you.

Video Segments

Intro – 00:00:00

Engaged Customer Score Performance – 00:00:48

SURF Analysis: Monese – 00:01:51

Monese’s Poor Service Issues – 00:03:31

Poor Service Channel Score Comparison – 00:04:05

Monese Poor Service Channel Reviews From Users – 00:05:13

Conclusion – 00:06:41

Full Transcript

00:00 Glenn: Hello everybody and welcome back to another Banking App Insight session.

The UK Challenger banks for June of 2022, and flavour of the month is we're looking at the underperformers. Challenger banks it's a very, very competitive space but, unfortunately there is one that is consistently underperforming and they don't seem to be doing a heck of a lot about it. Isn't that right, Tony?

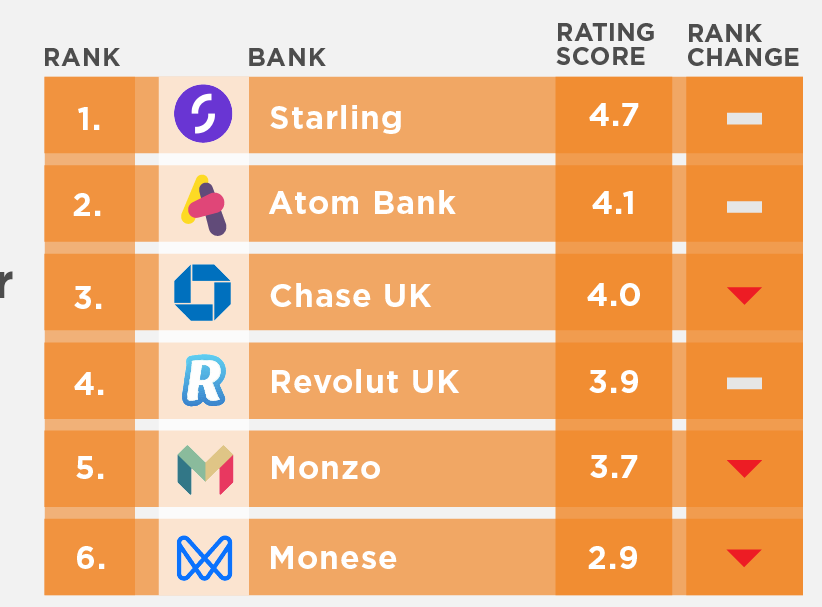

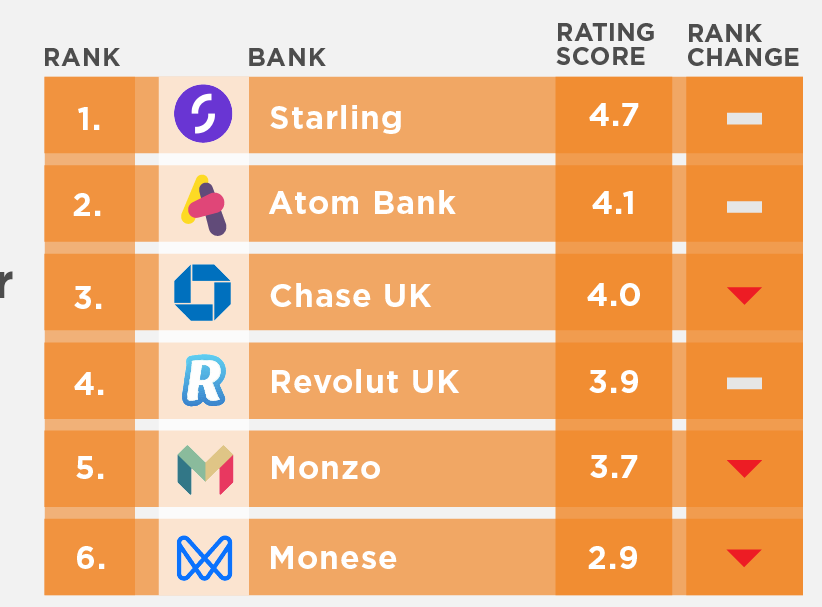

00:27 Tony: Definitely is. Thank you Glenn. The few banks we are looking at here; Starling, Monzo, Revolut UK, Atom Bank, and Monese. I'll just jump straight in and have a look at how their Engaged Customer Score is actually performing.

What we are looking at here is - normally we look at this month-by-month, but I wanted to have a look at something across time because this is looking quarterly.

We see here, Q2 for each of our brands 2022, when we take it all the way back to Q2 2020. So, back more than 12 months here. We can see what is actually going on.

The reason for that is that I want to understand what has happened to Monese because basically it is floating in around 2.8. No real movement going on, but historically they have done well. Like in Q2 and Q3, they were actually competing well with some other banks. They were up there, some potential slight improvement could have brought them up to the level of a lot of others, but that seems to not have happened.

Others are doing, like we saw Starling had this inconsistency into Q3. Over a quarter they picked themselves up, but they are consistently sitting above 4.6. They’re very good there. They have actually done a great job.

But, let's have a look though at Monese.

I'll compare Q3 2020 to Q2 2022. What has actually happened between those two time periods? If you have seen these before you will understand that this is our SURF analysis, it's a nice quick first go-to to understand, are you having some foundational problems? Are you having an issue with your basic logging in and usage of your product? SURF analysis covers-off those four areas: Security, Usability, Reliability, and Functionality.

One of the key things we can see between Q3 & Q2, Q3 2020 & Q2 is that, what stands out is authentication has actually improved. This means logging in issues aren't the problem. There are some problems, but it's not one of the major things that has changed. That is a good thing in that sense, but elsewhere we can see there has been some problems. Obviously, these are pain points. The higher the frequency, the worse it actually is. Design and UI issues are sitting at 6.3% - up from 5%. We see that Reliability is also worse, and Features, and Functionality is worse.

So, there are some issues across the board here for Monese. I can also have a brief look at this to see how much each of these areas are impacting the score. One of the biggest impacts on the score is Reliability and Stability that is actually dragging the score back by 0.08, but not much is here. There is some movement in the score, but it's not telling us that full picture of what is actually going on.

One of the things we saw in the data is there's actually some poor service issues going on. It's not just about the app as such, the app can go wrong, but the way to resolve that isn't being solved by the bank. So, we can see issues like Poor Digital Channel have gone from 19% to 22%, Poor Mobile App 18% to 21%, Poor Service Channel 19% to 22%. There has been some problems. Technical issues are picked up as well.

Let's look at this poor service channel. Maybe rather than look at the comments straight away what I can do is have a look at how this compares to others. When people talk about the Poor Service Channel, the Monese customers are on average giving a score of 1.7, and that is a lot lower than others in this area. Starling it's at 3.5 even though they have built a sort of a problem area they are still getting a 3.5. Those who are unhappy are not very unhappy, it's only slightly unhappy, whereas the Monese customers are really unhappy.

Let's have a look and see what's going on with Monese.

This is actually Monese Poor Service Channel. I might just look for those who are giving a particularly negative comment to get us down to some of that root cause of what's going on inside here. I will look at this Poor Service Channel. I can jump in here and see these types of comments.

One of the things that's coming up, this very first one is an indication of what's going on. Some things like they have changed your phone or your account, you will be blocked and it could take weeks or months for someone to reply to the email. It looks like things outside the app are also causing an issue. No one works in the bank to hear from you. So there are issues about getting hold of anyone from Monese.

"They blocked my account for one month" - no clear reason for the customer, and "… the customer service was abysmal"

Attached to these issues customers also see there is no way to solve it through other channels. They are having some major concerns going on. Again here, "My account was frozen, it has been for two months. Support was unhelpful. Advised me to wait for an email".

Again, this is a major concern and it potentially could be things around, like I said, growth issues where the customer service cannot handle what's going on, but, if your app is underperforming you increase the pressure on other channels, and Monese isn't handling that pressure in the other channels, which causes an additional effect of decreasing that customer service. So, major issues for Monese. They need to pick up their act across multiple channels.

06:41 Glenn: Yeah. And just because you are a digital bank it doesn't stop the fact that you are dealing with people, and people have people problems and need people to help solve them.

Great insights, Tony. Thanks again.

A very, very quick little look at Monese and the UK Challenger Bank Sector. If you want to have a look at your bank and your sector, or if you've got anything you want to add to this conversation, feel free to do so. We'll see you next month with a whole bunch of more insight sessions.

Have a great week. Catch you later.