In our snapshot of US National Banks this month we are turning our attention to the top performers to investigate the gap between Citibank and Bank of America. Watch the full video to find out where Bank of America needs to focus their attention to close the gap to take the top spot.

This is an exciting market to look at, as we can take away some excellent insights from those who are at the very top of the league. As Glenn points out “it is the little things done well, consistently over time, that make the big difference in the end”.

Join us for an insightful exploration into the gap between these two big shots.

The gap between Citibank and Bank of America has been consistent over the last 12 months, so to begin the investigation, we look at the distribution of the Engaged Customer Scores (ECS), ranging from 1-5. Tony brings our attention to the top scores and identifies a gap of 6% at the top end of the ECS.

Interestingly we see a similar gap at the lower end of the ECS too. Bank of America has a larger amount of 1-scores compared to Citibank. Whilst this does show there is room to improve for both, there is a lot more that needs to be improved by Bank of America than Citibank. Join us to discover where the gains to be made for Bank of America are.

Next, we shift our attention to the Foundational Attributes which includes both the SURF analysis that looks at the 4 key areas that any app needs to succeed in (Security, Usability, Reliability & Functionality) as well mapping the individual journey a customer has in using their banking app. This analysis gives a better picture of the overall user experience and allows you to compare against your competition.

With a gap of 6% the differences between Bank of America and Citbank’s SURF attributes are marginal. However, when we switch into the customer journey, Tony shows us the areas where people are giving feedback about specific things. Tony then delves deeper into the experience of the customer and here’s where Bank of America should really take note – customers are giving really specific feedback about things that can be addressed to provide a much better customer experience.

In this video Tony demonstrates the way you can drill down into the data using the Touchpoint group Ipiphany software. Taking the area of ‘Core Journeys’ we learn where both banks have room to improve the negative impact on their overall scores. Breaking apart those fundamental functionality measures, we can drill down further to see the biggest difference between these two banks.

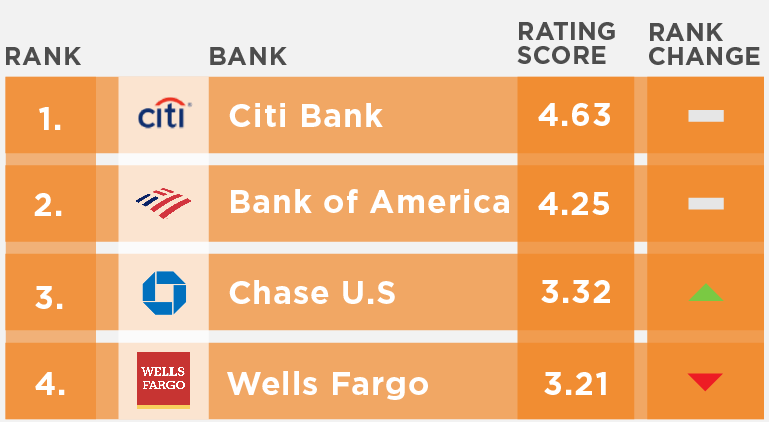

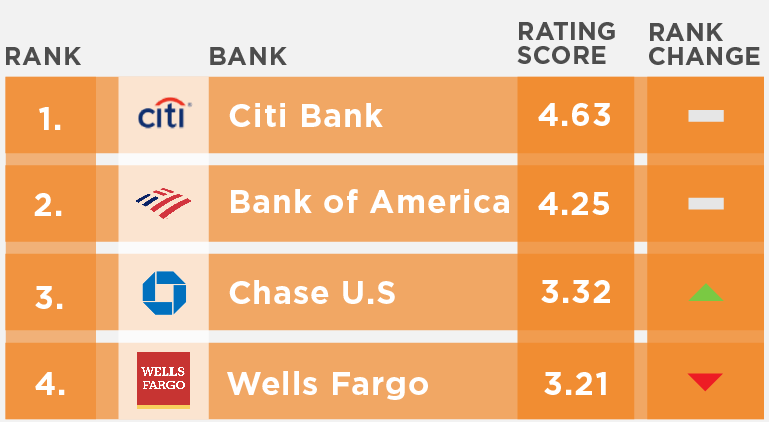

Engaged Customer Score Rankings as at July 2022

This snapshop is a great demonstration of the Ipiphany software in action. We know you’ll enjoy this deep dive and we would love to hear your thoughts.

If you would like a personalised look at your bank's app performance? Contact Touchpoint Group today for a specific insights session for your business.

Full Transcript

00:00:00 Glenn: Welcome back everybody, to another Touchpoint Group Banking App Insight Session for the month of July 2022 and this session we are looking at the US Nationals Bank. And we're going to mix it up a little bit today we're going to look at the top of the tree and why is it that Bank of America is consistently just sitting behind Citibank and not quite closing the gap. And when it comes down to it, a little bit like sports on those top performing sports teams, it is the little things done well consistently over time that make the big difference in the end between those two or three top teams at the top of the league.

Tony Patrick... Welcome, my friend. Let's rip into it. Will you just give us a bit of a walk through and have a look at those two banks and where we're going with them.

00:01:03 Tony: Brilliant. Thanks, Glenn and as you mentioned we're looking at US Nationals today and that covers Citibank, Bank of America, Wells Fargo and Chase. Of course, we cover the others in separate sessions as you can see on the right there but, let's jump straight into US Nationals and see first of all, what are the trends we're seeing.

What we can see here is now, we covered off some of the ones at the bottom here in our last round which is looking at Chase and Wells Fargo for example. Now, a little thing here, Wells Fargo yet to recover to the levels it had at the end of last year, which was sort of up about above 4 on average and it's gone slightly down this month. If you look at Chase there's some... it's that old sort of Whack-a-Mole thing where they go up and down up and down and they can at the moment they're down for the past two months so, when on the past trends we probably expect them to jump up in the next month but we don't know yet. But, of course the talk today is just having a look at why is, we can see here that Citibank is actually consistently sitting above Bank of America. It's a consistent Gap across time the past 12 months is pretty much sitting there except for a bit of a downtrend here in October last year for Bank of America. So, what we'll look at today is why is that gap there? And as Glenn said, it's not something major Bank of America is doing well but, how do they close that gap and it's a small things that matter.

Let's go in further and have a look.

First of all, before we jump right into it, it's nice to have a look at what's the distribution of the scores. Now, this is a five point scale from 1 to 5 just looking at the scores for each of these brands. In the case of... if you look at Bank of America at the top here, we're looking at this 73.6% that's how many people have given a 5 over this, over the past three months. Just to have a look at what's going on. So, 73.6% compared to about 81% for Citibank. There's a bit of a gap there of about 6%. So that just shows to be good. You have to sort of get to that level of having about 80% of your customers giving you a 5. And that's a tough task for a lot of banks. At the other end of the scale though, it's interesting what we can see is those giving a 1 for Bank of America is about 11, and those giving you 1 for Citibank is about 5. So, Citibank still has room to improve but again, there's a lot more room to improve for Bank of America. Interestingly, that gap of 10.8 and 5.2 it's about, 5 say, that's similar to the gap they're getting at the top end. Essentially, Bank of America needs to switch out the 5, the additional 5% from their ones and then add to their 5. So, yeah. There's some gains for them to get up to that level.

Let's move into what's going on with a bit more... a bit more detail. What we're looking at here is now we might have seen before we used this research approach looking at the SURF Analysis around Security, Usability Reliability, etc. But, what we're looking at here are three core topics that you need to succeed on to get your app right. These are what we're calling the Foundational Attributes, similar to our SURF analysis we've used previously but, also these core journeys. We should go down to individual journeys in the app and see if you're doing well on those or not, and you're obviously comparing those to others. So, we can see there of course, that you know, we're seeing that Bank of America is down on each of these things. We expect that with their score... But, you can see that the core journeys has a gap there of about 0.3,-I'm sorry, 0.5 out of the 3.8 that Citibank's getting and the Foundational Attributes, the things like: Speed and Logging in and things like that, as a gap of about 0.3. So, not as bad. Let's have a look though at those core journeys because that's the biggest gap I can see in here, it says apart from Functionality but, though we know the biggest driver of the score are these first two, whereas the incremental functionality gives you some extra boost at a later stage.

Let's close this right panel for the moment. What I can see here is that basically it's a gap on each of these journeys, and these are the most important journeys for customers. Things like: Depositing a Check, Updating your Mobile App, Paying Bills, Monitoring Account Activity and things like that. Lots of these things and these are the large majority of people, that's what they're using these apps for and this is what they're talking about when they give us this feedback. Across the board we can see a few things: Making P2P Payments, we can see that Bank of America is doing slightly better than Citibank. So, again then, Citibank has probably got some room to improve again on that area. One thing I can see here is, I want to have a look at which is Paying Bills by the App. Citibank's getting a 4.2 whereas we've got for Bank of America it's sitting at 3.5.

Let's have a quick glance at that from the view of the customer. Let's have a look at that for the Paying Bills for Bank of America and have a look on the right panel in exactly what customers are actually saying. Now, the first glance with this coloured view you've got here you can see that there's a few bits of red coming through. So, that's that sort of anything that's a detractor, so those ones and twos. We get a few of the blues in here, which are sort of the middle levels and a few fours and fives that's sort of a mix of things that are going on. We can also look in here and see in general "it's convenient..." that's fine. An interesting point here though, about that journey, at this one here, giving it 2 is saying: "Look, it takes seven clicks to actually complete my credit card payment..." Again, there's some hints in there about what Bank of America can be doing, is making that process simpler, less clicks and a more straightforward process.

Now, let's switch across and have a look at what comments coming through for Citibank in this Paying Bills area that will come across on the right. We do get a couple of ones in there but, what we're getting here is, there's obviously still some room to improve but, what we're getting here is pretty much a whole lot of green and you can see it coming through there apart from a couple of outliers, which is why that score is sitting at 4.2 rather than 3.5. Again, that's one thing Bank of America could do is actually update that journey for their customers about Paying Bills. Let's step forward and have a look at something else.

This is an interesting view. I'll explain what we're seeing here. Is basically, those three key areas of Foundational Attributes, Core Journeys and incremental Functionality. How much does that impact your score? What I can see here is when customers talk about these Foundational Attributes which we'll look at in a moment in a bit of detail, it's actually having a positive contribution on the score for Citibank. We can see there it's got a positive contribution of about +0.29. So, it's adding a really positive aspect to the score. Customers enjoy that. For Bank of America it's also positive but, only just at .05. So, there's some room to improve there definitely for Bank of America. And also the Core Journeys, both banks have a slightly negative experience so both have to improve on those journeys. But, Bank of America has to improve more.

Let's step into and have a look at those Core Journeys and see how much they're impacting the score. So, this is breaking apart those fundamental...Functionality, and we're seeing here that Usability is one of the biggest things that's the biggest difference as we can see between these two banks. So, again. Let's have a quick look at Bank of America first and see what that looks like in the scheme of things on the right. We see there's a fair bit of positive stuff. We can see the score is positive, it's having a positive contribution but, we are getting this a bit of a mix in here of these ones coming through. A few ones about you know, it's a difficult service, and a few fours in there as well. So, it's interesting the score here is still 4.6. But, we sort of get those ones and threes that are coming through if we compare that directly to Citibank. Let's have a look here, pretty much you're getting all fives you get a 4 every now and then.

So, rather than those ones and threes that pop up every now and then for Bank of America, you're pretty much with Citibank getting all fives coming through into the mix. So a very positive outcome. For me, there's a few Usability issues for Bank of America that need to improve and a few Reliability issues they need to pick up on as well. So, things to work on for both but, we see that Bank of America still has a lot of room to close that gap.

Thank you, Glenn.

00:09:49 Glenn: That's fantastic, mate and so, that's it for the US Nationals for July of 2022 with the Banking Apps.

If you want, feel free to hit us up, and we will give you a walk through on your bank. Have a great one, folks. See you next month.