This month’s snapshot of the US Nationals banking market we take a closer look at Chase. Join us as we get into the nitty gritty of the issues affecting Chase’s performance.

Can Chase flatten the curve or are customers in for a bumpy ride?

Over the last few months Chases’ Engaged Customer Scores have bounced up and down from 4, to 3 every 2-3 months. If Chase can manage to lift that Engaged Customer Score (ECS) back up to a 4 by addressing their issues, and maintaining that position, then they’ll be able to start competing with the top players in this segment.

To take a closer look at what’s going on for Chase, Tony takes us to a SURF analysis comparing the time periods of May 2022 and June-July 2022. SURF analysis tells us how well the app is performing in the areas of Security, Usability, Reliability and Functionality, and by comparing the two date ranges we can see where the issues are coming up for Chases’ app users, to find out what is contributing to the decline in the ECS. Right off the mark, we can see there are issues affecting each of the 4 SURF pillars, however the top two areas where the more significant issues lie are the areas of both Functionality and Reliability. Two critical areas that are paramount to the app’s functionality.

If you are curious about just how detailed the Touchpoint Group software can get, this video is a great demonstration into the capabilities of the Ipiphany software, where small problems that would typically be hidden by the larger issues are able to be presented, thus allowing Touchpoint Group to provide you with a refined level of understanding.

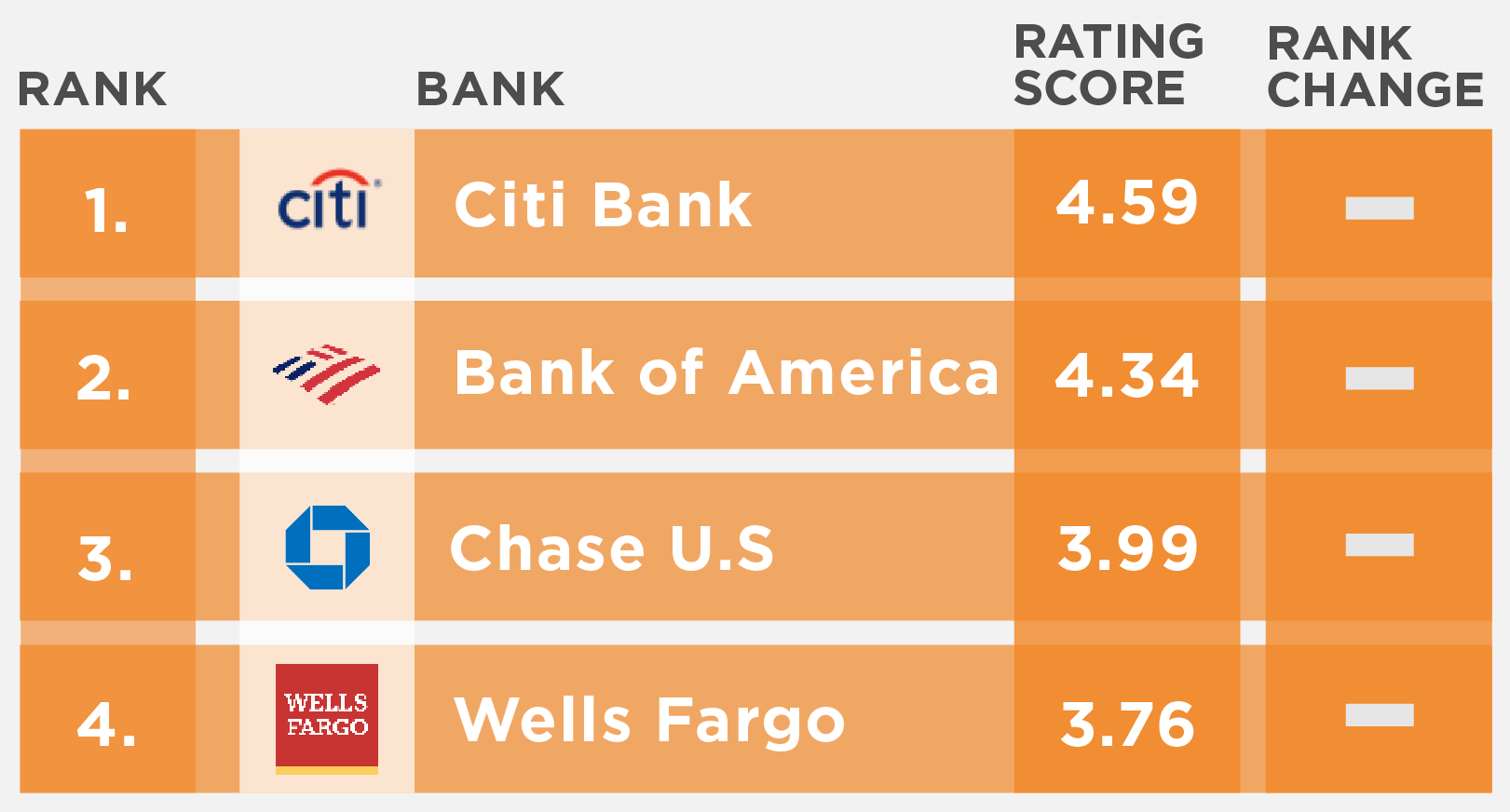

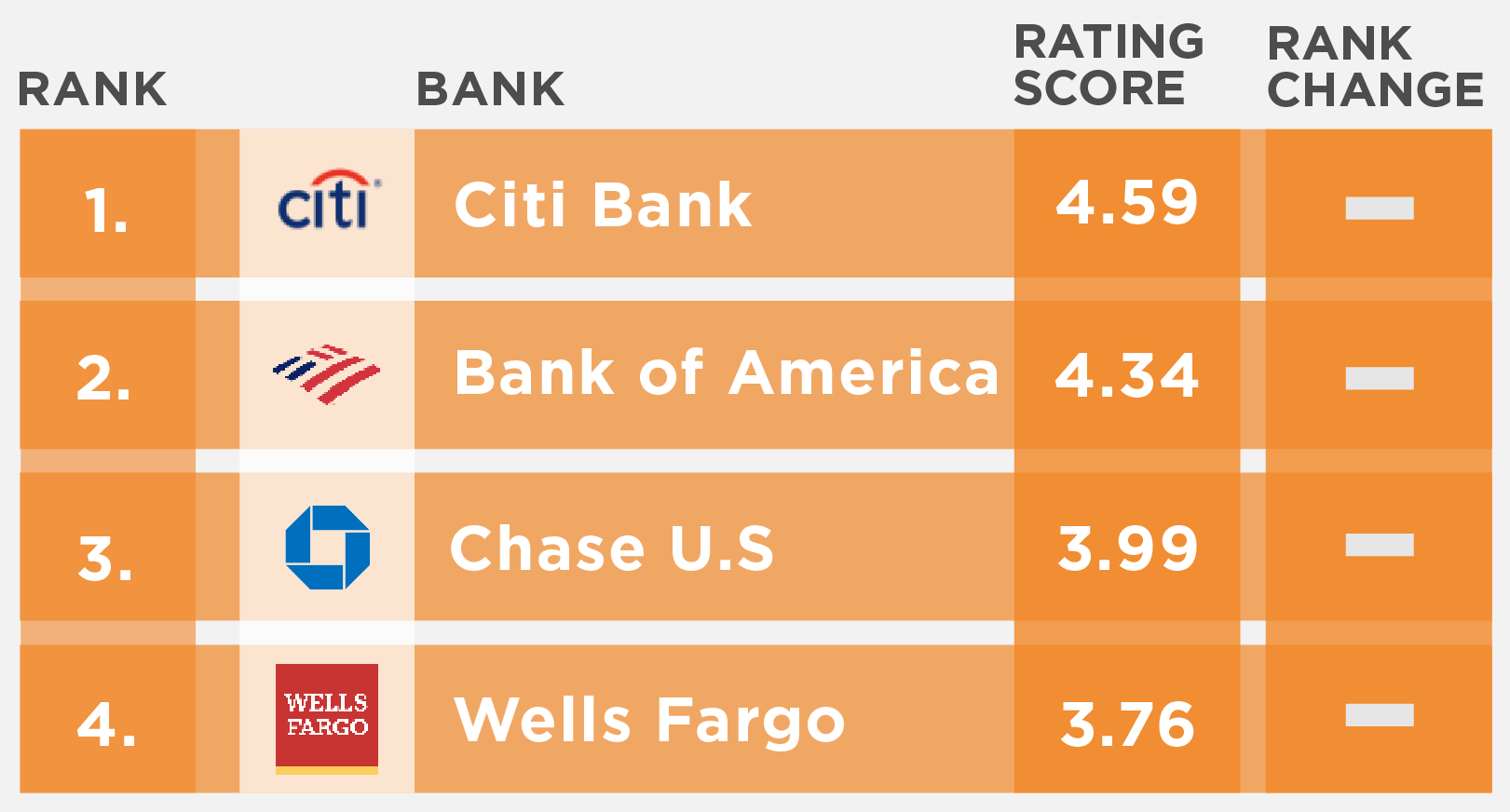

U.S. National banks Engaged Customer Score (ECS) performance rankings for August 2022

If you are a bank and you would like to see how your own app performs, you too can engage Touchpoint Group for a specific insights session based on your business. Contact Touchpoint Group today - we would love to hear from you.

Full Transcript

00:00:02 – Glenn: Hello everybody, Glenn Marvin here. Touchpointgroup.com, welcome back to another Insight Session where we are looking at the US Nationals segment around Banking App performance for the month of August.

We're going to feature Chase this month and we're going to look at some of the functionality issues and how using Customer Feedback Data can help with early detection and flatten out the curve to ensure consistency in that User Experience. Welcome Tony Patrick, so good to have you on board as usual and yeah, let's just rip into it. We've only got a few minutes so let's make the most of it.

00:00:48 – Tony: Brilliant. Thank you, Glenn, and welcome back to our regular listeners to this series and also any new people here. So we'll take you through today looking at US Nationals and that covers off Citibank, Bank of America, Wells Fargo and Chase.

And as Glenn mentioned we'll look at Chase today and see what's causing inconsistencies in the data there. Let's jump straight in and have a look at what's going on.

So one of our first views that we actually look at is what is the Engaged Customer Score and how is that moving. Now, for those new to this series, the Engaged Customer Score essentially covers people who have given both a score and a comment. Now the reason that's important is that allows us to see real movements in this data. In general what Banks might see in their data is it's fairly flat. They don't see much movement because we're involving every single customer type whether they're given a score or otherwise. What we tend to see is we get very sensitive as to what's going on. And one of the things we'll cover off today is that movement we can see there for Chase in yellow and I'll just highlight that in here. One of the things we're seeing with Chase is that every second and third month it just tends to drop away from a score of around 4 down to around 3.2 so it drops away consistently across the year. Now, one of the key things for them if they could actually understand why that drop is happening, can fix that and they will actually start to sit around 4 as their normal score, which will be really great for them. And they can start to then level up and start to compete with the top players here which includes Bank of America which consistently is above 4.2 and at the very top there we've got the likes of

Citibank sitting there above 4.5 consistently and one of our global leaders in this actual area we cover. So obviously, we can see here that Chase has actually picked up in the past month but what I want to focus on now is that drop between may into June and July so why has that happened and why is that so consistent for Chase? Let's have a look.

So first of all, this view here which is our SURF Analysis which covers off these topics around Security and Authentication, Usability, Reliability and Functionality so that's the complete SURF Analysis and because these are all negative topics the frequency- the higher frequency is worse. So you don't want to have a high frequency on these things and in general the best players they average in total under 20% for all of these added together. And you can see here that with Chase even in its best period in May it's getting around 30 to 40% in total across all these here. But one of the key things we'll look at is that difference between -and you can see up here- between May and that June, July drop we saw up front. And one of the key things we can see is this they're actually increasing all of these areas. Now on the right here with Security and Authentication there can often be a common problem people trying to log in and they get issues and obviously, it blocks them from doing anything else, so it creates a lot of anger and frustration. That has doubled to some extent but, it's not a major thing it's only a 3% sort of movement in raw percentage terms. What we can see though is Functionality has gone from about 1 in 10 people to a lot more, so 17% of customers are talking about some sort of Functionality problem as compared to 10% in that previous period.

One of the things we can look at in here is also what's the impact on my score from these things? So that's really interesting. So what I can do... I can flick this across here to what we call Contribution, so how much did that influence my score? So the area of this pain point around Functionality in May it had an impact of -0.14 So these are all negative topics, they are going to drag your score back to some extent. But, the impact on the overall rating score out of 5 is -0.14 Now though, in this June-July period, it's 0.3 so that difference there that's a reasonable indication of what's where this 0.5 gap between these two periods is. And we can see here it's getting around 0.15 of that 0.5 gap so this is part of that problem sitting inside here.

So let's also step forward and have a look at a bit more detail. So, underneath all of those topics around Functionality we have actual topics inside there, some subtopics. Now we get- there's a few here for example: "Poor at Money Transfer feature", "Poor app payments", "Poor app check feature" for example. So lots of things going inside there. But, we can see that the biggest one is this "Poor at Money Transfer feature". So one of the key functionalities of your bank app is actually transferring money and also making payments, for example. So, that's actually doubled. It's gone from about 1% to around 2% and you might think: "Well that's pretty low, it's gone from 1 to 2” but that doubling that's a fair few people have got that problem now and of course the data inside here is only a representation of what the total market of Chase customers are experiencing. So obviously, it's a fairly reasonable number of people if you think of 2% of the base of Chase customers, that's a lot of people.

So let's jump in here and have a look through of what's happening in this June-July period for Chase. So one thing here which I'll come back to which is scheduling a payment but, what I can see here there's a few things with making payments and actually one of the things that's popping up a fair bit and I'll just focus on it actually because it's this Zelle payment area and that seems to be a problem. "It sucks," well we probably understand what that means. But in here we can see here: "It's really bad, it's not safe on this app", "I sent money twice through Zelle and I can't find either transfer" so that customers actually thought they made the transfer it hasn't actually come through in the system. “Chase needs to discontinue Zelle”. So that is a really big pain point for customers and it's actually like doubled in problems in the past, in that period in that past month. So that's a problem of course across the board.

But of course one of the things we can also see in this data, if I clear away this cell and go back to our original comments. I can actually see there's actually room for improvement here. This person here is talking about "Why can't I schedule a payment for a certain date?" that seems like a reasonably basic functionality but this customer either doesn't see that feature inside Chase or it doesn't exist. And even down further here we can see another one: "I can't schedule a payment for a future date" so again, this is actually improvement initiatives that customers can actually see you need to actually pick your act up here as well. So that's interesting.

But, one of the interesting things we can see here is like if you have these big issues going on like you can't transfer money or there's login issues and things like that, often things can be hidden from you. Now one of the examples over here which is very small at this point. This is poor at alerts and notifications. But if I select that and just have a look there's a handful of people but they give us an indication about something that might be wrong, so... This person here: "I get notifications, you connect to the server and I get blank pages please fix it" Push notifications don't work, transaction alert could be better”. So, down here "Notification's not working I tried to remove it, reinstall the app and I can't receive any notifications" So very small number at this point, but this is the type of thing you want to keep an eye on and can be hidden by larger issues. So definitely something for Chase to watch. Which might be one of the causes for their drops and their dips in the next period. So some key, some very basic things there for Chase to focus on, but also some upcoming things they need to be aware of. Now of course we've only gone down one path in here, we've gone down to this feature area. There's a fair few things for them to work on. So again, with just a starting point here for them to cut, to stop that fluctuation they're seeing and I think they can do a lot better in the market if they focus on these things.

00:09:15 – Glenn: Yet again, some really really, simple but powerful insights there Tony, and absolutely with you 100% around those managing those fluctuations. So, thanks again for looking at that. That was US Nationals looking at Chase and if you'd like us to look at your bank and your app feel free to reach out we're more than happy to have a chat. Thanks folks, we'll see you next month.