In this month’s snapshot of the UK Challenger banks banking app performance we take a closer look at Monzo. Are they on the slippery slope to nowhere, or can they turn things around and claw back a better position in the rankings? Watch now to find out.

It’s not all roses for Monzo, with fraud issues being the thorn in Monzo’s side.

In this video we turn the spotlight on Monzo, who have been dropping away at a steady rate in the rankings with the likes of Chase now consistently outperforming them.

Looking at the Engaged Customer Score (ECS) movement over the past year, Monzo have been up- and-down, but from July 2022 they have begun a steady decline, from 3.8 to now sitting at 3.4. Indicating there is a consistent feeling of customer dissatisfaction - which is likely to be affecting churn rates.

The SURF analysis of Monzo’s performance, looking at the four core areas that the app needs to perform well in (Security, Usability, Reliability and Functionality), shows us that there are issues around Reliability and technical issues, such as app crashes. Tony demonstrates how the Touchpoint Group Ipiphany software allows us to take an even deeper dive into the finer detail to show exactly when and why issues are coming up.

One of the big problem areas coming up in the data for Monzo is the idea of fraud. This theme has a strong weighting and comes up in a variety of ways. Sometimes positive – when fraudulent activity was resolved for a customer, but also in a negative way. It appears that from a customer perspective, Monzo’s fraud prevention measures seem to be archaic and heavy-handed.

The issue of fraud has been a contentious issue for all UK Challenger banks in recent years. All in this category have been under pressure to tighten up their anti-fraud procedures. To give a broader perspective Tony provides a comparison across the UK Challenger banks and it would appear that Monzo is not alone.

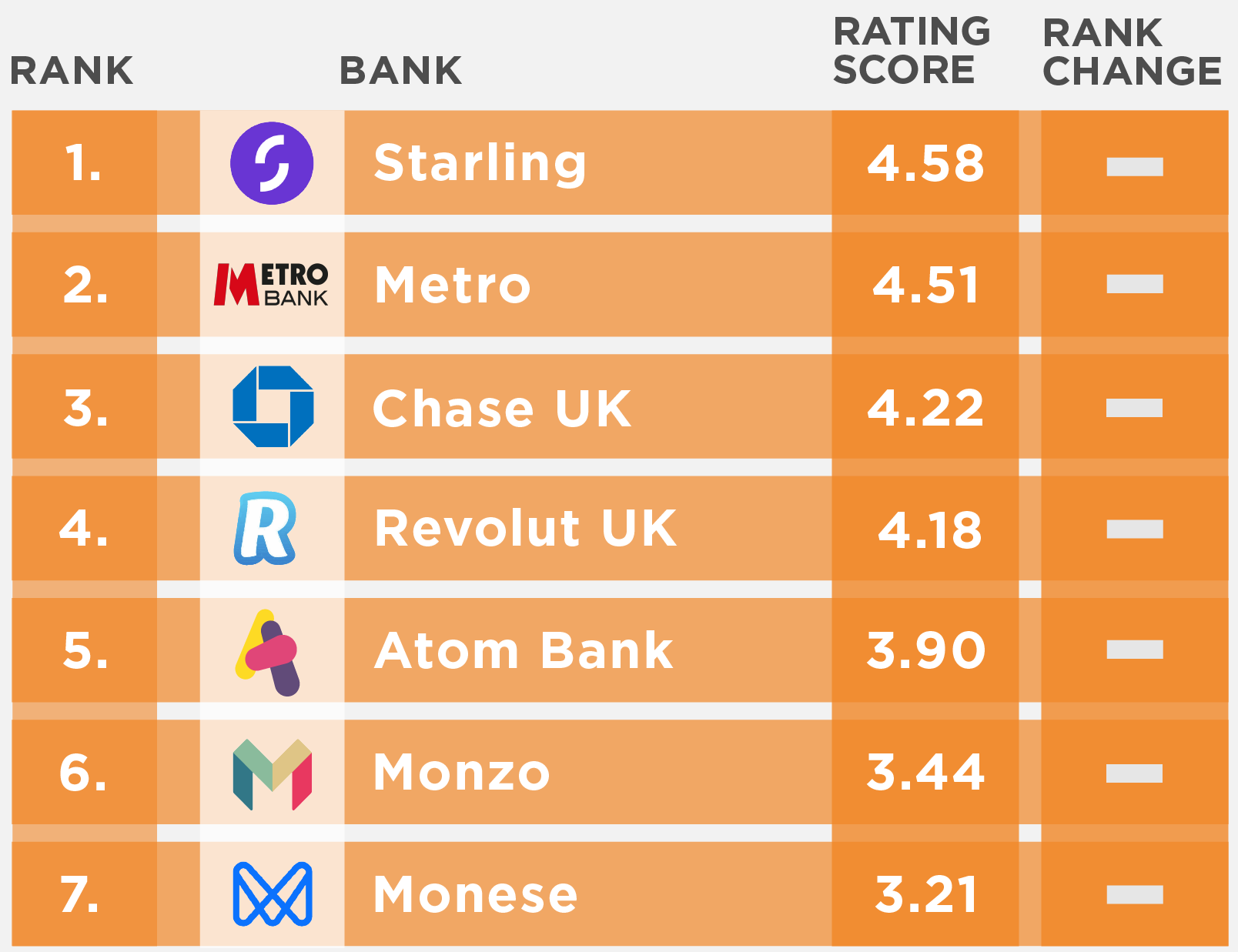

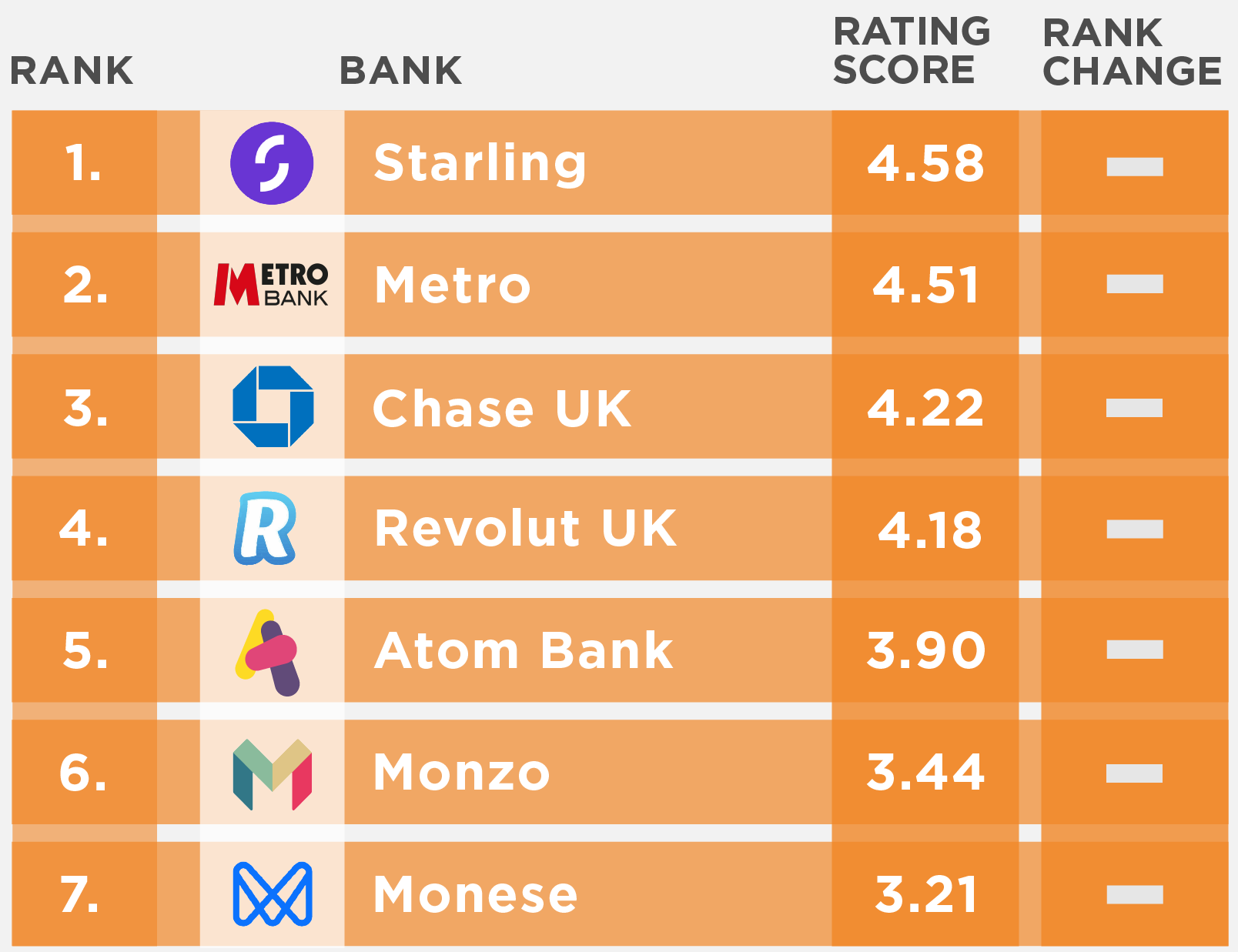

UK Challenger banks Engaged Customer Score (ECS) performance rankings for September 2022

Find out what the key issues are affecting your business or organisation. Get in touch with Touchpoint Group today to arrange your own customised insights session.

Full Transcript

00:00:05 – Glenn: Hello everybody and welcome back to another Banking App Insight Session.

We're looking at the UK Challenger banks for the month of September and in particular we're going to dig into Monzo and their performance because they've been dropping away in the rankings and even Chase from the UK is now consistent with outperforming them. Tony Patrick... Reliability is more of a recent breakout issue impacting them and complaints relating to fraud protection are starting to come to the fore so, I'll pass it over to you my friend and take it away.

00:00:39 – Tony: Definitely, yeah. Thank you Glenn. Yeah, so today UK Challengers as Glenn mentioned so looking at Starling, Monzo Revolut, Atom Bank, Monese, Metro and Chase. So yeah, Monzo is our focus today and I'll show you why. Let's jump in and have a look at that.

So this is looking at our Engaged Customer Score across time. Now what we mean by the Engaged Customer Score is these are customers who on either the App Store or the Android Store have actually given a rating and a comment. Now, what that allows us to do is have a really sensitive measure about what's going on but additionally we can uncover why that score is moving because we know all the detail because every single one of these people have given a comment as well.

So, one of the things we can see here, I'm just broadly looking across the board Starling is doing very well. Consistently above 4.5 and sort of averaging around 4.7 so, very good. They've done a great job across the past year. They were actually a lot lower in October but they've actually picked it up and maintained that. This for us is best practice, even like in the US we have the likes of U.S Bank and others like that who maintain this and sit at the top there because of their consistency is one of the key things, and they seem to be on top of things very fast. But let's have a look at something else that's going on inside here.

One of the things I can see is we've looked at this previously as Chase UK is actually moving up. So, obviously they're-- they've got an improvement course which is going really well. In fact, if I look at this they've just come into second place among these UK Challenger Banks and it's just sitting there behind Starling. It's not a lot of room to move but they're actually doing very well in that Improvement so that's potentially one to look at later about that... that's a bit of a hero story for what they're up to.

But what I can see here with Monzo is that they do jump down every now and then but often it's just a one month they drop down come back up and so on. I guess that's not a good thing in its own right but again you want to if you drop down, at least pick yourself up the next month looking at those updates. But what we can see here is that from July which was a reasonably nice number sitting at 3.8 drop down to 3.6 and again drop down to 3.4. So one of the rules of thumb we have if you go across three months with the significant decline like this often it can take you another three months to get back up. That's around half a year of customer dissatisfaction which can obviously increase churn and things like that. So... Not very good for Monzo if they continue this way.

Let's have a look at what's going on inside here. Now, what I'm looking at here is pretty much for those who watch our series every month you'll understand the SURF Analysis. This is looking at our areas on the bottom left here, around: Security and Usability... Security, Authentication -sorry, Usability, Reliability and Functionality so obviously they can spell out SURF for us there but, it gives us... these are the four core areas where you need to perform on at the basic level to actually get things underway. If you don't perform here the customers don't get access to your cool Journeys you've built or whatever else you've done because they can't get into the app, the app's crashing or whatever it might be.

So, I can see here that 16% of customers in - this is here looking for Monzo in September have talked about something around Reliability. Now, what I can see here is that in general the topic of Unreliable App has actually increased from August into September by 3.7 points. Technical Issues have also picked up by about you know 3.6 points, so there's issues popping up. But also we can see down here the app freezing although it's only got up 0.5 it's only 1.3. So it was 0.8 has gone up to 1.3. And again for App Crashes they've doubled, although it's a double to 1.1 but it has jumped up so these are the types of things you need to watch out for and they incrementally decline your score if you don't watch them across the board.

One of the things we can look at though, is how has trended across time across each of these particular areas. So if I just remove my right panel across here, what I can see here is that these are those same four things we looked at. Security & Authentication, Usability, Reliability and Functionality. Getting these low is the purpose. We don't get these as low as we can so your app is then usable by your customers. One of the things that's clear here is that we can see that things like reliability was hitting around 12% across much of 2021 into 2022 it sort of it bumps up sometimes but the highest we've had is in September. Reliability issues have peaked for Monzo in September at 16% of customers are talking about that. Clearly a problem for customers in here and what I can do is click on that and just have a look at the sort of thing we're talking about in here, you know - What is this? What are the types of things going on? It's best to filter down to those particularly negative people so it can get a real sense of what's Happening inside there...

So let's have a look. "It's slow, it keeps freezing... The app's non-functional. I can't log in... it crashes... I can't open the app..." and other things going on "It stopped working... might let me install the app..." for example. So, interesting things. Problems going on inside the app but where is this happening? Where is it over-indexing? Let's have a look at what's going on inside here.

So, what I can see here - this is a very brief view, it looks like it isn't particularly - a particular version of the app. It looks like it's sort of... What I might do though, to get us really honed in on what's going on, I'm actually filtering us down to September. So... let's see what's going on in September in this particular area on the right. So what I can do is if I have a look at - let's look at the Reliability issue. Reliability up at 16% and on the right panel I'll get down to details here. So it is the Google Play store or a bit of App Store. It's version 4.46 up to version 4.49... So those recent versions which would have been across the past two to three months which are causing those issues. it seems like it's not particularly happening with one of them it's sort of like ongoing. It hasn't been fixed across all of these particular issues, these versions of the app for example. So, that's interesting. Reliability issues need to be fixed for Monzo to actually pick up. It's as basic as that, but one of the things across looking at this data we can see which is really interesting, is the idea of fraud.

Now, fraud is obviously a big thing for someone to talk about. It comes in many flavors... There could be things like: "there was fraud on my account and then they fixed it for me" That's great. It could be things like there's there's fraud present prevention measures inside organizations. One of the things we do see is that the fraud prevention measures from a customer perspective seem to be archaic and really heavy-handed. We can see here though the people mentioning fraud for Monzo it was about 0.5% up to 1% but we can see it's more recently in September it's hitting above 2.5% mentions of fraud. Let's just jump in and have a quick glance at what's going on inside here.

One of the things I like to do is actually see is that number high or low compared to others? So, if I look at this across the board this is looking at from across this whole period the past year what I can see at the bottom here is mentions of fraud across its various forms is the highest for Monese and Monzo. They're both at about 1.3% 1.8% and that seems low but again, not everyone's going to talk about fraud in its various forms like these people do. But best practice is looking at the players like Chase, Starling, and Metro Bank and they're all below 0.5% so that's sort of best practice. Getting below that level means you're in the game but here it looks like Monzo and Monese are actually having trouble.

Let's though have a quick look at this and filter it to... let's look at it for the most recent month here in September and that'll allow us to get a quick view of that. We saw before there was a pickup in that it's the highest it's ever been for Monzo and what we can see here is Monzo is sitting at 2.7% and the next lowest is 0.8%. So it's more than three times the level the next lower one and even likes of Atom Bank no one's even talked about it. So there's issues with Monzo that need to be worked through and what I can do here is filter down to some of those negative things like say, those ones and twos let's have a quick look at what's going on in terms of fraud for Monzo. So again, there's a few things going on. There's broken fraud detection systems... Some person was a victim of fraud and then they couldn't get the money back from Monzo. There's fraudulent charges also going on. So a mix of fraud issues that are causing a sort of - an additional underlying problem beyond the errors happening in the app.

00:09:42 – Glenn: It's amazing the depth of detail that you can actually drill down to when you're looking at these sorts of things so thanks for those insights Tony. And if you want to have a chat to us around your Banking App and the insights that we can get to feel free to reach out to Tony or I and we can hook you up. That's all for now and thanks a lot, folks.