In this month’s snapshot we look at the performance of the UK Challenger banks to see who is leading the way.

Monzo may have lost their grip, but Starling stands out ahead of the pack.

Overall, this category performs very well globally in the Engaged Customer ScoreTM (ECS) rankings. Starling is consistently high, maintaining scores of 4.5 and above. We saw Metro Bank’s ECS rankings begin to lift from May this year, reaching around 4.5 from August to September, and looked to be on the verge of overtaking Starling, but alas, have dropped down to 3.7 in October.

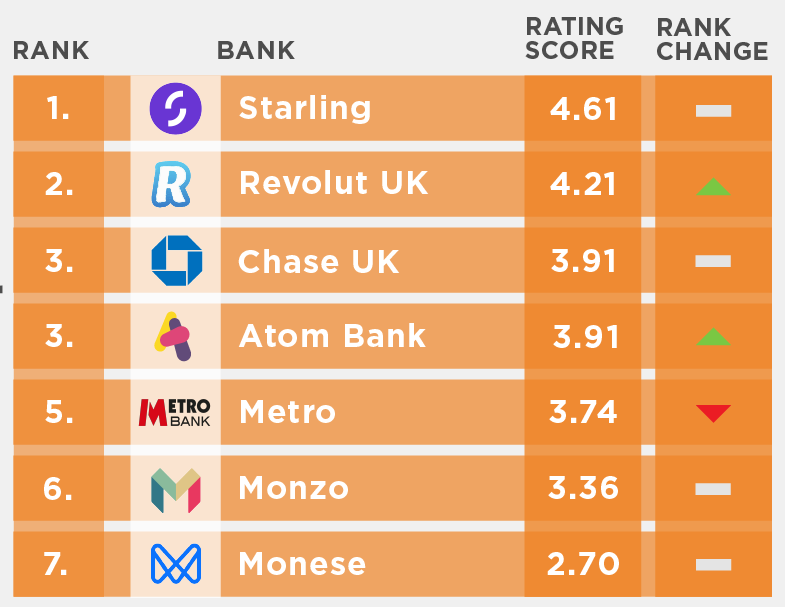

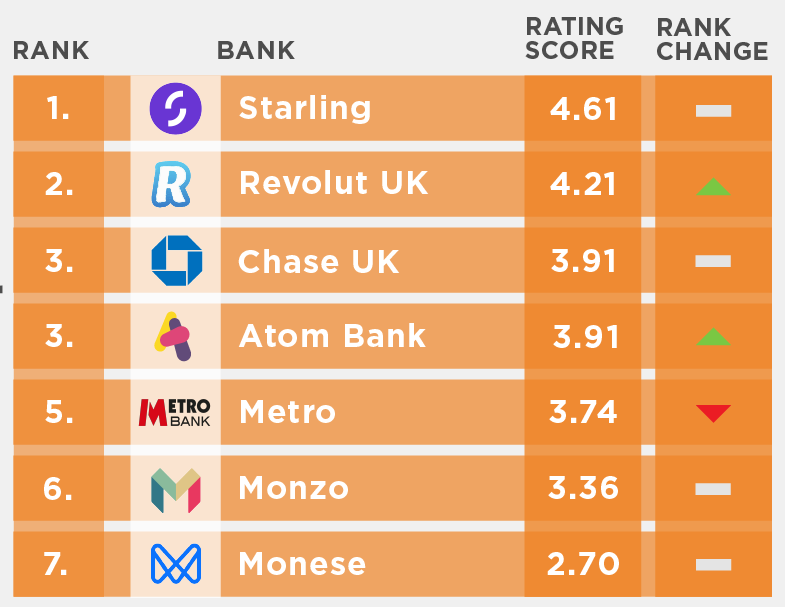

UK challenger banks Engaged Customer Score performance rankings for October 2022

To find out what is contributing to this sudden decline for Metro Bank we begin with the Touchpoint Group SURF analysis, which utilises a specific framework to provide an overview of how the app performs across 4 essential attributes, these being Security, Usability, Reliability, and Functionality.

SURF analysis shows that issues relating to Reliability and Security have doubled in the previous months and these broad technical issues are the likely cause of the lower ECS ranking for the month of October. Whilst they may not be the worst performers, having 20% of your customers talking about technical issues is a big problem for Metro Bank.

Tony takes us into the combined view of the ECS rankings for both the Legacy and Challenger banks in the United Kingdom, which provides a view of how each bank ranks. To better understand the spread between the banks Tony takes us into the analysis of the ECS data that looks at the impact of the issues, specifically for the October time-period, where we can drill-down into the things that customers are talking about.

Starling sits out in front, scoring 4.6 for October. Monzo on the other hand is not faring too well with an ECS of 3.4. To find out what separates Monzo from the other banks Tony opens the ‘Impact’ analysis which highlights their topical issues and the impact they have on their ECS and which areas need addressing, and on to look at Revolut, who are scoring above average for this category.

Starling appears to be the best example in this group of a bank app that has its functionality under control. When your customers are not facing broad technical issues to do with logging in, bugs, and crashes they are more able to experience the app as intended. It is only then that we see customer Journey and features coming through in the feedback data. Others in the UK Challenger bank category should pay close attention to Starling, the standout performer by a country mile.

Where does your bank rank? To find out how well your own bank is performing contact Touchpoint Group today for an analysis session customised for your bank.

Full Transcript

0:00:07 - Glenn: Hello everybody and welcome back to another Touchpoint Group Banking App Insight Session and this particular one we're focusing on the UK Challenger Banks for the month of October 2022 and Tony Patrick, you know in the digital age, core functionality and getting the basics right is so critical to allow your app features to shine. So, this month we're going to take a sneak peek at some of the sentiment behind the ratings that users are giving these banking apps and in particular, we're just going to use Metro as an example. Tony, over to you.

00:00:49 - Tony: Great. Thanks, Glenn. Yeah, it's getting those basics right. Is really important that we can show that with one of the leaders globally which is Starling but, the banks carrying off today are Starling Monzo, Revolut, Atom Bank, Monese, Metro and Chase.

Let's just jump in and have a look at one of the first things which is useful to see is how things are going in terms of score. So we're seeing Starling is consistently high, always above 4.5 and consistency is probably one of the things about them which is really important. They're always between 4.5 and 4.75 and just moving along very nicely. We did have a Metro challenge then to some extent in August-September but, they have dropped away dramatically in October. They had done really well from that May increase and to tell you what, like, the way they were going, they were on the verge of challenging and overtaking Starling.

But, it's a very big task to do that because they are at such a higher level. So, we can also see a bit of bumping around at the bottom Monese sort of moving around there up and down which is you know, the consistency is not... -you know, they're sitting around 3. It's consistent but, they're jumping up and down fairly often. Let's just have a look at what Metro Bank is up to. This is just Metro Bank we're focusing on now, and what they've had, what's happened to them in October. So, first of all, just navigate what you're seeing here is this is the score for Metro across time, August 4.5, as we saw there were they were near that sort of top level 4.5 in September but, dropped down to 3.7 in October. One of the things -this red sitting here behind that, is the number of pain points in these topics below.

How big was the pain for customers across these Reliability and Security issues? And we can see it's doubled pretty much in October and that's why that score has moved the way it has done. But, if I look below I can quickly see where this has come from.

One of the things I can see first of all, Reliability is at 22%. That's increased a lot but, a lot of it has come from we can see here, the score for October is 22.4% and that has gone up 15 points from September. So, that's massive. Before, Reliability was only mentioned by about 7% of customers it's now jumped to 22% hence the score drop. The same thing for Broad Technical Issues, App Crashes was previously at 0.4%, it's jumped up by 5.2% and got ourselves to 5.6%. So, clearly they have some issues to actually move forward on here. If I look at that for in terms of say, -let's look at technical issues. What I can do here, is even just compare what they're doing compared to other banks in this particular set. I'll just benchmark that briefly and have a look and see what's going on and just see -I might just highlight Metro in this case. We can sort of see where they stand. Again, they're not the worst this time around so we didn't see them drop to the lowest in the overall score but again, having 20% of your customers talking about technical issues is a problem whereas the likes of our global leaders Starling and even Revolut are sitting up there sort of below 10% and even below 5% so that is best practice getting to that level in terms of technical issues.

Let's just see where these banks perform globally. What we're seeing here is that Engaged Customer Score. This is again, those giving a score and a comment which allows us to have a really sensitive view of actually what's going inside that app. If your score goes down, we know what's actually happened because there's comments attached to it. One of the things we can see here, if we look at this the sort of the purple area here, we can see Starling is actually sitting second globally at 4.6 not quite up there with U.S Bank but, it's doing very well and it maintains that position across time whereas we can see the likes of Monese, we saw it sort of in the other chart -it's sort of lower there. The likes of... again this is the past quarter so that drop we're seeing for Metro isn't actually in this chart at the moment. They obviously will go backwards if they maintain that drop. Let's then step in to understand why there is such a spread in these Banks, why is it spread across such a wide range? Let's just jump in and have a look.

This is just looking at October, and this is just looking at the scores for just October, so if we look at Starling their score is 4.6 in October. If we look for Monzo on the far left here, their score is 3.4 in October. But, what we can do though, is have a look at this in terms of the sentiment so what are people talking about in terms of this particular bank. Now, what we're looking at here is what makes Monzo different to the other banks in this set, in October. What makes them different? What makes them stand out?

One of the -obviously the middle one there, Poor Open Accounts There's issues with opening accounts with Monzo happening in October in particular. But, one of the things we can see is there's a few positive things. So Good App Budgeting Feature is actually -it stands out for Monzo. Monzo are doing very well in that area but they do obviously need to fix up other things that are going on: there's Credit Score things, there's Postal Address problems, there's a lot of things going on inside there that they still need to fix. So, that's interesting. What we can do though, let's move up a level.

Let's move up to others perhaps even Revolut. Actually revolut is interesting. Let's go into that. So, they're above average for this category and let's see what's going on. This particular category is Good App Functional Appropriateness is actually an interesting topic. It's just showing the app is working well, it's doing what it's supposed to do. So I might even just select that and just have a look at the types of comments coming through there, and it's -these are fairly broad. "It works good... It works... It's excellent... It's useful, It does all the things I need to do"So, very positive from that perspective.

You know, a very broad topic but, it does capture the sentiment about what's going on. But, one of the things I'm seeing here though, for Revolut, is that what we tend to see is if you have your Journeys in order and your Navigation set up in a nice way, once you fix your problems with things like Logging in or Bugs and Crashes and Technical Issues, these things should start to shine where in fact here for Revolut we're not seeing any -Navigation is slightly negative and slightly negative topic. So we're not seeing any features popping up as being really positive. I'll show you what I mean by actually going in and having a look at one of our global leaders, Starling. They've got their things like Logging in under control. They've got their Crashes and Bugs under control, now you can see where it shines: suddenly Overall Good Banking App, great, that's fine but, what I'm seeing here is suddenly I'm getting Journeys and Features popping through as really positive things. So, good Spend Analysis. Again like Monzo, that's probably the two that have the best Spend Analysis and we see things like: there's Good Push Notifications, Good at Viewing Transactions and we're seeing with others if you can't get the extreme Basics right like viewing your transactions or making a transfer, then suddenly you can collapse in a big way. But, Starling has that under control. This category has a lot to learn from Starling. They're doing a very good job of what they're up to so I'd suggest, you know, learning to understand what they're up to job of what they're up to so I'd suggest, you know, learning to understand what they're up to and replicating that or doing your own version of it at least to get things under control. Yeah, positive news of Starling but, others need to catch up. They're ahead by a long way.

00:08:23 - Glenn: Yeah. I suppose a sneaky little plug there. If you want to be able to have a look at what Starling is doing, using the technology that we've got to understand what their customers are saying, give us a shout have a great month people and we will catch you next month with more insights.