UK Challenger Banks 2022 Year in Review

Executive Summary (TLDR)

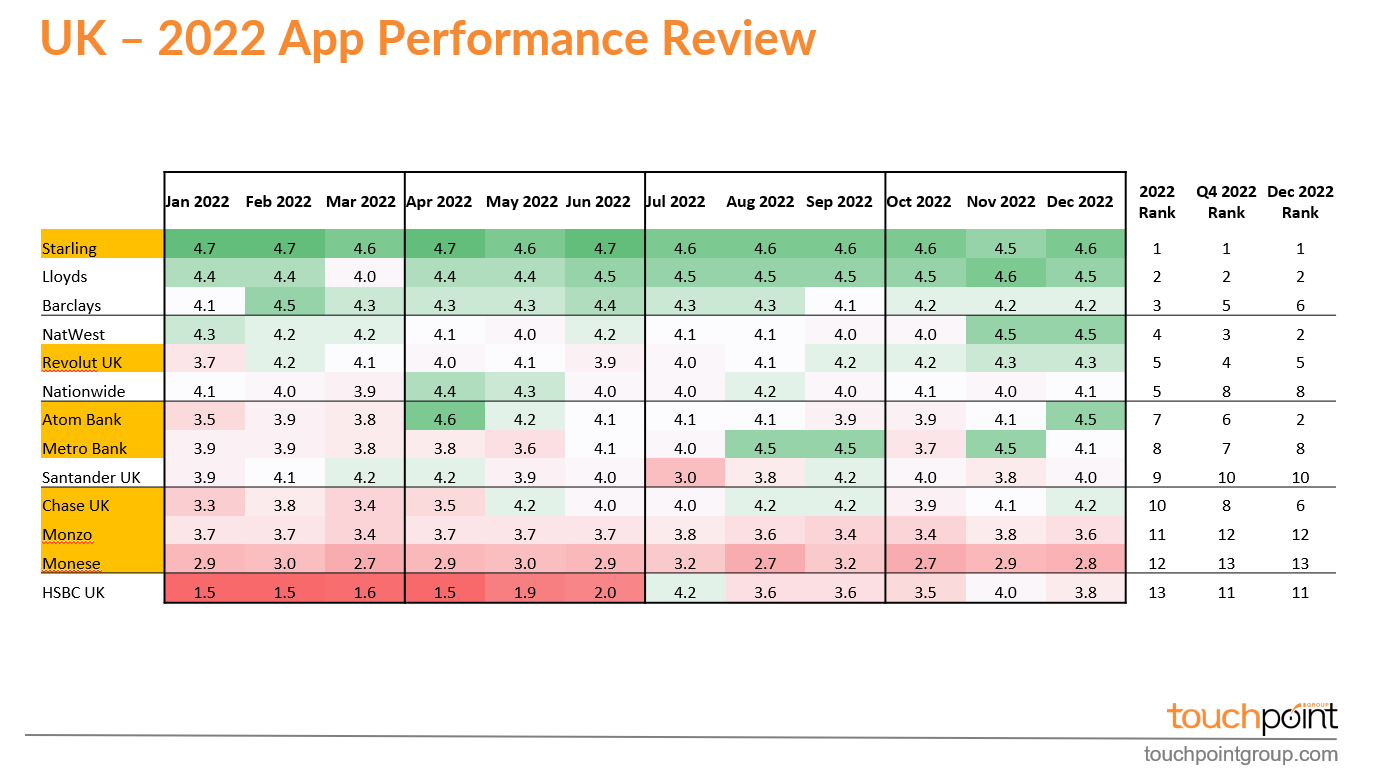

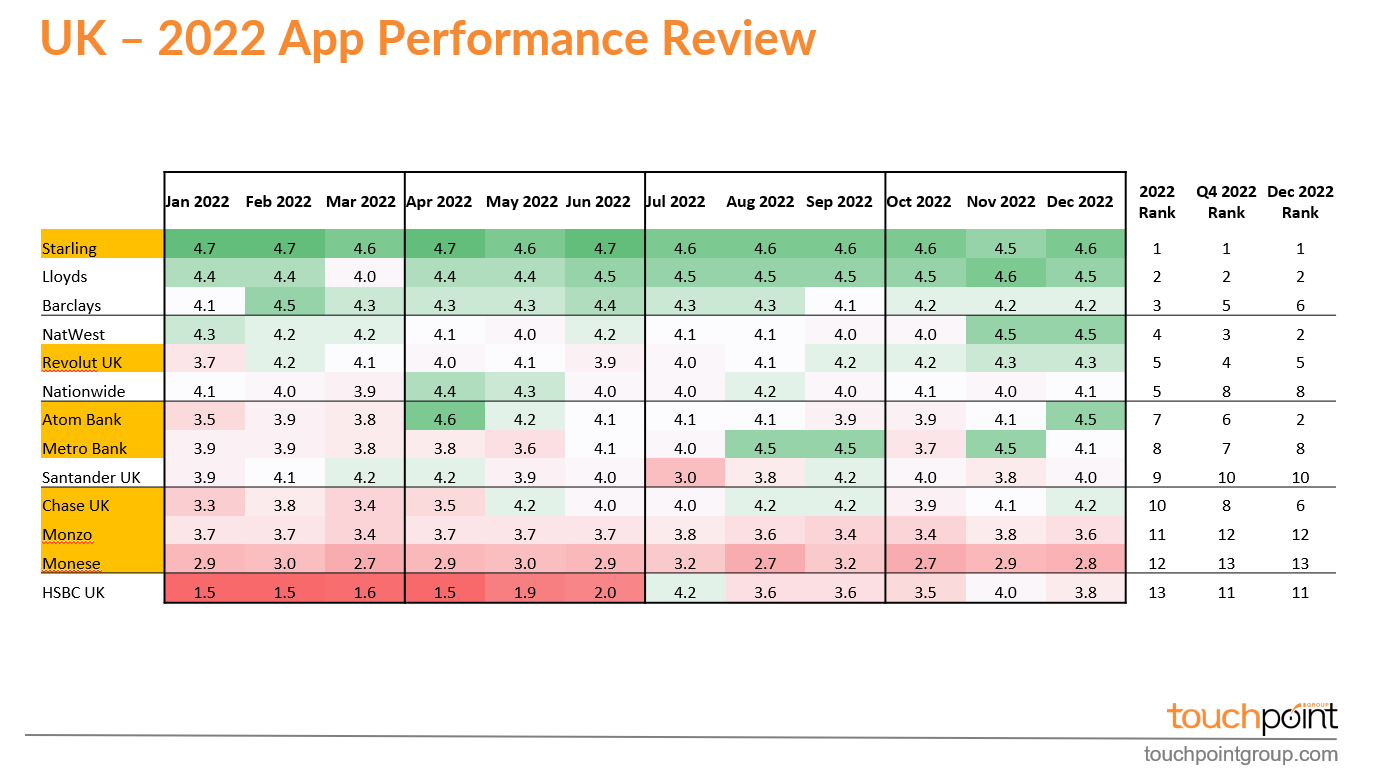

Starling Bank takes out the Touchpoint Group Best Engaged Customer Score Award for 2022. In fact Starling Bank als wins the global supreme award for best app globally. The Starling Bank app performance has been the standout for Global best practice in 2022 and Touchpoint clients have the opportunity to use the Touchpoint reporting technology to look behind the iron curtain and understand what makes the Starling Bank app just so good.

With the top US Banks investing heavily in in-app experience and the challenger and neo “digital banks” relying on incredible online and in app experiences, it will be an exciting 2023 seeing the race to the top unfold for the new year.

Atom Bank takes out the most improved app award with a surprising rapid rise in the rankings in the last quarter and finishing the year out in joint second place in the UK Market with an engaged customer score in december of 4.5, alongiside Lloyds and just behind Starling Bank who finished the year with an engaged customer score of 4.6.

Monzo and Monese are continuing to struggle at the bottom of the pack in 12th and 13th place respectively in the UK market with a disproportionately large proportion of customer feedback unhappy with payment tools, fees and worried about fraud risk. All this screams opportunity for these two banks and HSBC has shown how focussing on core fearures and journeys can make a dramatic improvement in those trust signals. Two of the core journeys that Monese is struggling to master are critical in the eyes of most customers, “monitoring account activity” and “checking your account balance”. These areas should be a quick fix and prioritised and when banks focus on mastering the critical journeys and features they have a big impact on overall customer experience, ratings and subsequent rankings.

We expect to see big things in 2023 when it comes to investing in “In App Experience” as most institutions are becoming hyper aware, in the current economic climate, of cost control and mitigating churn risk. The better banks understand customers in app experiences and feedback the easier they can mitigate churn and reduce demand on call center operators.

We estimate for the UK banks, an effective program being implemented to monitor and learn from customer feedback can have up to a 2% reduction in churn and 2-3% reduction in call centre costs (which can add up into the hundreds of millions of dollars saved or retained each year).

Touchpoint Group is a customer intelligence company utilizing advanced AI and natural language understanding in its proprietary analytics platform to analyze over a million banking app reviews each year in its global ECS index.

Touchpoint Group processes customer feedback data captured using internal customer experience platforms and sources. Data is updated daily, with insights available to identify issues for Operational teams, monthly reporting for Leadership teams, and a Mobile Customer Experience Analytics (MCXA) report published quarterly for Executive leaders to benchmark performance by category and against the best in banking app performance.

Video Transcript

0:05:00 – Glenn Marvin: Welcome back to another TouchPoint Group Insight Session. We're doing a 2022 year in review for the UK Challenger Banks and Starling the absolute performer outperforming all banks in the UK, not just the other Challenger Banks and Chase has had a pretty good up... -well up and down but a pretty good year overall as well. Tony Patrick, over to you and please dig into the detail.

0:30:00 – Tony Patrick: Great. thank you, Glenn. Yeah, UK Challengers so, Starling, Monzo, Revolut, Atom, Monese, Metro and Chase. Let's Glenn. Yeah, UK Challengers so, Starling, Monzo Revolut, Atom, Monese, Metro and Chase. Let's have a look jump straight in to our normal view which is looking at how they've gone across the year. Now, one of the things we can see as Glenn mentioned, how well Starling is actually doing.

Looking there we can see it's -you know, sitting above 4.5 all the time. A couple of down points, a slight trend down near the end of the year but looks that's still a major Improvement for them. The other one is looking at the likes of Chase. Starting at the start of the year at sort of 3... 3.5 towards there but again they've picked up really well towards the end of the year and maintained that Improvement. Obviously, if they actually -if they pick up again in the next round, they could actually become a second in this particular group. They've done very well. A few other sort of -there's a few ups and downs across the year but, let's have a quick look at how they compare across the UK Market. We've got a select group of UK Banks across the market here and we can see how well Starling here is actually done. There's a lot we're showing here but, essentially we can sort of see there's a block of green at the top with the sort of the top three I've got a block of green, they're doing very well compared to the market. In the other end of the scale we have a sort of block of three to four at the bottom here who aren't doing that well.

Now, we can see Starling's done well and I suppose an award goes out to Starling for that consistency across the year but also leading the pack and maintaining that lead across the year so very well done to them. For Lloyd's there's probably -there's a slight drop in March, but essentially it's been consistent across the year. So an award for Lloyd's in Consistency they've done very well from that perspective. Again, they're sort of slightly outside this category. If we look at the other ones in terms of Revolut, Atom, Metro, they're doing okay. We can see that Revolut's had some Improvement in the the second half of the year, looking at about 4.2 to 4.3 average for the last quarter. But that hasn't really changed their rank as such. Overall, their rank is about fifth and they're about that for the December and Q4. What we have seen though, is that Improvement for Chase. We can see that in the rankings as well. There were a 10th out of 13 across the year, but for the past quarter they're 8th and for the past month they're 6th. They're on that trajectory of moving up in the world.

Let's have a quick look at some reasons why they've gone that direction. One of the things we look at here, which those familiar with what we cover regularly this is our SURF Analysis. So, looking at Security, which is around Authentication, Usability -UI and things like that, Reliability and Functionality. In this case here, these are pain points so you want to get these as low as possible. Let's have a look though, at Starling in terms of Authentication they've got -that's pretty low at 0.9%. So, fewer than 1% of customers have issues with Logging in and Authentication. That is really really positive for them as compared to the likes of Atom Bank which had around 8%. They had some issues across the year. We can see there though why Starling is doing so well. They've kept these pain points down to a minimum compared to others, very positive for them. Let's have a look at it from a slightly different perspective. What we're looking at here is across the major Journeys that customers use.

One of the things looking at here, is the the big things, the reasons why you'd want to use a Banking App and it's Transferring Between Accounts, Checking your Account Balances, Monitoring Account Activity, Depositing a Check, Paying Bills, and Making P2P Payments. So, the basic stuff you want to be doing. Who's doing well in each of these areas? One of the basics you want to do with one of these apps is actually Check your Account Balance. We can see there that at 3.9 Starling is doing very well. Again, there's still room to improve, they can actually get that higher but again, it stands out compared to others and the same with a very simple thing you'd think should be across doing very well for all these is Monitoring your Account Activity. So again, doing very well there for Starling. As they are for the basics of a Transferring Between Accounts, some others sort of need some room to improve in that area. Let's have a look though, at in this case here, I'll have a look at what Starling looks like in terms of where it stands out in terms of the major concepts that come through in this area here. What we can do here is look at the major topics coming through for them that make it stand out, make it -why is it in this position? We can see there it's a Good Provider, it's a Good Financial Service Provider, Good App Push Notifications, Good Banking Experience so it's a very positive vibe and it's mostly green. A couple of small things they can improve on with the business customers here in particular coming through. So, very positive for them. Let's take another look at someone else. Let's look at maybe look at Revolut, which is doing reasonably well. Let's see how they look in comparison? Again, it's not all green. There's a few things coming through like: It's a convenient app, but there's issues with transferring money. There's issues with Managing Investments etc. coming through. So yeah, it's positive. There's no major technical issues but they need to pick up on a few of the Functionality things coming through and those Journeys as well.

Let's have a look at another one here which is Chase -which has had that Improvement across the year and what we can see there about them is things like there's Interest Rate is good, that's a very positive thing coming through but the Poor App Performance and Slow App. Obviously, they're making those improvements gradually continually and this would look very different in the past quarter because it actually changed rank and they've done very well at that latter part of the year. Customers like their long-term rewards and essentially it's there's some room to improve so, there's no major technical issues but they need to improve on these basic Journeys as well like the Account Balance and Checking your Account Balance by the App they need to improve on those in particular. Room to improve but some positive news coming out of some of these apps across the year. Thank you, Glenn.

07:04:18 – Glenn: Some great insights there and congrats to Chase on the improvements that they've made and Starling just absolute standout performance consistently across the year. If anybody would like a copy of that ranking chart, sing out where we rank the banks across the whole UK and around the year, the quarter and that last month of December and everybody have a fantastic 2023. We are looking forward to sharing this journey along with you over the course of another year.