Jan 2023 UK Banking App Rankings & Insights

One major change you will see in this months rankings report is the combined ranking data set which is in response to the overwhelming number of requests to provide and higher level view across all the major banking app providers in the UK market so those that want to can benchmark against any of the providers they deem competition.

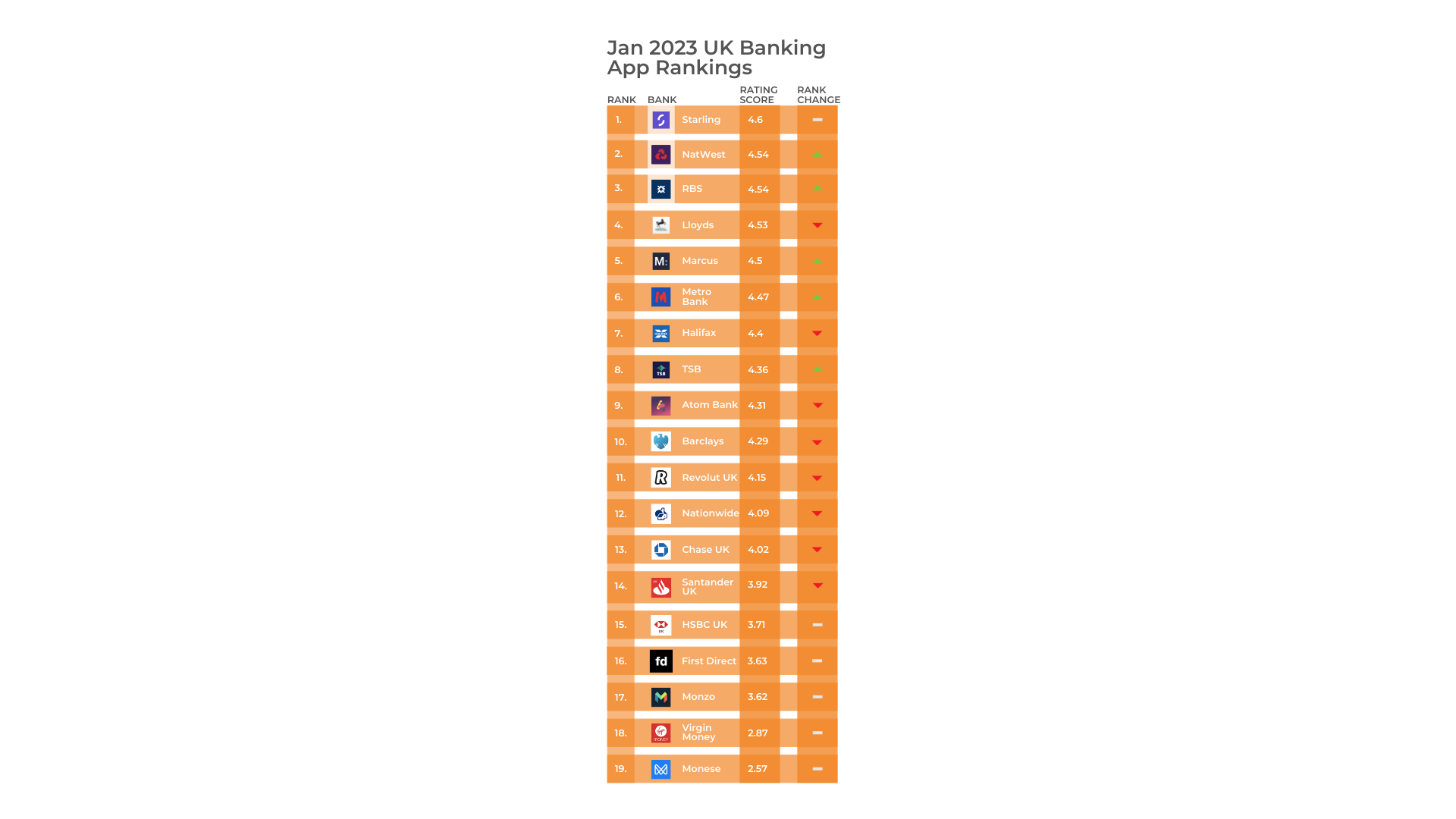

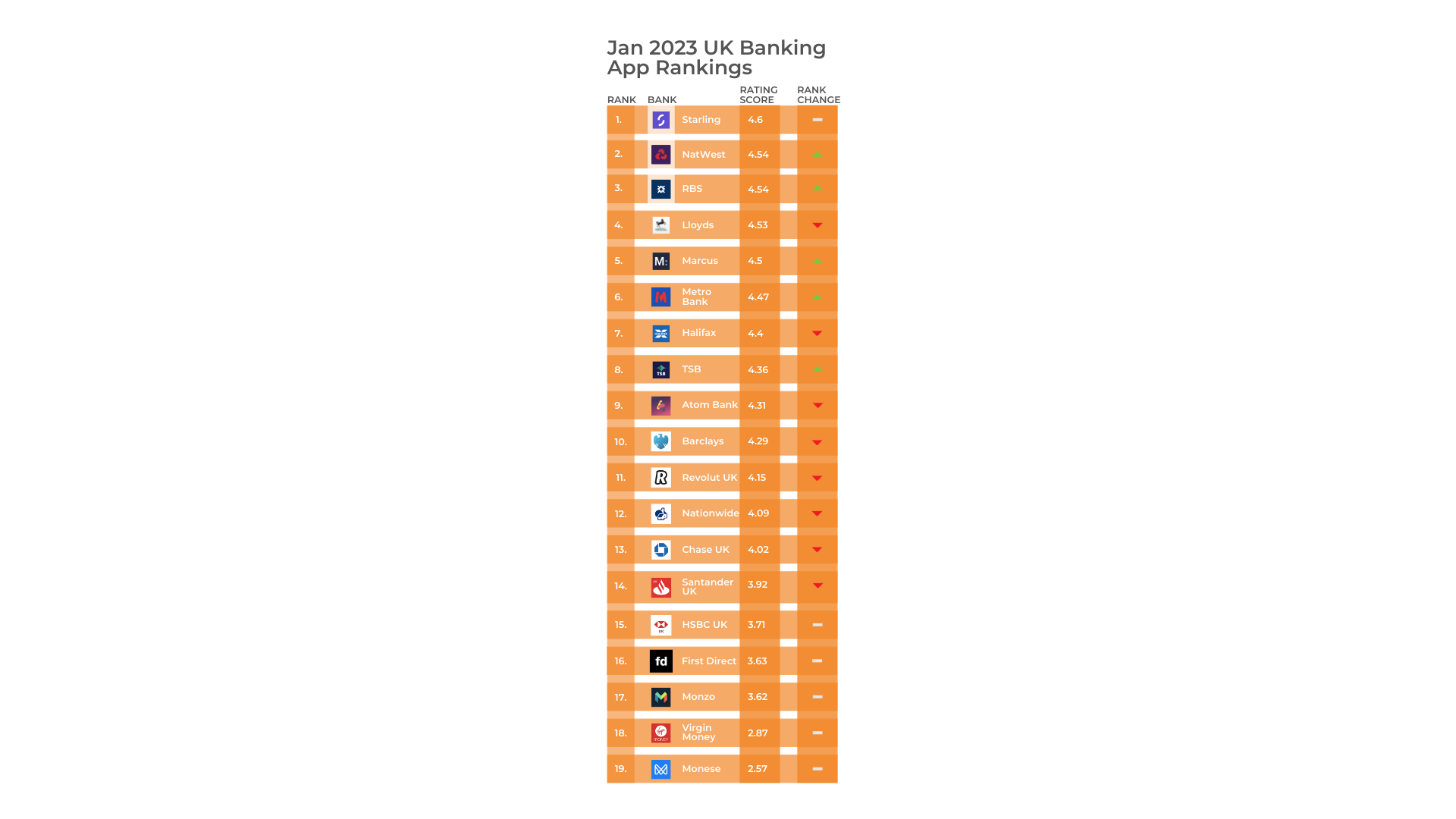

In January, Starling Bank kicks off the new year, leading the Uk Banking App Rankings with NatWest, RBS, and Lloyds within 100th of a ranking point of each other in hot pursuit.

The real story for January is the rise of NatWest, who have jumped up the rankings and have made some impressive gains over recent months. In this insights session, we dig a little deeper into NatWest's performance and how the app stacks up against Lloyds who have historically been the top-performing legacy bank in the UK for the past two years.

NatWest has seen major improvements across the board. When we look at core journeys like Depositing a Cheque, Monitoring Account Activity, Transferring Between Accounts, and Checking an Account Balance, NatWest is actually performing better than Lloyds (See the transcript below or skip to the 6min mark in the video above)

Looking at the 4 core pillars of App experience of Security and Authentication, UI and Design, Reliability and Functionality, NatWest top three of the four, and Lloyds rank top in the UK for UI and Design.

Looking specifically at the UK Challenger Banks, Starling clearly leads the pack. However, there is still room for improvement if the want to retain the title of UK's best app as if we look at a very simple but critical function such as transferring between accounts, Starling only ranks 5th and this would be a key area for them to prioritise to get the most significant impact on customer experience overall.

Touchpoint Group collates this customer intelligence utilizing advanced AI and natural language understanding in its proprietary analytics platform to analyze over a million banking app reviews each year in its global ECS index.

Touchpoint Group processes customer feedback data captured using internal customer experience platforms and sources. Data is updated daily, with insights available to identify issues for Operational teams, monthly reporting for Leadership teams, and a Mobile Customer Experience Analytics (MCXA) report published quarterly for Executive leaders to benchmark performance by category and against the best in banking app performance.

Touchpoint Group UK Banks Video Transcript

00:05 - Intro by Glenn.

00:57 - Engaged Customer Score Ranking Chart

01:23 - UK Banks Market Insights

03:14 - UK Banks SURF Analysis

06:00 - UK Banks Journeys Review.

07:58 - UK Challenger Banks Insights/ECS Chart

09:19 - UK Challenger Banks SURF Analysis

10:52 - UK Challenger Banks Journeys Review.

12:03 - Final words by Tony & Glenn.

00:05 - Intro by Glenn.

Glenn: Hello everybody, and welcome back to another Touchpoint Group Banking App Insight Session, and we're going to be looking at the entire UK market for the month of January, and... due to popular demand and lots of interested people reaching out, we are combining the data sets. We're going to get a look across everything when we move into benchmarking.

But, first of all, we're going to have a look at the main UK Banks, and in particular, we're going to be looking at NatWest Bank and the strides that they've made to nearly topple the market leaders in there. Before we move into the Challenger banks, have a little look at that, and Tony Patrick... You have been doing some great work looking at the benchmarks for some of the different areas in the apps across the entire UK Market.

00:57 – UK Banks Engaged Customer Score Ranking Chart

Tony: That's right, Glenn. So looking at... the groups we have here, the UK Banks and UK Challengers but again, as you said, Glenn, let's compare these side by side and see how well they're doing against each other.

So, first of all, I'd like to just jump in and have a look at what we saw at the end of last year, just for some context, so we can have a base to see actually what's the movement being like into January.

01:23 - UK Banks Market Insights

So, what we can see here is there are a few leaders sitting there, for example, like Starling and Lloyds sitting at the top there. Sitting, you know, above 4 consistently and they're always ranking 1 and 2. We saw Barclays soften at the end of last year, so let's see how they've gone in January.

And a few others like Atom Bank does tend to move around, and Santander has had a sort of a softening recently, but, you know, there are some movements we see as well like, for example, HSBC is that big mover mid-year, and you see that they've maintained that movement up into clearly -near 4, but their rank hasn't actually improved that much, they need to actually do that next level to get up a bit.

So let's move in and have a look at these sort of main Banks here, and what I'll do, I'll put HSBC back in just so we can see that movement we had, and it's good to clear it away so our scale can get back to normal. But one of the things we can see here is they've hit that level of around 3.75 and just slightly above sometimes, but they haven't gone to that next level-up which is hitting that 4 consistently.

I'll move that away just so we can see what else is going on. One of the things we can see is Santander has made that jump from July. We have had some issues in July but that's picked up nicely but again, they need to actually improve to the next level to get above that 4, the same as HSBC.

But one of the big movers is NatWest, and we can see there it actually is bumping up against Lloyds very, very closely and, in fact, in January, it's basically neck and neck. And so what we can say then is that NatWest has done something in November to make a massive change to actually improve things up.

Let's have a look at what they've actually done. Or what the outcome of what they've done is.

03:14 - UK Banks SURF Analysis.

So, what I can see here -what we're looking at here is our SURF Analysis covering off these four key areas of Security and Authentication, Usability, Reliability and Functionality.

So, when we're looking at these things, these are all pain points, these are all problems, so we want to get the frequency down as low as possible. And we can see with Security and Authentication (logging in and things like that) we can see that from the most recent three months from November to January, we can see here that NatWest has done very well at 2.8%. Very, very low numbers in terms of that area there, and that's half from what it was in those three months prior to that so, logging in is really good. Let's look at Reliability, that's also dropped away in terms-- which is really good; they've actually got Reliability under more control in that area. So across the board, some good improvements. But even with that improvement, how does it compare to Lloyds? So let's have a quick look at that.

So Lloyds is at the top there. Now, we see NatWest is sitting with this Authentication piece at 2.8% Lloyds is at 2.4. Pretty much neck and neck. Not too much difference there. So they're doing very well in that sense. Reliability is also under control at around 7%. So that's really good. The customers can actually get through and actually use the app as it was intended rather than things breaking down, which is great. But there are two areas where we can see NatWest has more issues than Lloyds. Usability issues and if, you know, if I jump in here and look at Usability on the right panel here, you can see that there are a few things: "Is impossible to log in using the app", "it's hard to use the app", "there are things that are slow", "it's difficult to use", etc. So there are a few other things that sort of seem cumbersome or things like that.

Obviously, we could drill into those but, we're just looking from a higher level from this perspective. But also there are some Functionality things that can be improved as well.

But to give you context about how things are going here if I have a look at this from a... from a full market perspective and benchmark this by bank, I can see that NatWest is actually doing very well, so let's just do it across all of these banks.

And so what I can see in here if I just remove the filter from NatWest, just looking at Usability, even though it's at 8.5%, which is reasonably low, it's actually doing very well compared to others. Still in that top, at the top there. When I say top it's the ones with the lowest frequency here is the best, so I can see there NatWest did 8.5, it's doing very well compared to the best, which is actually Lloyds in this case. And we see others in that range as well. So very positive there, but still, that incremental improvement is going to make the difference.

06:00 - UK Banks Journeys Review.

Now, one of the things also we can look at is jumping across and having a look at how well they're doing on each of the journeys. So first of all let's compare NatWest to Lloyds because Lloyds, again, they're competing at the top of the moment, and this is across that past quarter so it's past three months. And this is very interesting; we can see that NatWest is actually doing better on each of these Journeys.

So when I say Journeys, it's things like Depositing a Cheque, Monitoring Account Activity, Transferring Between Accounts, Checking your Account Balance, all the basic stuff, from moving money to just checking your balance that an app should be doing very well. And you can see there that NatWest is actually performing better than Lloyds. So, if Lloyds can get those Usability and Functionality things a notch higher, they could actually leap ahead of Lloyds. So a very positive position for NatWest to be in. And also a nice Benchmark piece, I'm just looking at Lloyds for the moment; let's compare NatWest to the total Market.

We can see there, they leap ahead even further so that their position is very strong in terms of the way these particular Journeys are actually working for customers. So very positive for NatWest. So, another look here and what NatWest is up to.

This is the app release cycle, and we can see here that in November this is where we picked up, so version 7.24 is where all the magic happened for NatWest, they actually had a massive uplift in their score compared to previous periods. And they've actually flowed that on to the release 7.25. So NatWest need to be careful, they make sure they understand what the magic is inside here, which we can see and they make sure they maintain that and improve the areas that are going to make that difference. So a very positive position for NatWest to be in and we expect them to at least maintain or improve from where they are at the moment.

07:58 - UK Challenger Banks Insights/ECS Chart.

Let's have a look at the Challengers briefly and then we'll do some Global comparisons.

So, one of our... not quite the global leader, that's out of the US with a U.S Bank, but Starling is sitting consistently at 4.7, 4.6 very strong and consistent across the year, which is why it is ranked number one in the UK. So this is just a reflection on what happened up till the end of last year. Some other movements, for example, we can see here, we see NatWest that's that Movement we saw, that movement up 4.5. So lots of positive movement for them.

Let's have a look though at what the scores show us.

So what I've got here is actually their scores across time, I might just remove a couple of these like Monese is having trouble getting above 3, it's consistently down there but, let's just get our scale in order here. One of the things we can look at is just briefly where Lloyds sits compared to these Challenger Banks. So near the top there and we see that Starling is sitting ahead of them. So Starling is actually doing very well right at the top there, but very closely behind the likes of Lloyds and also, of course, NatWest which I've just looked at. So that's interesting where that fits in. But let's have a look at some Global comparisons across all of these Banks we've been covering.

09:19 - UK Challenger Banks SURF Analysis.

So I'm switching here to this SURF Analysis, which is looking at these four key areas and again, here is where we want these scores to be as low as possible; these are all pain points.

First of all, I'd like to look at this area of Security and Authentication, so just move this chart from the top of where it's. So what I can see here is that 2.5% is the average across of that particular period in January but, let's look on the right here about what's going on. I can see that Starling is doing the best so the only 0.6% of the conversation for Starling is around Security and Authentication, so very limited login issues. So customers are getting into the app consistently and very easily. But we can see here the likes of Lloyds is 2.4 we've seen NatWest is 3, so that level of 3 and below looks like a good Benchmark to actually be sitting at. If you're above that, you need to have a good look at what you're doing with your Authentication piece.

What about Reliability? Where is that sitting? So this is just looking at January, by the way, what I can see here is that we've got Starling which is, of course, at the top in terms of the overall score, but the Reliability is really, really strong. Customers can use the app as it was intended without having these issues coming through, so only around 4% having issues as compared to others in here, which you know, getting above 10% you started to get into a territory where customers are having a negative experience here as compared to others.

10:52 - UK Challenger Banks Journeys Review.

What I'll do now though, is have a look at Journeys. So again in a similar position here, we can see the journeys across here in terms of the scores. Now, this one here of course, this is just looking at average score because this is positive and negative comments coming through, so what's the average score? The higher the better. You want to actually get a really good higher score on this one across all these, well, pretty much basic functionality you want to achieve in an app for banks.

So let's have a look on the right here I've got a very simple one about Transferring Between Accounts. Very, very simple thing you should be able to do, we see Lloyds actually leading so 4.3 which is why it does so well in that area there. Barclays sitting up there as well, Halifax, Starling can actually do some improvement there as well, they're sitting at number 5 but still, they're very, very strong. Here, it looks like pretty much getting anything 4 and above is going to do you well in this market.

If I look at another very simple thing: Paying bills. How well is each of these Banks doing on there right here? So Barclays is again doing well there, NatWest we saw before was doing very well in a lot of these things, and Lloyds is also up there. So again, getting above 4 on these is the Benchmark to actually show you actually doing very well for your customers.

12:03 - Final words by Tony & Glenn.

Tony: So Glenn, yeah, it just shows that there's a lot to improve for every Bank, even if you're up near the top there's still room to do one better.

Glenn: Yeah, absolutely. And if you're interested in getting a copy of these, having a look at where your bank stacks up and having a chat with us, feel free to reach out we're more than happy to have a quick session with you and talk through what is possible with the software that we've got, and the services that we offer. Thanks again, Tony and we look forward to bringing you another Insight Session next month.