Executive Summary

Welcome to this month's Banking App Insight session, where we delve into the Engaged Customer Score and overall performance of three prominent UK banks: Barclays, Nationwide, and TSB.

Each bank presented a unique story in April, reflecting its successes and challenges, and we will cover the contrasting performances of these three banks.

Nationwide's consistency has solidified their position amongst the leaders, while TSB's recent app release has led to a decline in various areas. Barclays, despite its initial strong showing in February, has encountered reliability challenges in the past couple of months.

Nationwide Building Society

Nationwide has demonstrated remarkable consistency, maintaining a score above 4 and securing the top position in our rankings for nearly a year. While it tends to dip just below 4, it quickly picks itself back up.

TSB

On the other hand, TSB faced a significant setback during the month of April. Our comprehensive SURF Analysis revealed a sharp decline in various areas. The primary factor contributing to this decline was the release of their new app in February, which has encountered numerous issues and caused trouble for their customers.

TSB needs to address these challenges swiftly to regain its footing and rebuild customer confidence.

Barclays

Barclays, while initially showing promising results in their Engaged Customer Score in February, experienced Reliability issues across their app during March and April. Although they have gone up from their March drop, there is still the need for more improvement.

Video Transcript

00:00:05 - Intro by Glenn

00:00:26 - UK Banks Engaged Customer Score Comparative Rankings (ECS)

00:03:42 - SURF Analysis - TSB

00:07:26 - SURF Analysis - Barclays

00:09:54 - Final Words by Glenn

00:00:05 - Intro by Glenn

Glenn: Welcome back to another Touchpoint Group Banking App Insight Session. We are looking at the UK Banks for the month of April. Three Banks featured this month; we have Barclays and they are starting to get into danger territory, Nationwide who are continuing to lift, and one out of the box, Tony Patrick, TSB, who are finding themselves in a little bit of trouble. But I'll let you take over and go into the detail.

00:00:26 - UK Banks Engaged Customer Score

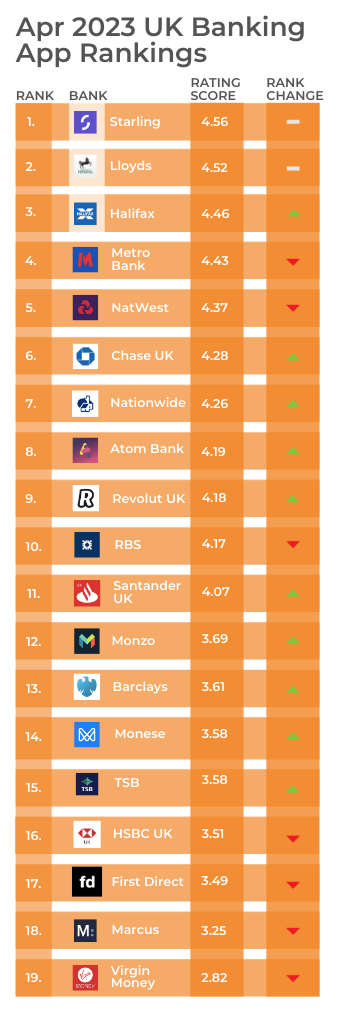

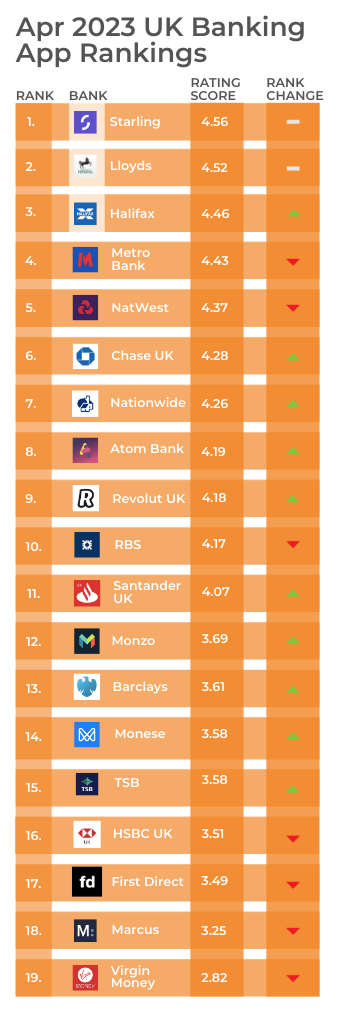

Tony: Great thank you, Glenn. So, TSB we don't normally cover but, let's have a look at some normal numbers we look at when we jump into this. So, the first thing we can look at is our scores for the major Banks across the UK.

ECS - HSBC

One of the things about this particular chart as we always talk about is that HSBC has historically, just about a year ago, had problems so it's ruining our scale so I just chopped that away for the moment.

What I can do it helps us see the picture of what's going on. This score... we talk about this all the time but, the question we get is Why is this score so important? This is our Engaged Customer Score. What this is, is those customers giving both a score and a comment and what makes that so powerful is any movements we see here, we actually know exactly why that's happened because there's a comment attached to everyone who's given that score. And this will be different to what you see in the normal scores which are normally flat which you see in the App Stores.

What we're seeing here though is the pointy end, this is where you need to be focusing rather than looking at everything at once.

ECS - NatWest

One story here as we brought up is NatWest and how well they've done and they've gone up against Lloyds at the top there. They haven't necessarily overtaken them, maybe one point they did slightly, they're still up there slightly down, but they're doing very well there, which is great.

ECS - Barclays

Now as Glenn mentioned, Barclays has dropped away; we saw that last month dropped away into March, but that hasn't immediately jumped back in April.

We need to look at that and see what's going on. Let's move forward though, and see what's happening elsewhere.

ECS - Monese

Lots and lots of banks sitting in here, one of the ones I want to have a look at though, just briefly, is Monese.

Now traditionally, Monese are sitting around 2.75 to about 3 and it's jumped up now to above 3.5 and it's hitting the territory of other Banks there so, we're not going to focus on it today but something interesting for Monese to be aware of. Whatever they've done recently has actually worked and hopefully they can maintain that.

ECS - TSB

Now, one of the ones we want to look at as well is TSB.

We don't normally look at TSB from our normal mix, but here we can see its historical movements, had some trouble in August, but it's maintaining a level of just below 4. It has peaked above 4 in January, but then since then it has dropped away. What's happened between January and those other periods?

ECS - Nationwide

Just to compare and contrast, let's see what we'll cover off today. I don't want to cover off too much into Nationwide, but one of the things Nationwide is doing well is keeping itself above that 4 level.

It dips just below sometimes, it is maintaining that, and in fact, in April it's actually hit above 4, it's sitting there at 4.3, and that's probably one of the better -except for about a year ago, it was about the same- It's hitting a sort of Peak Performance at this point. Hopefully, they can maintain that across time.

Now, let's have a look at TSB. TSB we just saw has gone down in February, March and April, what has happened? Let's have a look.

Now first of all, this is what we're looking at, is that this is our first diagnostic, getting these things right is making sure your App is going to function at a basic level.

00:03:42 - SURF Analysis - TSB

What we're looking at here is what we call our SURF Analysis looking at Security and Authentication, Usability, Reliability and Functionality. Now here these are pain points, getting these as low as possible is our goal.

What I can see here between January and that period where TSB dropped, is massive increases. Reliability, more than doubled -issues more than doubled, Functionality issues doubled, Usability issues doubled, Security and Authentication issues doubled.

Across the board there have been issues for TSB they need to get on top of. Now, we can obviously go down to a bit of detail here like Authentication, for example, let's jump in for TSB, maybe go down to some problem areas the really, really bad ones, the 1s and 2s and then from there, we can see what's going on.

We've got down to a bit of detail, people having to uninstall and reinstall the app, can't login using their fingerprint anymore, having to log in again and again, so constant login issues of just repeating trying to log in for customers, which wasn't there previously and that's just jumping up as a major problem. That's an issue there for TSB.

Let's have a quick look for TSB at some of the things underneath Reliability, broad technical issues have more than doubled nearly tripled in terms of broad technical issues.

App crashes have multiplied x5, even though it's low in the first place, you don't want those jumping up too high at 2.3%, it's still a controllable but, they need to watch out for those types of things like crashes and bugs and so on. They need to pick up on those areas and clearly that's having an issue on the score as we saw.

Now let's have a look at what they've done across time, so this is TSB. This is looking at their score across time.

One of the things we see is the start of February, the 6th of Feb into the 13th is where issues started to happen and that hasn't really increased.

We've got a bit of a pickup at the start of April but, we can see what's happened here getting into April into those last two weeks of April there's been a drop, the score is getting down to 3 again. They haven't picked up to the levels they were pre Feb.

Let's see why, let's have a look.

One of the things I'd like to look at is the App Release Cycle, and what we're seeing here is that 7.0.1 was doing very well, that was when the score was doing really well in January, and then there was a release in February.

We see the use of 7.0.1 because customers obviously have upgraded, and that has dropped away in terms of usage. But what we're seeing here this version 7.2.2 has jumped in and suddenly, the scores if you see on the mouse over there- the scores are averaging around 3.2, below 4 whereas before they're above 4 doing very well.

This release has caused an issue and then TSB has then made another release at the start of March, this one here in green, and the scores there around you can see they're 3.3, 3.6, 3.8 and does the frequency of use peaked at around the 3rd of April? That's when we started to have this third release come through here in this cycle. 7.4.1 in yellow here, has started to pick up use, it's a dominant version use at the end of April.

What we saw though, that score has dropped at the end of April so this particular one here, 7.4.1 hasn't solved the issues. TSB, now they need to go back and have a look at what they were doing at 7.0.1 and get back to that level because that's when their score was doing very well.

That's enough of TSB for the moment. Let's have a look at Barclays.

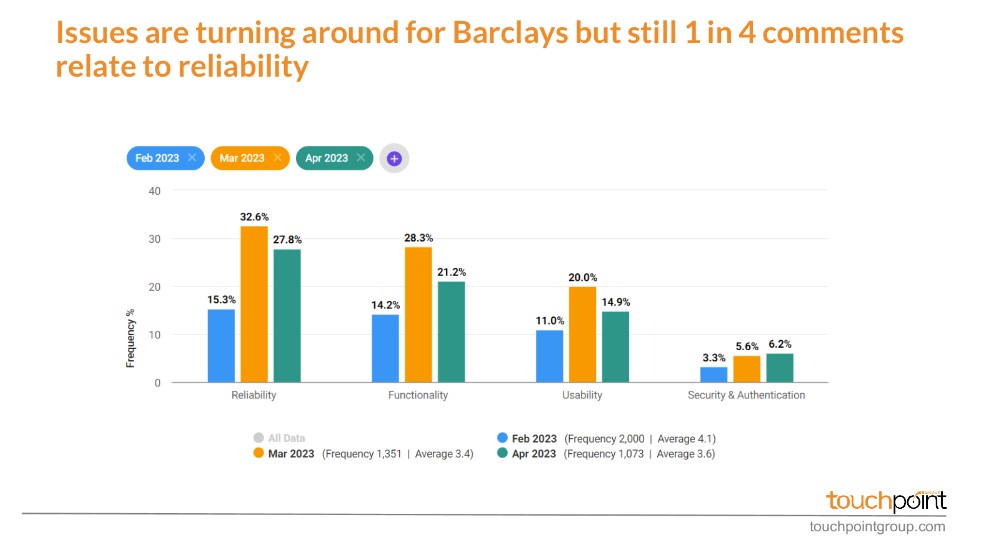

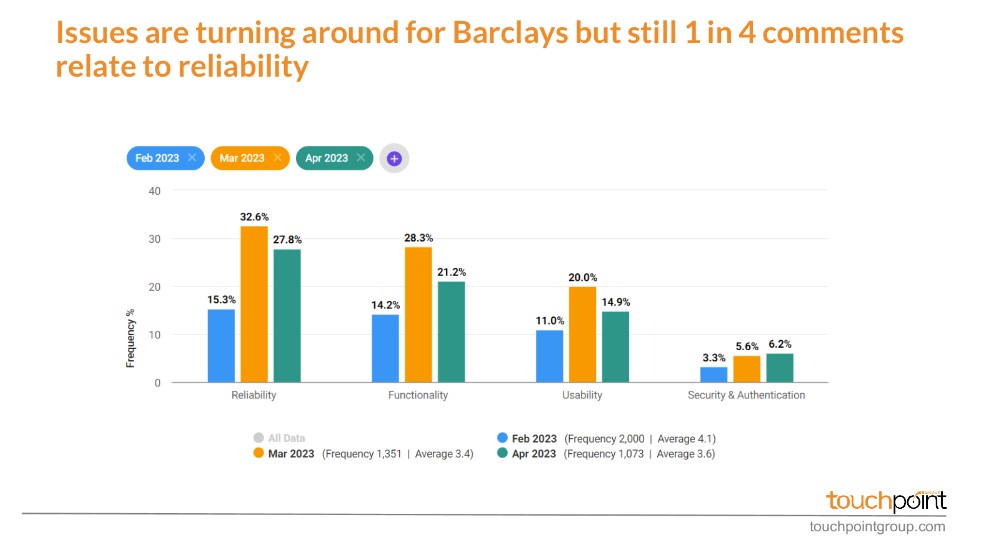

00:07:26 - SURF Analysis - Barclays

Barclays if we recall, the past two months has dropped away in terms of its Engaged Customer Score and it was doing very well previously.

So if we look at the bottom here, we can see the average score was 4.1 in February then it drops to 3.4 and then comes up slightly at 3.6 but still, that's well below what it was in February.

One of the biggest things that's happening is across the board, we're getting things like Reliability issues have jumped up, so if we see here in March, one-third of the feedback for Barclays was around Reliability issues, these are all problems, we need to get these as low as possible but imagine that a third of all the feedback was Reliability.

Now, Barclays to be aware of this, they would know there's some Reliability problems, but getting down to what needs to be fixed is where they need to get to. Functionality issues also picked up, they've improved slightly; they're on the right path but they just continue that process.

I'll have one last look though at- one last thing to look at is Barclays and how they've actually done in terms of their customer Journeys. So these things here like things like Depositing a Cheque, Monitoring Card Activity, Paying Bills, etc., these are by far the dominant things people are trying to do with their app.

Getting these right is going to make you do very well and, in fact, those issues though that are happening across the board with Reliability are impacting the feedback around these particular things as well.

So things like Paying Bills, Monitor Account... -we can see they're sitting lower. We can see that a basic thing like Checking your Account Balance is now scoring 2.8 compared to 3.8 previously.

We have a brief look at and seeing what's happening in there, and looking at a Checking Account Balance and some examples, let's go and get down to some negative things because this is across the board, let's get down to those really negative things and see if we can see some major things going on for Barclays.

We can see here that some people they can't see their current account balance isn't revised... "it takes two minutes to load and just see that balance...", There's delays in getting that balance being seen by people and -the app keeps crashing after they log in and when doing transfers with their balance.

Basically, this is a concern for customers, they can't even see their balance in some cases. Some issues there for Barclays that need to revise, and we'll see in May whether they can pick that back up and fix these issues. So thank you, Glenn.

00:09:54 - Final Words by Glenn

Glenn: Thanks Tony, and just another reminder there that when you have some core Functionality issues across the app it can impact so many of those user Journeys; it's really hard to get those lifts in performance when some of the fundamentals aren't working great. If anyone wants to have a chat, more than happy, reach out, and we can organise a one-on-one with you, but in the meantime, get out there and we will see you next month.