Executive Summary

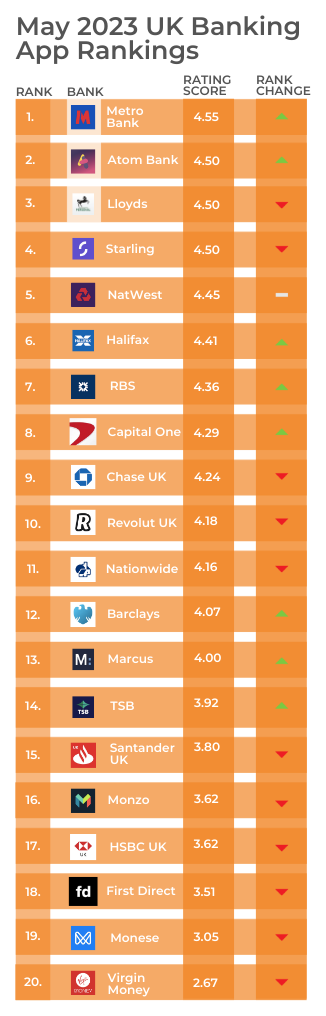

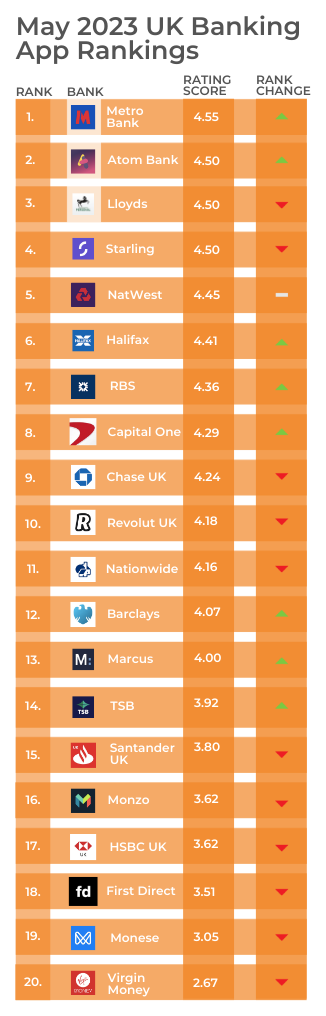

In this month's Banking App Insight Session we mainly focused on reviewing and analysing the performance of two of the historically strongest traditional banks in the UK market: Lloyds and Barclays.

Lloyds has consistently outperformed Barclays in the Engaged Customer Score, maintaining a strong position above 4.5. While Barclays experienced a dip in March and April, it saw a mild recovery in May.

Both banks have consistent scores around Security and Authentication, but have seen a rise in issues in other areas. Lloyds' Functionality issues and Barclays' Reliability problems have doubled.

We also cover Starling, facing a dangerous position by dropping for two consecutive months and facing a dip that caused Metro Bank to jump ahead of them in November last year. If Metro Bank continues to improve on its scores, it can prove to be a strong contender for Starling.

Monese and Monzo sit at a low score of around 3, without much volume of improvement.

The Banking App Insight Session provides valuable insights into the performance of these banks and highlights areas of improvement for each of them.

00:05 - Intro

00:46 - Engaged Customer Score

02:10 - Starling and Metro Bank

02:52 - Barclays vs. Lloyds

03:53 - SURF Analysis

06:36 - Barclays' Reliability Score Drop Culprit

08:04 - Final words

Video Transcript

00:05 - Glenn Marvin: Hi, and welcome back to another Touchpoint Group Banking App Insight Session, focusing on the UK market for the month of May. And this month, Tony Patrick, we're going to be focusing on Lloyds and Barclays and just why Lloyds seems to keep that edge and consistently be ahead of Barclays. I'll hand it over to you, my friend, and you can lift the lid.

00:31 - Tony Patrick: Brilliant. Thank you, Glenn. Today we're covering Lloyds and Barclays is our focus, but of course, there are a few others in there, just to update you on those scores as well.

00:46 - Engaged Customer Score

Let's jump straight in, and first of all, we'll cover here, which is what we call our Engaged Customer Score. These are customers who've given both a score and feedback. So each of these movements you can see here, we can actually understand why because there are all comments attached to them.

I'll just clear out HSBC because we're in our final period across the past year, where there were very low and causing our scale to change.

But I will just move them out of the way for the moment and across these banks here, one of the things we can actually see, and we mentioned this last time, is that Barclays dropped away in March and April. They have picked up to some extent in May, but we have to see if that can be maintained because we can see the last week of May they had problems. I'll show you that in a moment.

And what I can see here is also Lloyds. Lloyds is one of our global best players in terms of what goes on in the market. You can see that they're averaging around four and a half and they rarely dip down. They're very, very solid from that perspective. One of the things we can also see is they're always sitting above Barclays in there as well.

Let me just move forward here and just have a look at at one of these things here. Just looking at these banks here. These are some other banks we're looking at as well, briefly.

Looking at the likes of one of the things here is Monese are sitting sort of Low in general, sitting around 3 and I'll just move them away so we can sort of stretch the other banks out here. And again, Monzo is sitting there as well at a low point. Let's just move that away as well.

02:10 - Starling and Metro Bank

One of the things I can see here is Starling is one of our global best players, their best practice, they're sitting 4.6 on average. But we can see though, in the past two months, they've dipped around to 4.5. In two months in a row, they've gone down. So that's a problem for them and they haven't maintained that really high consistency where we used to. As a result of that, we can see one particular bank here.

Metro Bank has actually jumped up ahead of them for the first time, or the second time actually. It happened in November last year. Because of a dip down from Starling. They've dipped ahead this time around, so we won't focus on that now, but It'd be good to watch next time around as to see whether that's actually made... -if they could maintain that, Metro in particular.

02:52 - Barclays vs. Lloyds

Let's move to what we've mentioned previously, Barclays and Lloyds so here we can see more clearly what historically the gap has been. It's about 0.25, historically. Obviously. Recently, Barclays has had these problems and they've picked those back up.

Let's have a look at this weekly, though, to see that dip away from Barclays and see what's actually happened here.

We can see Barclays has dipped away, the week commencing about the 20th of Feb, started to dip away and then the low point was the week commencing the 6 March. And they've moved up since then, getting back to near their historic levels. Although this last week here has actually dropped away a bit, so we can see it's actually dropped away. Let's see, though, we'll have to see in June how that picks up to its level.

One of the things we can see here, even week on week, Lloyds, is very consistent. It's sitting between 4.4 and 4.6 historically, so it's a very high bar to reach, but Barclays is very close and they need to get up to that level. So what do they need to do? Let's have a look.

03:53 - SURF Analysis

Now, for those familiar with this... You'd be used to seeing this type of chart here. What we're looking at here is pain points. We want to get this as low as possible. We can see there on the right, Lloyds has these under reasonable control. What these are, though, are pain points around Security and Authentication, so, logging in, Usability, Reliability and Functionality. All the types of things that customers want to have function properly all the time, you want to have those functioning all the time too. And I can see here, for example, that one of the things at the top here is across... -And this is just so you're aware, this is actually before those drops we saw for Barclays. This is coming into February this year. We can see there, this is the normal situation for Barclays versus Lloyds. And what I can see, though, is Security and Authentication are about the same. So that's not where their problem is. They've both got that under control.

One of the things, though, is around Functionality. Functionality issues are more than double for Lloyds. Reliability issues are around nearly double as well there for Barclays. They need to pick up on those things.

What about if we look here at Functionality? Let's look underneath that to find out what is going on. What can be improved there?

If we compare side by side the frequency so, again, the frequency here is important. The higher it is, the worse it is, because these are pain points.

So, nearly 4% looking at May and the most recent data here, nearly 4% of Barclays customers are talking about problems with some sort of money transfer feature, as compared to 0.8 from Lloyds. Now, that is insignificant, really. It's very low. Obviously, you want to keep an eye on it, but it's very low in terms of that frequency.

And also things like Poor App Payment Feature connected to the Money Transfer as well, and Poor App Cheque Feature. Let's look at one, though. Let's look at this very first one and see how the improvements being made by Lloyds compare to Barclays.

Let's see what they're doing. One of the things we can see here is that the Poor App Money Transfer topic has been increasing slowly for Barclays across time. They should be keeping that below 1% but it's hit nearly 4% prior to that jump up. And when they had problems in March and April, nearly 1 in 10 customers, the feedback was around Poor App Money Transfer Feature of some sort. Clearly, a problem for them when they hit that point.

Let's compare this chart, though. So, remember, in your head, the normal situation for Barclays is around 3% to 4%. Let's have a look at Lloyds. So, Lloyds, it rarely gets above 1%, and more recently, it's around 0.4% to 0.7%. Very low frequency of this issue.

What I'm going to do now is have a look at why this issue is occurring for Barclays.

06:36 - Barclays' Reliability Score Drop Culprit

This is looking at the past three months, March, April to May -March to May. We can see there across this period, the biggest topic coming through is 'contactless payment'. Here's a very specific thing that Barclays can improve on to get closer up there to Lloyds.

Let's just jump in and see what's happening here and see what the conversations are like.

Here we can see: "Contactless payments have stopped working. ...They've messed up the contactless payments. It always crashes when to make contactless payments." So clearly a lot of difficulties coming through for Barclays customers. And as we saw, Lloyds customers are not having this issue. This is coming through just for Barclays in this case. And one of the things we can see across this period, this is March to May, is how overall, for this particular topic about Poor Money Transfer, is that percentage we saw for Barclays bad?

Well, let's have a look here. Compared to many other UK banks here, the frequency of mentions for Barclays is 7.4%. And that is the highest compared to Virgin Money and Santander. They're sitting there at 6% and 3.8%. Clearly, a problem there that Barclays needs to get onto.

And that's one example. We could have dived down into each one of those as particular journeys as well, to understand what was happening there.

That's what I have for Barclays some clear things to improve. And thank you, Glenn.

08:04 - Glenn: Thanks, Tony. And it's really, really clear when you start digging down deeper into those areas just how granular you can get regarding uncovering those pain points that people can focus on. Banks can focus on improving the overall experience and rankings for their app in the market. Thanks again, my friend. And if you want to have a chat with us about your banking app and how we can use these insights to help you improve, feel free to sing out.