Touchpoint Group’s Mobile App Performance Analysis service has been working with banks to help them gain a greater understanding of market positioning and truly understand their customer review data. Over the course of our investigations, we’ve revealed insights in several banks’ data that can be used for strategic planning, churn reduction, and increased customer retention.

One such insight stemmed from an experience our CEO, Frank van der Velden, had as a customer with a Tier 1 bank’s mobile app. At first, it seems innocuous enough: an error in the app resulting in a message asking the user to contact the call centre.

We were curious about whether this issue had been mentioned in any of our sample bank’s mobile app review data, so - using our AI customer feedback analysis tool, Ipiphany - we investigated. We found that of the 16% of Android and Apple app users for this bank who mention a reliability issue, 2% say they were asked to contact the call centre to resolve it.

2% may not seem like a high number at first, but for a bank with 60 million customers, 51 million of whom use a digital channel, our research indicates that approximately 35 million are app users. If 2% of those users experience this issue, that means it’s impacting 700,000 customers.

Let’s assume that 10% - 70,000 - of affected customers actually call to resolve the issue rather than waiting it out, visiting a branch, or emailing instead. How much would those calls cost? The average cost of a general financial services call is $3.00 per minute, and lasts about 5 minutes for a total cost of $15.00.

The assumption that only 10% of these customers will call is very conservative, especially given that visiting their local branch may not be an option in our COVID-19 world. Regardless, this translates to a call centre cost of $1,050,000 annually, or $87,500 each month.

Using Ipiphany and our SURF analysis, we tracked this bank’s reviews over 12 months to identify how reliability issues trend over time. While our bank believed that their third-party app development team had these issues under control, we found several instances where customers experienced these issues for up to 5 months at a time, often after an app update. We also discovered that customers who experience this issue often call back more than once. If a bank doesn’t move quickly, not only do they run the risk of losing customers who choose to switch to banks that meet their in-app needs, they also waste hundreds of thousands of dollars each year on call centre costs.

By comparing call centre data with the public app reviews for our bank, we learnt two things. First, that increased call centre volumes directly correlate with the feedback we see in public reviews, especially as they line up with newly released app updates. Second, that customers experiencing app issues regularly have to call back multiple times - thus driving the call centre volumes up even higher.

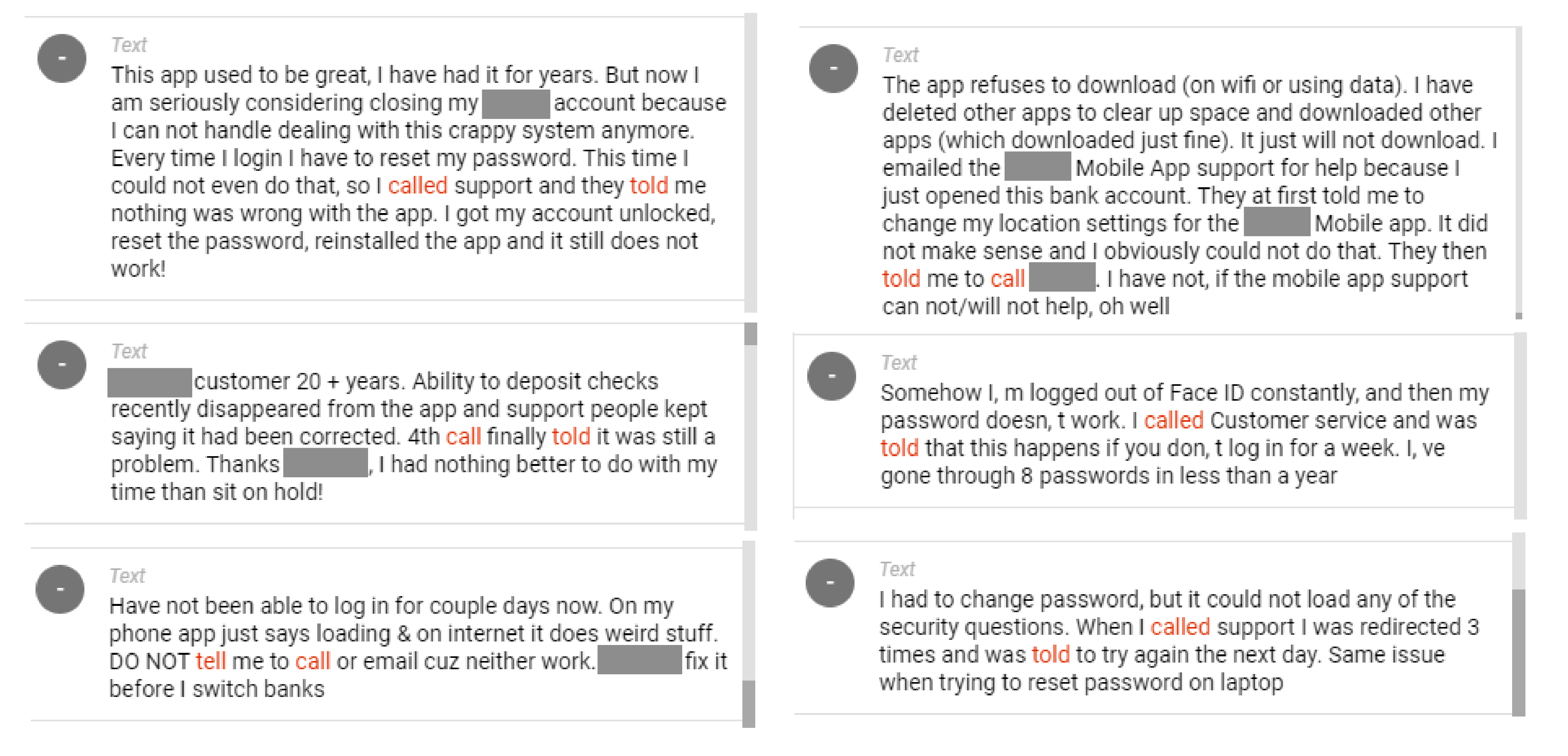

By analysing the content of the calls themselves, we can focus our search on only the customers discussing issues they’re experiencing with the app, and within that segment, how many are resolved. The vast majority of app-issue calls aren’t resolved on the phone - call centre staff are able to help the customer complete the task or transaction, but no solution is offered for the app itself - or for the next time the bug occurs. If these conversations don’t inspire confidence and trust, customers are more likely to consider switching to a different bank.

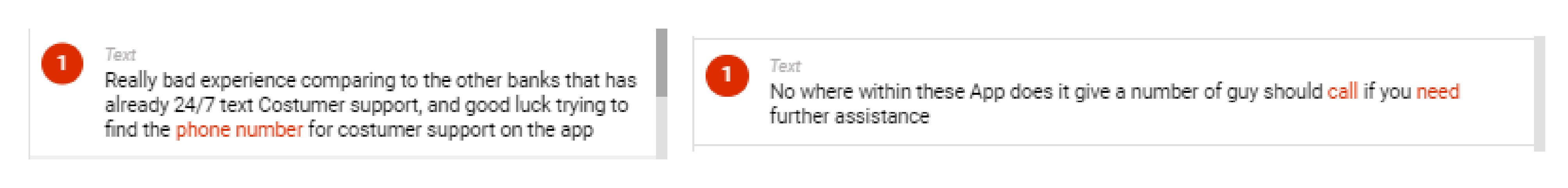

We expanded our search to include public review data from other banks in the market to benchmark our sample against and discovered an attempt to solve the call centre issue by excluding their contact details from the app. This could simply be an error on the app development team’s part rather than a wilful omission, but regardless, our data shows that the topic of customers unable to find contact details has a greater impact on the overall score than those experiencing a bug that asks them to contact the call centre.

We’ve already proven for banks across the US, UK, and Australasia that benchmarking public review data is a critical aspect of understanding market positioning as well as identifying and solving issues as they arise for customers. By analysing publicly available app reviews in conjunction with your own VoC and contact centre operational data, you’ll be uniquely positioned to identify issues like this in your own organisation. Using Ipiphany to perform this analysis can help to provide focus and reveal the level of granularity required to solve problems at the source, before they blow out into months-long usability issues that cost hundreds of thousands of dollars.

For more information on the mobile app performance analysis service, or to see a demo with your data, contact us here.

*Statistics given reference publicly available information and benchmarks. Identifying information has been removed from customer verbatim comments.