This month’s focus is on the underperformers, and it’s evident that Wells Fargo hasn’t recovered from the major update to their app. Ironically the update hasn’t even fixed the very issue it was supposed to be addressing.

Wells Fargo continue to fumble the dropped the ball created by their latest update.

Prior to the app relaunch in Feb 22, Wells Fargo was doing well, with an Engaged Customer Score (ECS) maintaining a steady position just above 4, but the score dropped sharply to 2.5 when they launched the updated app. Their ECS has picked up a bit but Wells Fargo are still sitting well below where they were, and not at that level where they can really compete.

In this video Tony takes us through SURF analysis: Security, Usability, Reliability, and Functionality, which provides a clear view of the very basic aspects Wells Fargo need to get right if they are to actually start to compete at the top level.

We dig deeper to explore the Wells Fargo customer pain points. Our deep dive this month provides an excellent demonstration of how Touchpoint Group’s Iphiphany platform can drill down on the ECS feedback to provide highly accurate, actionable insights to improve customer experience.

Watch the June snapshot to find out what issues are affecting Wells Fargo app users the most.

One issue is so elementary that it begs the question, “What were they thinking?”

Want a personalised look at your bank's app performance? Contact Touchpoint Group today for a specific insights session.

Video Segments

Intro – 00:00:00

Engaged Customer Score Performance – 00:00:40

SURF Analysis: Wells Fargo – 00:02:40

Underperforming Features Analysis – 00:06:03

Conclusion – 00:07:51

Full Transcript

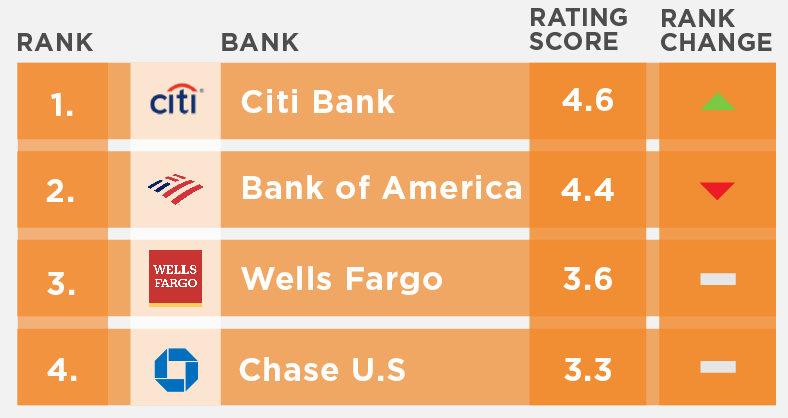

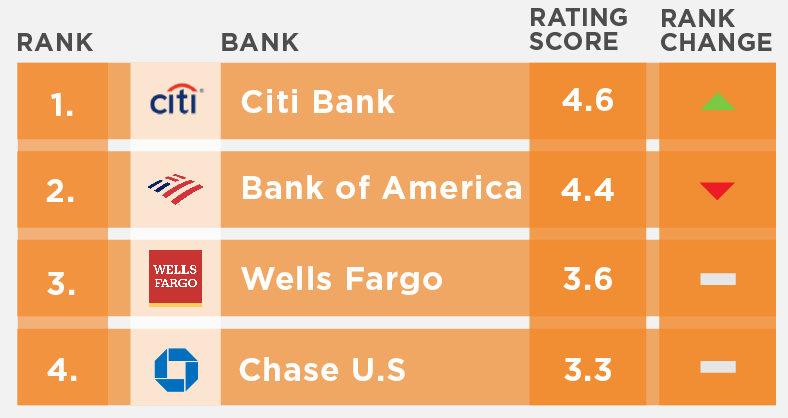

00:01 Glenn: Hello everybody and welcome back to another Touchpoint Insight session. We are looking at the US National Bank's Banking App Performance for June of 2022, and Tony Patrick - it is pretty much ‘steady as she goes’ at the top of the table with Citibank and Bank of America keeping that gap at the top of the table but, Chase and Wells Fargo, they are still up-and-down and all over the place when it comes to that Engaged Customer Score and, wow! Wells Fargo! They don't seem to have recovered from the update that they did. The major update that they did in February of this year, and I think that's what we're going to drill into a little bit today. Isn't it?

00:40 Tony: Yeah, Correct. Thanks Glenn. The ones we'll cover off today in US Nationals is Citibank, Bank of America, Wells Fargo, and Chase. I'll jump in straight away and have a look at what the scoring is looking like for this month. One of the things - I'll just look at the whole lot of the data here. The two at the top there in red and blue, that's the ones we were looking at: Citibank and Bank of America. They're doing very well up there, actually competing strongly with each other. In particular, we can see that Bank of America has actually made some improvements across the last year where there were below average score, but, now they're competing just below what Citibank are doing. So, positive at the top there.

One of the things at the bottom you can see is that there's a lot of jumping around. If I just look at the moment at Chase, which I'll just highlight here. One of the things you see there is they do make some improvements in certain months, but then it drops away with about a three-month gap to fixing those potential issues, and that seems to be a common thing as there are two months between those peaks. Again, there needs to be some consistency with Chase about what they're up to with their app. But the focus today is looking at Wells Fargo.

We can see here, this major drop. Now, we have seen this before. It's not something new to anyone who has seen these sessions before. We can see here that Wells Fargo was sort of doing reasonably well. It was above 4 consistently up until the launch in about January-February. Then it dropped away very sharply. So, from being above 4 making a major app update to actually hitting the bottom here at about 2.5. That's very low considering this is a 1 to 5 scale in here as well. They have picked up to some extent, but there are still some major issues going on.

Although it has picked up, they're still sitting well below where they were before and they're not at that level where they can really compete with the likes of Bank of America, let alone CitiBank at this point.

I'll shift into the next view here and this is reflecting that Improvement, you might recall previously we talked about what's called a SURF analysis. This covers off things like: Security, Usability, Reliability, and Functionality. So, some of the foundational pieces you need to get right, to actually start to compete at that top level.

We can see here, the higher the percentage the worse because these are all pain points. These are clear problems. One of the things we can see is there was that March spike in massive problems. In June there is an improvement, but still it's not at that level they had that pre-launch. There are major issues there. A lot of it can be around things like Reliability but, there's also things like the Functionality of the product as well.

Let's move forward to have a look at a couple of areas here. This is that same information we saw before, its on the left here. This is looking at just June. We can see here these are problems. 16.5% of Wells Fargo customers talk about pain points connected to Functionality.

One of the things here that’s interesting is Usability. This is just having a look at where the improvements are coming in. We can see here for example, Poor App User Interface, the frequency has gone down by 2.1 points. In June it's 3.9%, but it was about 6% in the previous month. That's positive. It's an improvement. However, is 3.9% something to shout about? Is it a good thing? Let's have a look. Because that's an important thing to understand.

If I move into here, if I select my Poor User Interface what I can see - that's the 3.9% in June for Wells Fargo. On the right here I can actually see where that stacks-up against others and so, one of the things I can see here at 3.9% - that's more than double the next one down. So, although 3.9% doesn't sound that high, it's more than double others. So, considering this app update was about a different user interface, this is not good. You should have expected an improvement here. Particularly, since Wells Fargo was actually doing well on this aspect prior to the launch.

It's something they need to look into. We talked about this. We actually talked about this a few months back saying, "Look, should there be some reconsideration of, not necessarily a rollback but, there must be some ways to fix what's going on in here.”

05:18 Glenn: I suppose the other consideration is, and we talked about this earlier, was that improvement in that score is not necessarily an improvement in the product, is it just that people have stopped talking about it?

05:32 Tony: I think that we see this elsewhere. There is a bounce back just by normal process. You get the customers who have the initial problem, they'll complain about it in their comments then that customer generally doesn't complain anymore. They've actually said their piece. So, you end up with a few things going on like potentially those customers getting angrier with the product, they go to a different channel which might be the web or elsewhere but, they're still upset with the brand because they can't use the channel they prefer.

06:01 Glenn: Absolutely. Let's keep on digging.

06:03 Tony: So, let's have a look. One other thing to dig into here is looking at some particular features which are underperforming as well.

This is just looking at June. Here we're comparing things across: Wells Fargo, Chase, Bank of America, and Citibank. In this case here, with this new process and the journeys that have been put together, expect these things to start to improve and be better than others whereas they're underperforming on the login process. These are the major things that people are doing in the app.

This is the purpose for a lot of people, 90% plus of people, this is what they're doing. They're doing bill payments, they're viewing their transactions and they're building their account balance. That's one of the major things people are doing and Wells is underperforming on each of these. This is the average score, so lower is not as good.

We can see here for Bill Payments - it's 2.3, for Viewing Transactions of 1.5. That's a lot lower than others. If I select this one here on Viewing Transactions, this takes me to some detail just for Wells Fargo on viewing transactions. I can actually get down to some actual examples in here.

So, in here are some examples of layout, of how to view transactions is difficult. "The app you used to be able to do search transactions for dollar amounts until this new version".

So, there's people who are doing things in the past and had things lined up, but now it's not working: “I'm tired of this app. It's now frustrating to open the account and see transactions.

Basic functionality like seeing transactions, that should be something you have nailed as an app. In this case it is not.

Thank you, Glenn.

07:51 Glenn: Well, yet again, just goes to show that you need to nail the basics, the Functionality. And it's actually quite disconcerting to see some of those comments there because that really indicates churn risk. Doesn't it?

08:07 Tony: Definitely.

08:09 Glenn: Fantastic. Well, another great Insight session.That was the US National banks folks.

Feel free to reach out to us if you want to have a deep dive session into your own bank, and we will move on to the next session shortly, which is when we will look at the US Tier 1 banks.

Thanks Tony, We'll see you soon.