This month we focus on the underperformers and PNC’s dramatic drop in Q4 has caught our attention. PNC – What Happened? Join us as Tony asks the question and uncovers some rather specific answers to PNC’s problems.

What's keeping PNC consistently behind?

Up until August 2021 PNC was achieving scores above 4, nearly as high as the top 2 performers in this category, but in Q4 things have started to get hairy with sharp blips and a steady decline.

Using SURF analysis for the go-to view of what’s going on we look at PNC’s app performance in the areas of Security, Usability, Reliability, and Functionality. In comparison to US Bank and Capital One, PNC’s SURF stats indicate a need for improvement in both Reliability and addressing issues with Features. Overall, the trend across all the major features is that PNC is underperforming.

So what’s a poor performer to do? Using our fundamental pillars of SURF, but this time also investigating ‘Contribution’ to analyse the data, Tony demonstrates how Touchpoint Group’s Ipiphany platform can help pinpoint some rather specific issues and just how great an effect these have on the movement of scores.

Could this be enough to bump PNC up to the lofty heights they once enjoyed? We think so, but not without some serious front-footing on their part.

Would you like to see how well your bank’s app performance compares? Contact Touchpoint Group today. We can organise a specific insights session for your business.

Video Segments

Intro – 00:00:00

Engaged Customer Score Analysis – 00:00:50

SURF Analysis: PNC – 00:03:14

Poor Service Channel Reviews From PNC Users – 00:06:36

Conclusion – 00:07:29

Full Transcript

00:00:00 Glenn: Hello, folks and welcome to yet another Banking App Insight Session with Touchpoint. We are looking at the US Tier 1 banks for June of 2022. And, US Bank and Capital One are leading the pack. US Bank is widening the gap at the top of the table though. If we dig down deeper into those other banks competing for space, we're going to dive deeper into PNC. And, PNC have been up there. They have done it before, they have been up there at the top with an Engaged Customer Score of over 4, but inconsistency is really hurting them.Tony Patrick, let's dive into this and have a little look at how things are going and a little deeper at PNC.

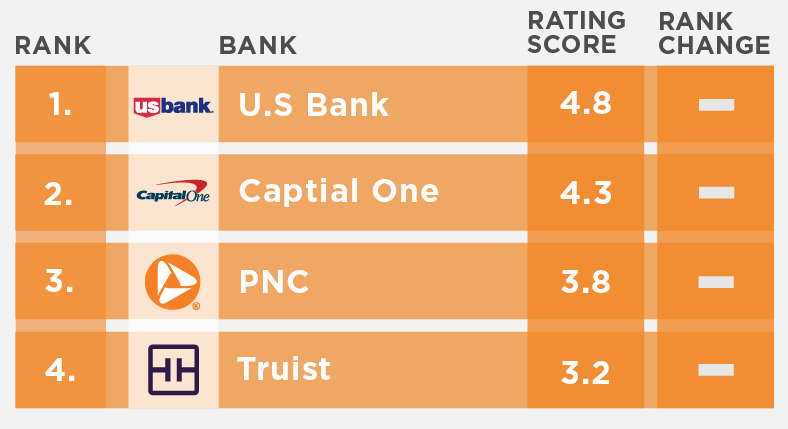

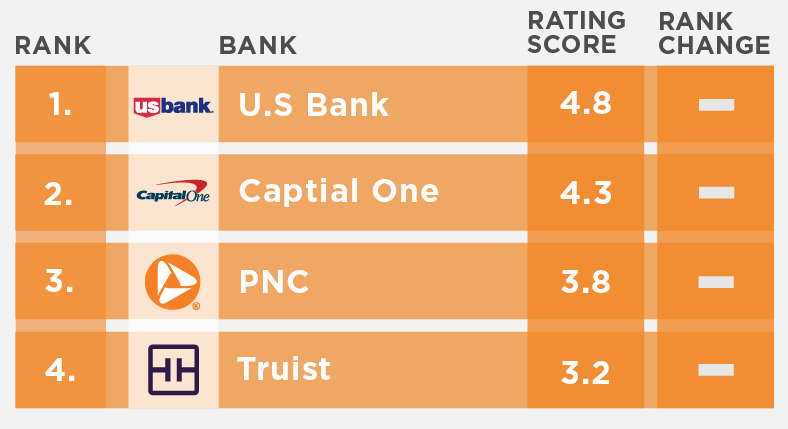

00:00:50 Tony: Brilliant. Thanks, Glenn. And as Glenn said, it's these four Banks and U.S Tier 1 we're looking at today: US Bank, Capital One PNC and Truist.

Let's jump in and have a look first at how the score is moving around. As Glenn mentioned, we've got US Bank sitting up here at a very consistent, and actually slightly increasing. If we looked at their score from about a year ago, they were above 4.5 and you would have thought, ‘that's pretty good’. They've actually improved on that and they've got over 4.75 over the past three months on average. They're doing really well, and so their customers must be very pleased with using their app.

One of the other things that we can see is that gap down to Capital One. Part of the gap increase is coming from a slight decrease from Capital One, but that increase as I said, from US Bank, whereas in the past if you looked back a year ago, they were just about neck-and-neck. Still, the order was the same, but they were very close back in time.

I'll have a quick look at Truist now. Truist has had some troubles last year to say the least. They were sort of averaging around, you know, 1.5, around there somewhere up until November and obviously some improvements are in play. They're actually picking their act up to be getting above 3 and just keep in mind, in this scale of 1 to 5; 1 is the lowest possible. That's if everyone gave you 1. Getting in the 1.5 is probably the lowest you can get. It's hard to get much lower than that. So, they've done some improvements which is great.

However, I want to have a look at something which is bugging me in a sense. I'm looking here at PNC and thinking, ‘Well, they were doing pretty well up until August 2021’.

They were sitting above 4 consistently. They were just about competing with those top two we talked about before, but, then there's this drop-off in October, then a pickup in December and it looks like to me, for what I've seen with others, is there's a bit of a ‘Whack-a-Mole’ approach going, ‘Look I've found a problem, I'll fix it’. Then something else comes up. Not staying on top of problems consistently can cause this up-and-down movement for customers.

The question is, what's keeping PNC consistently behind the likes of Capital One? And even obviously, US Bank sitting up here.

Let's have a look. One of our first clues as to what's going on is, we've talked about this before, is our SURF analysis. Using the idea of Security, Usability, Reliability, and Functionality. You get those things right, you can then be on a nice platform to be launching into those big scores.

But, we can see here compared to them, those two major players looking at Reliability we see Capital One and US Bank are around 2 but, PNC - it's more than double that. So, the Reliability issues are there. That's an obviously clear Improvement space.

Issues with Features. These again, are negative things. The higher is the worst. Looking at 3x the level of Feature issues coming through here as well. And user interface issues are double that of the leader, US Bank.

There is clearly some improvement areas. And this Security and Authentication, the leaders are actually making it easy for customers to get in and use their app in a secure manner - making it easy in a smooth process whereas for PNC, it's an issue here.

Let's just step forward into having a look at something else. Let's look here at some particular journeys that customers would go through. And these are the most important journeys. These are the ones that people are talking about. These are the things, these are the reasons someone's using your app.

Obviously, the reason to use your app isn't to log in, but again, we can see here, the login process is a bit cumbersome - only scoring a 1.8 when we have to talk about that topic. But, other areas here like Checking Account Balance, a fairly basic thing when people talk about that the score coming from PNC is 2.1

I won't go through each of these but, you can see the trend here that across these major features PNC is underperforming so they need to pick up their act across a lot of places.

Let's have a look now at - actually what I might do, I might have a look at this. Interestingly, that's a good thought I had here: If I have a look at this from a perspective of - okay, how is my score being impacted by these SURF areas? What I can do rather than looking at frequency, let's have a look at this thing called Contribution, where we can see how much this score - this particular area, is dragging my score up and down.

One of the things I can see here for example, when people have conversations about the User Interface the PNC score is being dragged back by 0.14. That's a fairly reasonable amount on a five-point scale whereas the others, US Bank and Capital One, it's a very minimal movement for theirs - particularly for US Bank.

Reliability is dragging a score back by 0.12. Again, we can see there across these basic areas - improve there you're going to start to actually improve across a whole lot of things.

Let's move forward as to the other area I was going to have a look at, which is around specific features. So, these are features here, Authentication, Account Balance, Viewing Transactions, and Bill Payments - and these are fairly basic things that people want to be doing all the time or the basic functions people want out of an app. The scores here aren't very good for PNC, particularly as we can see here, Viewing Transactions. You think that would be a basic feature you should be able to get right, in this case there's problems for PNC - in this case, looking at Q2 this year.

Let's have a look actually what's going on inside here. If I select this Viewing Transactions feature what I can do is see the actual comments coming through here. Now, in this case we're looking at that some people are having a great experience but, there's people here -most of this is red. In here I can see for example, “It takes days for transactions to show”, “I can't keep track of spending”, “I can't even see my transactions until the next two days later”, “I can't see my transactions and nothing else at night because the app never works.”

Basic things like viewing transactions are an issue for customers and if you can't get the basic features and functionality right on the app that obviously is going to cause your score to drop. If they can pick-up on these basic things that is going to ease that score and make it a lot better and they can actually bump-up against those top performers.

Thanks Glenn.

00:07:29 Glenn: Yes. Another great insight there Mate and with that whole ‘Whack-a-Mole’ analogy that you talked about earlier it just goes to show that some of these issues, these underlying issues are not necessarily what are cropping up. That they are using as the ‘quick fix’ approach these are underlying issues that can be consistently dragging them down, and unless you actually proactively go out there and look for them you can really struggle, can't you?

00:07:58 Tony: Yes, definitely.

00:07:59 Glenn: Great stuff. Well, that's another one for the month of June folks. If you want to have a look at your bank and deep dive into the performance, how you are ranking, and those challenges you've got, feel free to sing out, and we can do that for you.