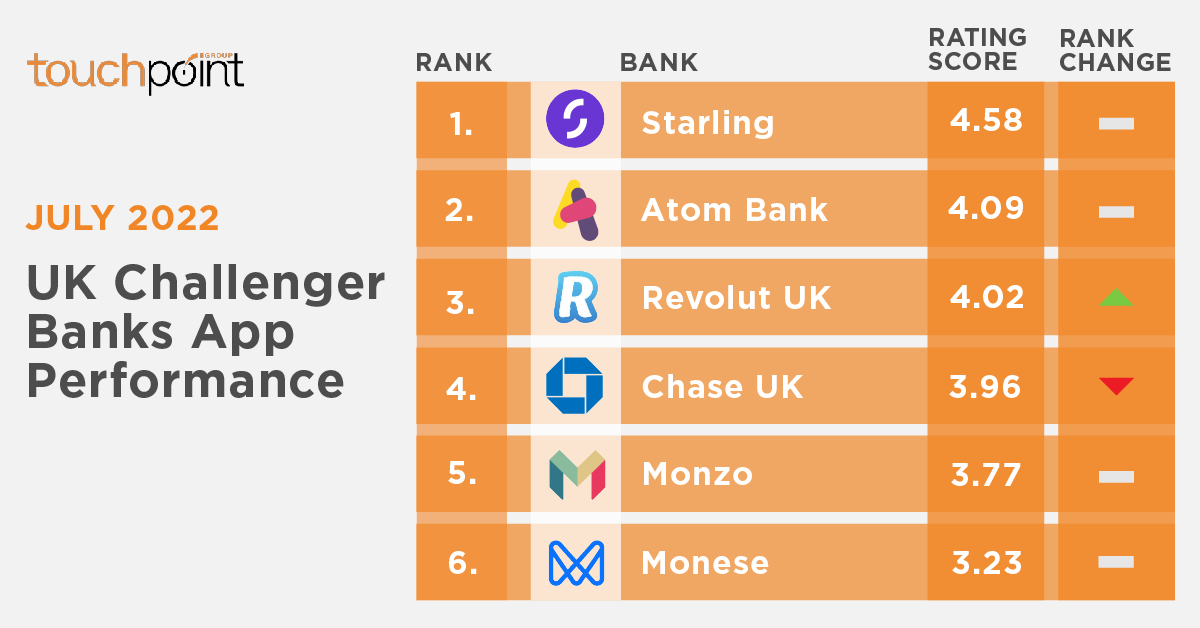

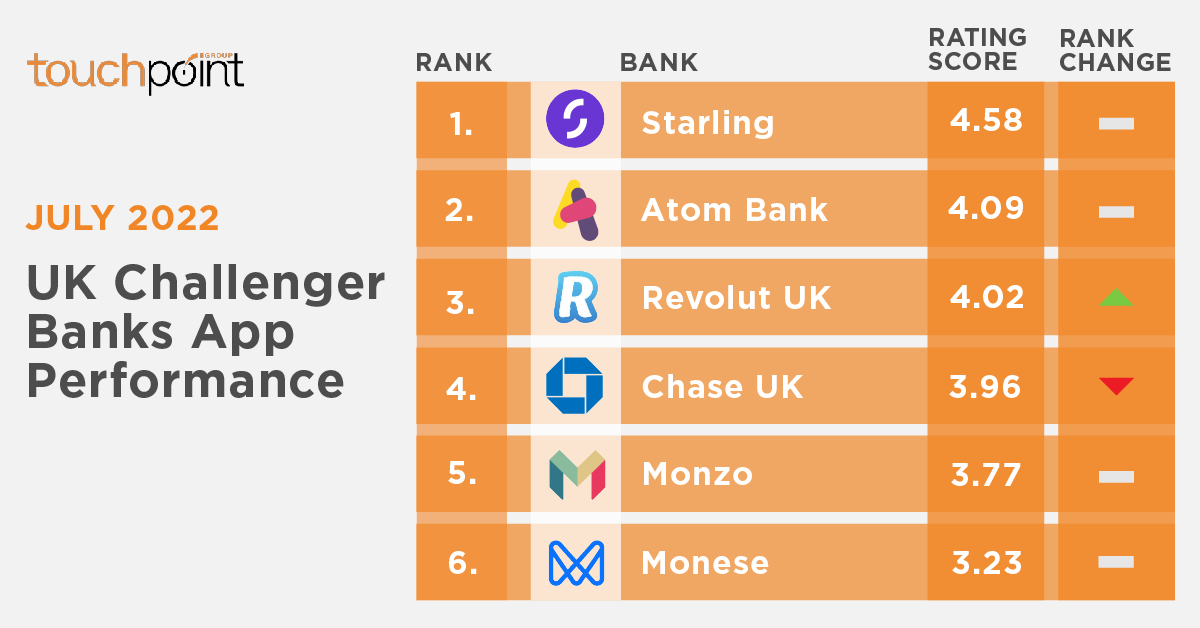

This month’s UK Challenger bank snapshot looks at closing the gap between the two of the top performers. Does Revolut UK deserve its spot as a top performer, and can they to catch up with Starling? Join us to find out.

After addressing a few problems mid-late 2021, we have seen Starling leap ahead of the competition in the UK Challenger bank category this year. Whilst other banks are trending higher at present, they’re inconsistent, so Tony selects Revolut UK as the bank for comparison in this snapshot video since they have held a more consistent second place position over time.

With such disparity between their scores, has Revolut UK got what it takes to close the gap?

We begin our investigation by looking at the distribution of Engaged Customer Scores (ECS) ranging from 1-5, with 5 being the top score. Starling is performing well, hitting numbers that we see with other leading banks world-wide when we do this kind of analysis for the 5-scores at 83.5%. In comparison, Revolut UK is only getting 66.2% overall for their 5-scores and to worsen things further, we see that, at the other end of the scale Revolut UK has a much greater number of 1-scores (19.6%) compared with Staling who only have 6.3% ECS of 1. So, in this snapshot video this month we do have quite a bit of difference between our two banks, which is going to give us plenty of scope for what Revolut UK need to do to make gains and deliver an app that meets the needs of their customers.

Using the Touchpoint Group Ipiphany software, Tony highlights the individual performance in each of the key areas a customer would typically use the banking app for through the ‘Customer Journey’ view. Here we learn what areas Revolut UK needs to focus on improving and explore what’s behind some of those engaged customer scores.

We then move into the app’s functionality, with the SURF analysis, looking specifically into the areas of Security, Usability, Reliability and Functionality. This is where we see quite clearly, that Starling is performing far better than Revolut UK, and Tony is able to identify a major pain point for Revolut UK customers around reliability.

Whilst Revolut UK have a lot of work ahead of them if they are going to have any chance of closing that gap, we think that with focus in the right areas they can make some real inroads. With a tool like Ipiphany at their disposal, Touchpoint Group are only a phone call away, ready to steer them in the right direction.

If you would like a personalised look at your bank's app performance? Contact Touchpoint Group today for a specific insights session for your business.

Full Transcript

00:00:00 Glenn: Welcome back to another Banking App Insight Session looking at the UK Challenger Market and the theme of the month is we're doing a little bit of gap analysis and in particular here, we're looking at Starling and Revolut at the top of the table consistently over the last six to twelve months.

Tony Patrick is going to give us a quick run-through of why Starlings at the top of the tree and what Revolut really could do to help bridge that gap. Over to you, Tony.

00:00:34 Tony: Great. Thank you, Glenn. As Glenn mentioned we're covering off the UK Challengers today, Starling, Monzo, Revolut UK, Atom Bank and Monese. Let's just jump straight in and look at these scores so to see what's going on in here.

One of the things we've seen recently is that we've got -and this is looking over a fairly long period but, recently over the past year, we've seen Starling leap ahead. It's actually sitting above the rest. They had their problems sort of mid to late last year, they've actually really done a good job of keeping that gap in there. Now, one of the things I could look at is compare them to Atom bank but, Atom Bank is actually going up and down. It's a bit sporadic and it hasn't been leading for most of this year. But, one that's consistently behind we can see here is Revolut. It's consistently sitting there of a gap of about from 4.2 up to 4... But, there's a gap of about 0.5 consistently across time. So, that's the one I'll focus on today and have a look at: Why that's there, what's that gap and how could the likes of Revolut actually close that gap. Let's have a look.

First of all, just having a look at the scores between these two: Where are they coming from? Now, one of the things we can see when we look at this this big blue area, those are the customers giving a 5. So, we’ve got 66% of Revolut customers giving a 5% compared to Starling at 83%. So, Starling is up in a really pretty high territory. It's getting above 80% giving you fives. You're in the top of the banks globally that we measure whereas, 66% is there's obviously a fair bit to improve there. It's about… it's a fairly big gap actually. Even with the other end of the scale, those giving it 1, Revolut's giving, nearly 20% giving a 1, as compared to only 6% giving a 1 out there for Starling. So, let's step forward and have a look at why that might be happening. One of the things we can see here is that we've got these journeys. These are the major journeys that customers do across the app. So, if we look at things like for example, transferring between Accounts, Monitoring Account Activity, Opening and Authenticate so it's a sort of getting into the app journey, Depositing Checks, for example. So, we can see across the board a few areas where Starling is actually doing a lot better. For example, Monitoring Account Activity is 4.5 compared to 3.7, Depositing Checks is 4.8 to 4.3. One of the big ones here is Checking Account Balance 3.8 compared to 2.4. So, what is going on there with Revolut? Let's have a Check on that to see what they're actually doing inside there.

If we look at that I'll get down to the actual comments to see what's actually going on. This seems like a very basic function thing -of actually checking your account balance. A lot of the problems here there seems to...This person here is actually closing their account because having trouble seeing their account balance: "Constantly bugging out cannot see my balance login issues..." There's issues with actually getting money in there and how it's transferring but, in general you can see the trend is this sort of red and a couple of green in there, about the low and high scores. But, let's have a look at that and compare that to Starling.

It was doing reasonably well at 3.8 although it's slightly below the average score for their bank overall. Now, if we look here, we're seeing a few of these other ones coming through with a sort of mid-level not sort of all you know... it's not all red, getting a lot more greens going on. Again, here: "I can check my balance... I can find it easier to use... You can see your remaining balance in the transactions..." But, there's still little issues coming through: "each transaction does not update the balance in a way that allows you later to see the changes..." So, there's still some issues and some U.I improvements that Starling can actually make in there. Again, there's the very positive stuff for some people: "Instantly updates my balance..." Again, some issues and some good things they need to improve there as well.

What we can do though, is look at another area which is looking at this one here, which is looking at this whole idea of the fundamentals of the app, things like: Usability, Reliability, Functional Suitability. So, is it actually doing the purpose it's supposed to be doing for that particular journey or whatever it is or the app speed or security? One of the biggest gaps we can see here though, is that Starling is doing a lot better on this whole area of Reliability, and that is a major Bugbear for customers. If it's not reliable, it's crashing, it's not doing the right thing, then of course, that's going to be a major issue that stops you getting to those great features you might have in your app.

Let's have a look at what it looks like for Revolut. If I select here, what I can see in my examples, let's jump in and have a look. So, Reliability says for some people: "it's actually easy, it's fast, it's reliable..." For others, they can't log in, they can't download the app, "I couldn't top up my card because that had problems..."The app doesn't work..." There's lots of down time with the app as well. So, it's interesting there's a very... there's a few good ones coming through but in in the end there's a lot of problems coming through only averaging 2.5.

If we jump into Reliability of Starling, even though it's a bit below average for them, we can see a lot of fives coming through. So: "it works reliably... It is slick, it's seamless..."A couple of small issues there for customers: "Nearby payments doesn't work..." So, clearly there's some Reliability issues in some parts but, in general it's very positive. Overall, it's around Reliability looks like an issue for Revolut they can actually pick that gap up into Starling and also some of those key journeys like checking your account balance. Some of the basic stuff you need to do with the app needs to actually function uh better for Revolut. So, thank you, Glenn.

00:06:40 Glenn: As always, mate. It's fantastic to get those insights from you and... How amazing is it when you can lift the lid on exactly what people are saying about you, your bank and the app, and you use that to help identify and prioritize areas that you can focus on to make those incremental improvements and catch the competition.

If you want to do that for you, your bank and your app, give us a call. Reach out, we'll have a chat.

Have a great one!