This month we look at two top performers who are neck and neck in the UK Legacy banking category, Barclays and Nationwide.

Get out your microscope Nationwide - it’s the little details that matter.

With such a slim gap between the two banks, Nationwide is just behind Barclays in the Engaged Customer Score rankings (ECS). With such a slim gap between the two banks the stakes are high and it's the little details that make all the difference.

We begin with a SURF analysis comparison between the two banks to see how each bank performs in the fundamental areas of Security, Usability, Reliability and Functionality. Both banks perform well by global standards under the SURF analysis. Nationwide need to do a little more to reach the levels of the best performers globally, however good scores overall.

Between the two we see that Nationwide will need to turn their attention to all 3 of the 4 SURF pillars: Reliability, Functionality and Security & Authentication and really focus on identifying what the little problems are that they need to fix.

We move on to the area of Customer Journeys and as before, we see very subtle gaps between both banks with only very small differences between the scores. Things become a little clearer when we filter by the low ECS, to isolate the pain points customers are experiencing with the apps.

This snapshot video is a great example of how Touchpoint Group’s customer intelligence software can focus on the details in a hyper-specific way. For Nationwide, this level of scrutiny into the finer detail is exactly what is needed for them to identify what it is going to take to close that gap with Barclays. Have Nationwide got what it takes to overtake and get ahead of the competition? Only time will tell.

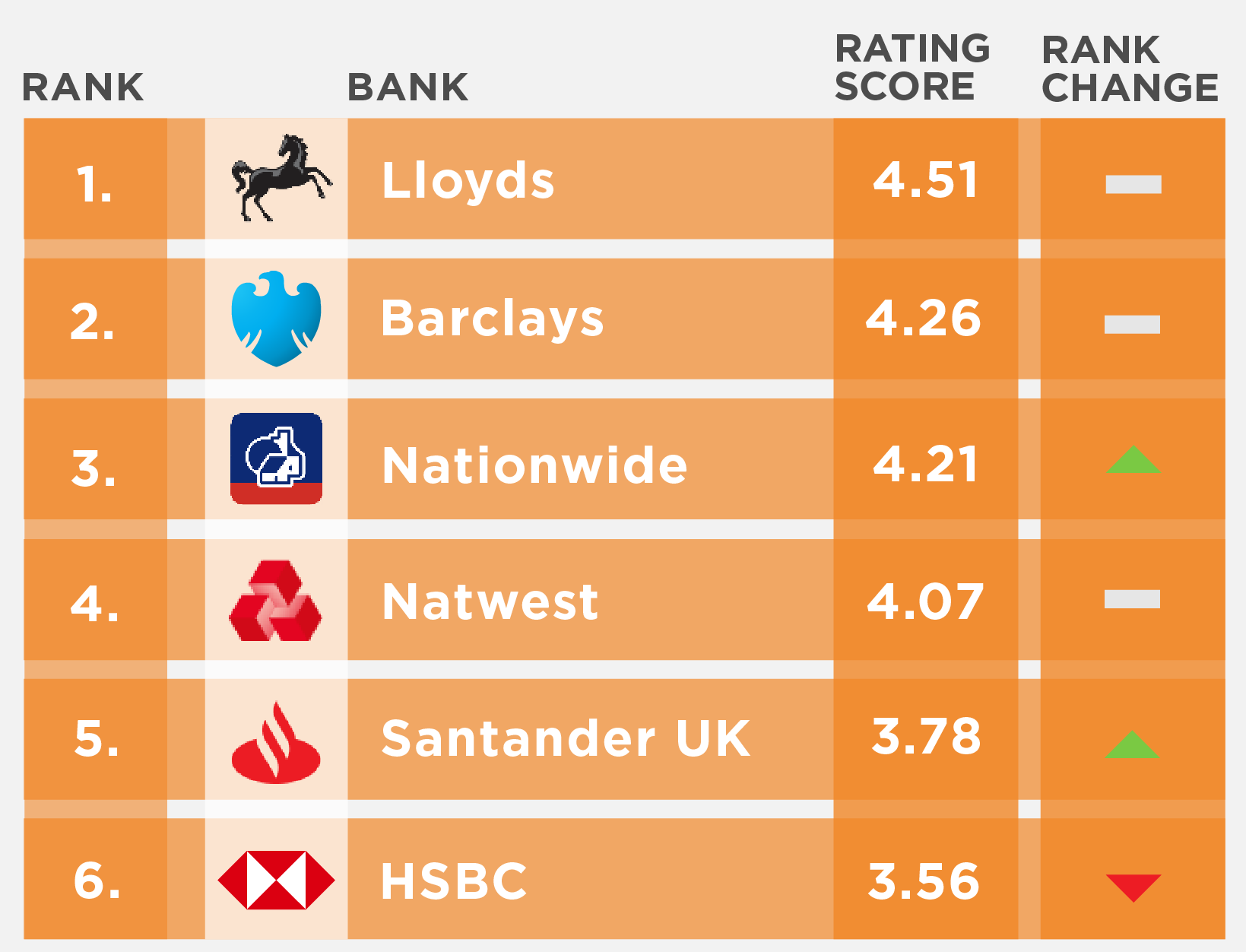

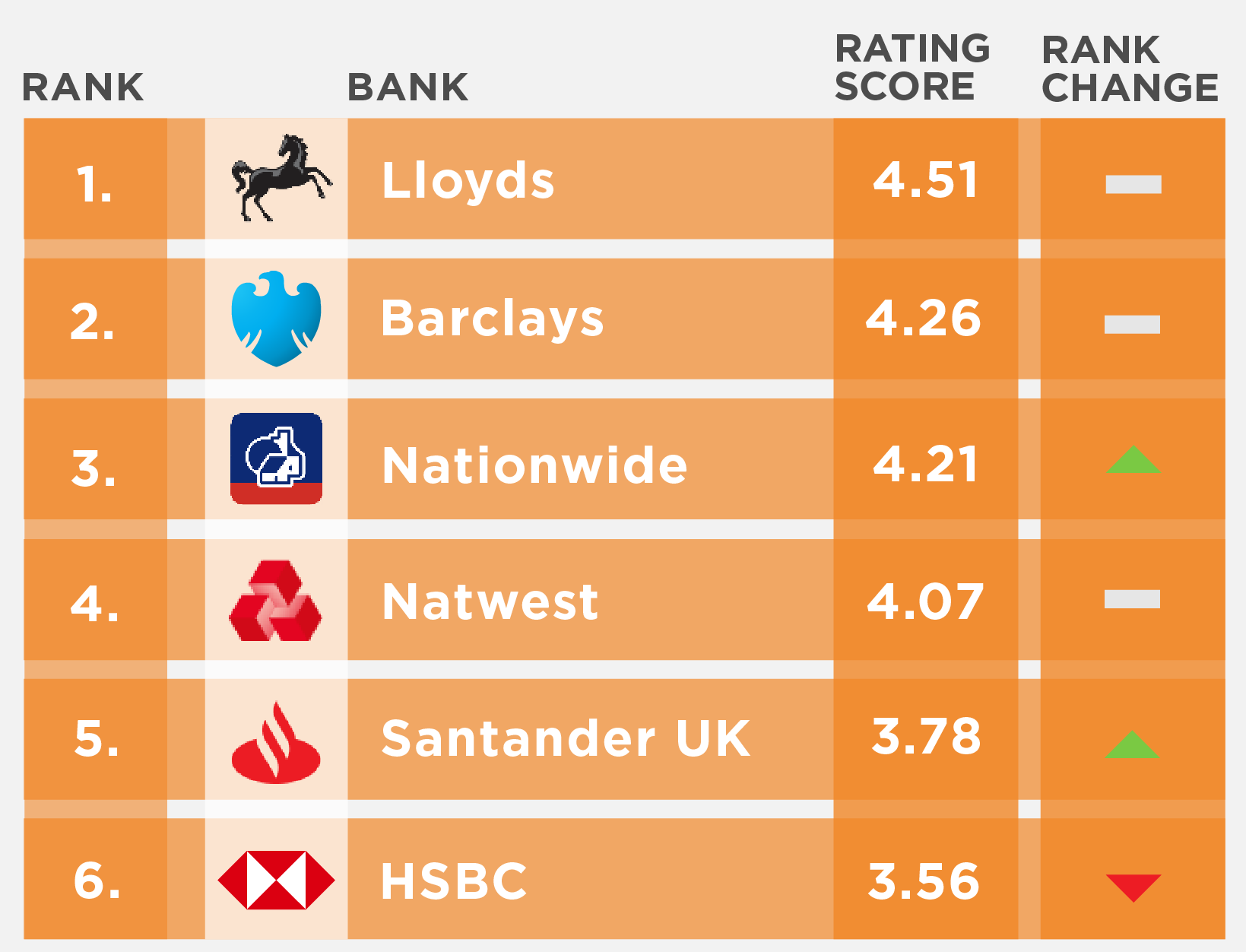

U.K. Legacy banks Engaged Customer Score (ECS) performance rankings for August 2022

Would you like to know how your own bank’s apps performance measures up? Contact Touchpoint Group today for a specific insights session for your business.

Full Transcript

00:00:02 – Glenn: Everybody welcome back to another Touchpointgroup.com Insight Session. I'm Glenn Marvin and we are going to be focusing on the UK Banks, in particular, the Legacy Banks and even more granular we're going to look at Nationwide versus Barclays this month because this is a great example of two Banks and Apps that are really close in their rankings. And that if you focus on incremental gains in hyper-specific individual Journeys and features, that can be the difference that you need to make to either overtake or keep ahead of the competition.

Tony Patrick, welcome back. It is so good to have you giving us these deep Insight Sessions and let's get straight into it, because there's a lot to cover off in this.

00:00:58 – Tony: Definitely, yeah. Thanks, Glenn. And yeah, today the UK Banks, so we'll cover off Lloyds, Barclays, NatWest, Nationwide, Santander UK and HSBC UK. So broadly, let's just jump in because a great way to kick us off is to see what are the scores doing?

So let's have a look here. So what I might do, I might pop on just to start us off. I might just put on these Santander and HSBC. So one of the things we notice about HSBC last time around was that there has been a massive pickup in July. So HSBC has done some massive work at the back end to make sure all their issues with the app were improved. And that's really picked things up, it has dropped a bit into August, but we'll see how that settles down and how that works through as those improvements come to bear on customers.

The other one we can see here that Santander has actually dropped and actually has picked up since that point. So they obviously, clearly had some issues in July that have actually picked up. Let's clear away those two so our scale gets into some sort of order here. And what we can see is one of the things I'd look at today is Nationwide.

So Nationwide has done really well except for potentially the September to November period last year. It's moving in the right direction in general, it's moving up towards those Top 2 which is looking at around the likes of Lloyds, and of course even if we jump in here and look at Barclays as well. So Barclays is up there, but Barclays tends to be just above, like Nationwide has jumped above, probably once over the past year, but Nationwide is just sort of sitting below it. If we look at this time around though we can see that the Engaged Customer Score for Nationwide is 4.2 compared to the Engaged Customer Score for Barclays at 4.3, so very close. Now one of the things about the Engaged Customer Score, for those who aren't aware the Engaged Customer Score looks at those customers who've given both a score and a comment. And that's what we call Engaged and what that allows us to do is have very sensitive information as to what's going on with the App. So if we see movement in that score, we see there's actually something real happening with your App. If it goes down there are definitely problems going on, if it goes up you've actually improved something. So, it's a really positive way to make improvements and compare yourself to the rest of the market.

So, Nationwide. Let's have a look at them and why and how they can close that Gap into Barclays? So, first of all one of the things I'd like to do first is definitely have a broad look at the issues going on with the App. So, this is looking at our SURF Analysis. So this is looking at Security and Authentication, Usability, Reliability and Functionality. Now, one of the key things about this, is these are all pain points, so the lower the better. You want to get these as low as you can. And in some of the global markets if we add all these together, in terms of each of these sectors together if you get below 20% you're starting to compete with the Top globally. And of course even Barclays here is sort of around 30, 33% so they've still got room to move to be best globally, but they are doing better than Nationwide. But it's not a massive gap, and that's what I was talking about before. Is this it's about this small gap that's consistent between Nationwide and Barclays, what can they do?

Well across the past quarter we can see that it's about a 3%, there's 3% more issue issues with Reliability for Nationwide. There's about 2-3% more issues of Functionality. Security and Authentication, there's a couple of percent. So Usability is fine, so in general the Usability of the App is all fine, it's just these little problems that appear elsewhere that are the problem.

So let's have a bit of a look at Reliability because that's, you know, that's a core one to understand. Interesting, before we look at the technical issues let's look at bugs. So overall Nationwide in the past quarter has had fewer bug mentions than Barclays at half the level so, that's interesting. App crashes are about the same. So it's not necessarily about the bugs and crashes it's about things working as you expect them to. Which is a big issue for customers here with technical issues so, they're trying to do something and it doesn't work as expected. Not quite a bug and not quite a crash, but somewhere that's a bit softer than that, but it's a problem along the way.

So one of the things we'd like to do now is have a look at things like the particular Journeys in here. So, what we've got here is just a few I've selected. So, some very basic ones like Monitoring Account Activity, Depositing a Check, Checking Account Balance, Transferring Between Accounts and Paying Bills Via the App. Now, the view I've got here though is a general view of people just commenting around about this topic. So, the score here is the average score about that. So people can talk about positive or negative things, it's different to the SURF Analysis which was purely negative. This could be anything around that topic, so in here the score, the higher the score is better. You want a higher score here because you want people scoring well on each of your Journeys across the App.

So again, there's subtle differences, and it has to be subtle here because there's a very small difference in gap between the scores. But Monitoring Account Activity, one of the core functions of a Banking App 3.5 versus 3.8. So a 0.3 gap between the two. And one of the things I can see here as well across to the right is a basic thing like Transferring Money Between Accounts has a 0.2 Gap in there. And also Paying Bills has a 0.4 Gap. So there's a few little things that need to be improved across the board.

One of the things we'll look at now though is this little thing here about Transferring Funds. Let's have a look at Nationwide across the past quarter and see... Now what I'll do here, I'll actually- let's go down to the negative things as I said, this could be negative or positive things and all we're seeing is the average score. Let's look at the negative things coming through for Nationwide.

So in this case here I can see a few things here. Now one of the things that's popping up here a few times is "I love this app, but the one major problem is you're unable to transfer money to a new personal organization without your card reader, which is really annoying". So that's interesting. That's obviously Nationwide were aware of that, because that's the Security feature they have. But it is annoying customers and actually here, this person actually said here... and I'll click on this to give us some more detail. So this is about that card reader again, so "You need to actually have that card reader to set up that new payee to transfer that money" so obviously a problem for that customer there. And across the board we can see a few things happening here. Again, this is all, there's little- small things going on. "The App crashes-" this person here "The app crashes when I try to transfer money". Again "I can't transfer money outside donation weight or set up new payee" So an issue for that customer. So again, there's probably some little emerging issues. But it's the small things they need to have a look at, is there a different way that can add security to this rather than having that card reader? Because that seems to be annoying a lot of customers along the way. So, a few things there for Nationwide to have a look at.

But one of the last few I want to have a look at is actually looking at Nationwide overall. Because Nationwide has actually improved from our July to August. So it's improved from our 4.0 up to 4.2 and we can see a few things going on. So we can see with Reliability, again these are purely problem so, the lower is better. And Reliability overall has gone it was up around 14 it's gone to 12.8. Technical Issues have also dropped and The App's Not Working is also dropped so that's really good. We've got things like Usability Improvements as well, so Usability has gone from around 7% down to 5 so that's a really good Improvement across the board. So it's not some major thing that's actually gone on, it's actually some incremental things that have gone on and again if I do that once more in September they go a long way towards overtaking Barclays. So yeah, well done to Nationwide. They've still got room to move to get to that Top Level.

00:09:14 – Glenn: Yeah, fantastic insights yet again, Tony. Just going to show that consistent incremental gains and focusing on the little things done well can end up making quite a massive difference in the overall performance.

Thanks everybody for tuning in and if you'd like to talk about your Bank and do a deep dive in regards to your App's performance we're more than happy to have a chat. We'll see you next month.