In the October US Tier 1 banking app insight session we explore the sentiment of customer reviews to understand why they rank where they do and what makes a top global performer.

If you want to level up, look to US Bank as the finest example of what best practice looks like.

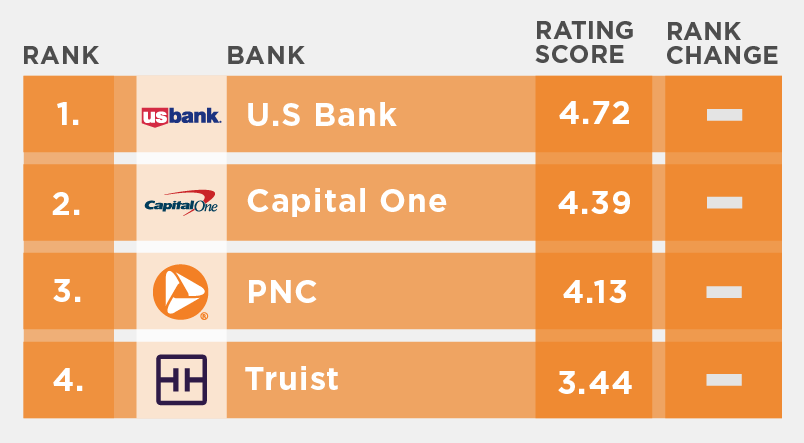

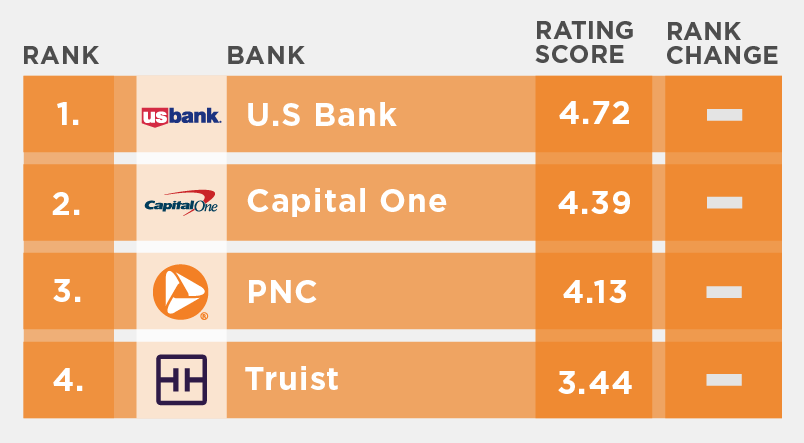

The US Tier 1 banking segment overall has enjoyed very consistent Engaged Customer ScoreTM (ECS) rankings over the last 12 months and have maintained their positions. This is very much the case at the top of the scoreboard with a bit of a gap consistently maintained between Capital One and US Bank. PNC is sitting in 3rd place and moving in a similar pattern to Truist at the bottom position but appears to have been working hard to come out of a low point in February, although we are starting to see a downward trend in October.

US Tier 1 banks Engaged Customer Score performance rankings for October 2022

A quick look at their SURF analysis tells us what is contributing to the drop in the Truist scores, and we move on to how the market performs when we look at both the UK and US markets combined.

US Bank is the top performer globally, taking 1st place from a pool of over 60+ banks across the UK and US with their exceptional score of 4.8. Capital One follows in 7th place, with PNC in 22nd place and Truist in 26th place.

To find out why that gap exists Tony uses one of the many analysis tools within the Touchpoint Group platform to reveal the customer sentiment behind the scores for the month of October. Looking at what each bank over-indexes on and delving deeper where needed, for Truist we can see issues around checking and depositing checks are featuring strongly and reliability is also a problem for a lot of customers. PNC still has a fair few problem areas being raised but for the most part their customers are liking the Zelle Payment feature and are expressing positive feedback.

Moving to Capital One we see that there is plenty of positive feedback about the navigation. This is an example of once you have your basics, such as logging in and app crashing issues under control, then you really start to see journey narratives come to the forefront.

Lastly we come to our global leader, US Bank. As expected, US Bank sets the bar very high. Things look quite different, with very positive ideas being conveyed with “Check Deposit” over-indexing, followed by sentiment around the overall products and services, providing good user experiences across the board.

How well is your bank performing? Contact Touchpoint Group today for your very own customized insights session today.

Full Transcript

00:00:02 – Glenn: Hello everybody and welcome back to another Banking App Insight Session from Touchpoint Group for the month of October. And we are focusing on the US Tier 1 Banks and this Market segment has such consistency in their ranking positions over the last 12 months, we thought we would dig into the sentiment of customer reviews for each bank that highlights why they rank where they do and the areas of opportunity or why -for the top performing Banks- they are so highly ranked? Tony Patrick, this one has me excited because there is plenty to look at when it comes to sentiment coming through.

00:00:57 – Tony: There definitely is, Glenn, thanks for that. Yeah, today as Glenn said, US Tier 1 is covering U.S Bank, Capital One, PNC and Truist; so I guess let's get in with our our standard. Let's have a quick look at how the numbers are going. So very consistent at the top there we've got U.S Bank and we've got Capital One, they're really consistent and I suppose for Capital One is like, you know, why are they sitting behind? That's obviously a deeper session to understand why they're behind and to get more detail. But we can see there that Truist is doing a really good job of coming out of that low point in February to jump up to September but they have had a bit of a knockdown in October, it's sort of a move backwards slightly. And we see PNC is also moving in a similar Direction sort of picking itself up, you know, back to that top level. But, again how do you move to that next level up to actually get to for them to even get past Capital One, let alone U.S Bank?

Let's have a quick look, though, at why Truist has gone backwards slightly -not into too much detail but, let's have a quick look at what's going on. So what we can do, is we can see for example here what we're looking at is these particular topics around Security and features in Reliability these are all pain points, so you want these things to be as low frequency as we possibly can. One of the things I've had a look at, we can see this score has gone backwards from around 3.8 down to 3.4 and what we can see is that Security and Authentication - one of the first things there is Unable to Log In is at 3.1 in October. But it was 1.1 in September so it's gone up by 2. So it's gone up a fair way. Now, biometric login feature has gone from about 0.6 up to 2.1, so that has gone up a fair way, like tripled in terms of what's going on. Again, these aren't the sort of thing that's you want to keep an eye on these to keep these as low as possible. And if they're increasing you want to be on top of that pretty fast because it will affect other customers as well. So you can see there's some areas there we can obviously dive in and find out a bit more detail, well that's where, that's how we can see some clear things that can improve on.

Let's have a quick look though at what this Market looks like from a Global Perspective. And when I say Global, I mean I'm looking here at UK and US at the moment. Let's have a look at the black gray dots just here. One of the things we do see is U.S Bank is actually first globally from the 60+ banks that we track and we can see there at 4.0 it is pretty high out of 5 and so very, very positive stuff for them. Capital One is up the top there it is seventh in this group sitting there at 4.4. The other two PNC and Truist are sitting down at sort of 3.6 and 3.8 so, not terrible, but they have this gap to leap up to get to these top group. Now this is Q3 in 2022 so there's a gap between those bottom two and the top two. So what I think what I'd like to do is explore why that Gap exists so what I'm going to have a look at here is the sentiment sitting underneath each of these Banks so if I look at Truist let's start from there we'll move up the chain here, so let's have a look at Truist now one of the things here... What we've got popping up here is actually the- it's a concept Cloud, so this is actually around showing us what topics that Truist over-indexes on, so which things do they over-index on. We can clearly see I don't have to explain this to you, the Poor App Check feature and and Depositing a Check Via the App clearly a problem for customers. Now again one of the things for Truist is obviously there's a few other negative things in there, things like the App versions and things like that and also things like App colours, for example, are coming through as well. So if they did fix that Check Deposit feature, other things are going to come to the front as well so they need to be on top of each of those, not just this major one that's in your face as well.

So a few things to pick up on there, and obviously I can click on each of these and have a bit of an understanding about what's sitting underneath that. So I'll filter down to the more negative types of things and what I can do here is just have, you know, have a look at what's going on so... "It never works", "It's unreliable"... So reliability looks like a problem for a lot of customers and they're having massive problems each time they try to use that so, issues there for Truist around that Check Deposit. Let's move along though to PNC so up a bit, PNC is averaging higher all the time against Truist. One of the things about PNC obviously with their connection with Zelle Payments actually doing a very good job there the customers do like that feature, so good App Zelle Payment features coming through. Although a few people are having issues, so it's a bit of a amix of going both ways in terms of this. So a few customers having issues but, a lot of them -more of them are actually enjoying what's going on.

So I think there's still room for them to improve on that but we can see here if I jump into it: "It's fast and easy" "Glad I use it" "It's a breeze to utilise" "It's great" "It's easy to set up" and etc. So, very positive stuff there coming through around the Zelle Payments, but in general there's some poor functionality going on elsewhere across various areas, and even things like App Freezing is coming through as well. Again this is just for October.

Let's jump up a bit and have a look, let's look at Capital One I think we looked at that there were seventh overall globally, but I think we can have a look. So have a let's jump in and see, look: "App easy to navigate" so first thing there. Like navigation is one of those things is, once you get your logging in and crashing issues under control suddenly navigation can come to the fore and actually like and really highlight what your app can possibly do. So great- a good payments process. A lot of stuff happening here there's some issues with the credit card here obviously there's a lot of detail in that. But again we can look at- and I have to click on that and get into more detail in there as well. But if I look in here like "Easy payment process" as an example. We can see it here: "It's fast and convenient to pay bills" and so on. And this is like, one of the most -I suppose it's one of those obvious things to say: getting these basics right is why these leaders are up where they are. An extremely basic thing like say viewing account transactions or making a simple payment if you get those right every single time, you can start to lead the market.

So let's have a look at what is the global leader out of all the 60+ Banks we track and this is U.S Bank. Now look, this looks very, very different to what we saw with others, basically everything is green there's one gray which is sort of means it's average score. So we can see there that U.S Bank is over-indexing on Your Check Deposit. Other things like for example Basic Goods, Products and Services. "Makes my life- App makes life better", "Good product service quality" this is what best practice looks like, so you're aiming towards this to build up the good experience across the board.

So basically, we can see the sort of, you know, again, Truist and PNC aren't terrible in the scheme of things, they just need to pick their act up to overcome their initial problems that are happening right now, particularly with Truist with Check Deposit but PNC can even improve more on their Zelle Payments system. So a lot to do for these two Banks here, but you know, well done to U.S Bank. Thanks, Glenn.

00:08:31 – Glenn: Thank you, Tony. And yet again, highlighting how just getting those foundational attributes and those simple things right can have such a dramatic impact on the overarching experience of your customers. Well thank you very much everybody, we will see you next month and feel free to sing out if you'd like us to have a look at your Banking App.