In this month’s session we look at how the US National banks compare to each other and delve into customer sentiment to find out what it takes to be a stellar performer.

You can add all the bells and whistles you like, but it’s nothing but a fool’s game if your fundamental attributes are failing.

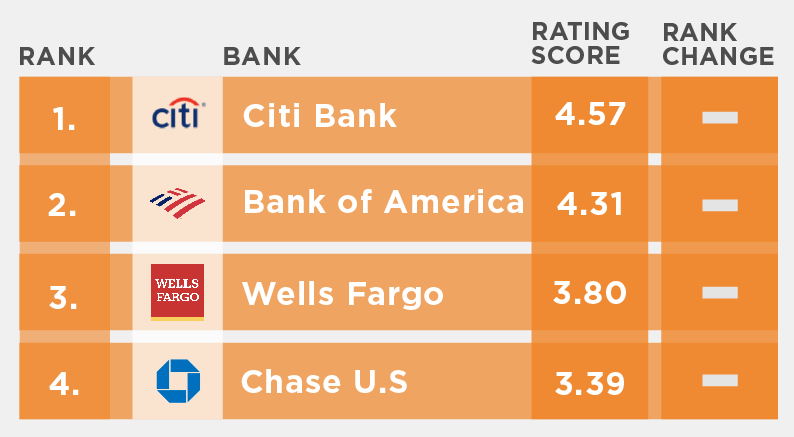

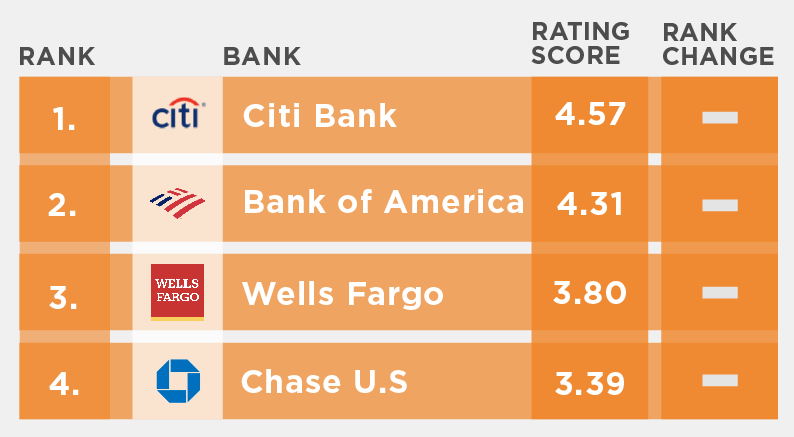

Looking at Engaged Customer ScoreTM (ECS) trends over the past year, Citi and Bank of America are both doing well, consistently hitting scores above 4.25 to 4.5. Wells Fargo are showing improvement following a major app update in March but still have a way to go to get back to where they were last December. Chase on the other hand has been fluctuating quite considerably, indicating their customers are likely to be enduring a rather frustrating user experience.

US National banks Engaged Customer Score performance rankings for October 2022

To gain further insight into Chase we look at the analysis of the app versions that are being released. Typical best practice would show movement up and down as new versions are released at regular intervals. When we change the view to look specifically at Chase we see a very different picture of multiple versions overlapping all the time, creating a chaotic “spaghetti” effect. This would indicate that customers are using outdated versions that contain historical problems and bugs.

Touchpoint Group’s analysis enables us to better understand the impact of the customer feedback by identifying the frequency and weighting of the various themes, both positive and negative. We begin with Chase to see where they are over-indexing compared with the other banks for the month of October. A big concern is that much of the customer feedback contains threats of churn expressed in a variety of ways.

Wells Fargo is next, and what we see here coming through is a slightly different story and a bit more positive, however we can see that for some areas and app features the experiences are mixed so further analysis would be needed here to identify the problem areas. Moving onto Bank of America and things are starting to look a bit more positive, although with still a handful of minor issues for customers.

Citbank is the only bank that is displaying evidence of doing very well in this group. This is very clear when we look at the things that over-index for them. Here we can see that Citibank is demonstrating a best practice approach where they have their fundamentals under control allowing the journeys to come through and be talked about in a positive light. When we switch to graphs on how the US National banks score across journeys we can see very clearly that Citibank is performing very strongly, as predicted.

Find out how well your bank performs. Contact us today to arrange a customized insights session with the expert team at Touchpoint group.

Full Transcript

00:00:01 – Glenn: Hello everybody and welcome back to another Touchpoint Group Banking Insights Session and this particular one is around the U.S Nationals. And for the month of October we're going to dig into why some bank's performance is lumpy with their reviews and others are just so highly consistently rated. And then, we're going to have a little look at how no matter how many features you can add in your app, getting 4 fundamental attributes absolutely right can have a dramatic effect on positive impact across the board with both your customer's experience and corresponding rankings. Tony Patrick, welcome as usual. Looking forward to you taking us through this one.

00:00:56 – Tony: -Great. Thank you, Glenn. So, I'll get straight into it. So, today we're looking at the U.S Nationals, Citibank, Bank of America, Wells Fargo and Chase. And I'll get straight into it. One of the first things to look at, to give us a guide of what's going on, is the score. What's actually going on in October? Now, one of the things that was- well, I suppose, the two consistent ones looking at the top there, we've got Citi and Bank of America consistently moving along at nice scores above 4.25 most of the time and yeah above 4.5 for Citibank. So, very positive. Obviously -there is obviously room for Bank of America to close that gap but, it is that they're both doing very well.

One of the things we're seeing here is this Wells Fargo increase from the major app update in March it's still moving in the right direction. Positive but, it has taken a while, so you know, 7-8 months it still sort of hasn't reached that level we had back in December. Now, of course, this score here is the Engaged Customer Score. What these are -these are people who've given a score in the App stores and they've also given a rating and a comment that allows us to understand why these scores are moving. It also makes it very sensitive, so, in some other measures you might not see what we're seeing here in terms of the dissatisfaction with Wells Fargo.

But, one of the things I want to have a look at here is -we looked at this last time as to why Chase is fluctuating. But, one of the things I want to look at is -and consistency here's one of the things well it's consistently inconsistent is what I'd say here, because this ducks down for two months, jumps back up for one and similar here, now it's ducked down for two more months. I'd expect in November it's going to jump back up again, but again, for customers that's a very frustrating experience, because it's -you want your app to be consistent not sort of jumping around the place.

Let's have a quick look at what's happening inside here, and one of the things we can look at is the app versions that are coming through. Now, I'm looking at Citi here, this is Citi this is when app versions are released and as they drop away in usage. So, at any one point there's obviously a couple of versions being used by our users, by customers. But, if I look at it here, if I just put my mouse over this one here which is our version 4.9.4.9 We're sitting there it peaks up in April, then we go forward to 9.50 we see a peak up there in May and I can continue this we sort of -yeah 9.51 we see a peak up there in June. The only thing slightly inconsistent is that 9.52 had a bit of a... it looks like there were two releases there, 9.52 and 9.521 and that was the peak then but, otherwise we're getting a very consistent movement in the right direction including a release near the end of October which is 9.56. But, it's a very consistent sort of movement up and down.

Let's compare that with what we see for Chase. Now, you can see a vague idea of things jumping up and down, but the case here looks like spaghetti. You've got various versions going on at various points in time. Now, one thing here for example, I can see there's a version here 4.302 which was released in May and it peaked up in May in terms of frequency but, it seems to that the feedback coming through from customers was flowing through into August and September, which means customers either don't feel compelled to make an update on the app or they're just -you know, they're not forced to for some reason. So, in this case here, the feedback coming through from August 13% of it was actually coming through from an app release in May and the real release that was happening there was 4.3.3.1 and there's other ones as well. There's multiple versions still sort of flowing through. So this inconsistency whether it's customers feel like "I don't want to update because the one I've got now is okay, my last experience with an update wasn't good, I want to wait until I'm happy..." But, that causes ongoing problems for Chase customers as they keep those old bugs. The problem for Chase is as they go and fix those problems, they think –“Well, the problems are still there. I need to refix them” but in fact it's just the old versions causing that problem.

Let's have a brief look at just some global numbers. We saw before the scores we saw for Citibank and others. What I can see here is just a UK-US perspective. So, what we can see here is that Citibank actually ranks third from this perspective at 4.6 and this is across Q3 up 'till the end of September, and we got there Bank of America at 4.3. We can see there's a clear difference as we saw in that first chart. We can see there's a clear difference to Chase and to Wells Fargo with the differences there.

What we can do with that is actually understand what's the sentiment coming through from each of these four customer groups, and that will give us a feel about what's going on in this world. So, let's jump across to that. Inside Ipiphany here, I can actually have an understanding of what's going on. What I'm looking at first is... this is Chase. And what we're looking at here on the right is where does Chase over-indexes compared to the other three banks for October. Just looking at October one of the things I can see right in the middle there, the over-indexing on Threatening Churn and the frequency is represented by the size of the text here. Again, these aren't just -this isn't just a word cloud as such, these are actually concepts. So, the idea of Threatening Churn is not just people saying -I'm threatening churn because they don't say it that way but, it's things going "I'm thinking of leaving", "I want to close my account" "I'm sick of this" "I want to move somewhere else" for example, so all the variations of that. And we can quickly see here there's things like Poor Mobile App Update is coming through as well so there's issues for customers about how these updates are being pushed through and I suppose being enforced in terms of letting customers, you know, hang on to those updates for months on end. So that's interesting so let's have a look up the chain a bit at Wells Fargo.

So what we see here coming through is a slightly different story, a bit of green coming through so it's a bit positive. But one of the clear things I can see here about Wells Fargo is that there's a bit of green for Good App Check Deposit so, some people are having a really great experience with the Check Deposit, whereas others are having this red here, just shows me there's also some negative stuff going on. So, for Wells Fargo, for them I know they can do well with their Check Deposit because they are for a lot of customers, they just need to fix the others and understand where that's happening? So which customer group is that hitting hardest? Let's improve that piece, because Check Deposit is one of the key things for customers here. But there are some other areas where it's underperforming to others, like Payment features making P2P payments, etc. So there's room to improve that, definitely.

Let's step up a bit further into Bank of America. Now, one of the normal processes we see with this approach is we see right at the bottom, often we get things like "Difficult to log in" "There's a bad update process", etc. But once you overcome that, your Journeys can start to shine, your journey is coming through really well. Although with Bank of America there's a few things that are sort of a slight issue for customers, navigation is an issue, but although there's some positive things there "It's very useful app, I'm satisfied" and so on. There's some small Credit Card issues going on in here as well. I know I can obviously click on these and go into a lot of detail but, for the time here we can't get into the exact detail.

Let's look at for this particular group best practice for this group. So Citibank is doing really well, let's have a look at where it over-indexes. First of all Good App Usability, Operability, Easy to Use but also, these Journeys are coming through Easy Payment Process Easy to Navigate, Good App User Interface etc. So, a very positive- one negative for them is "In-app Advertising" we've seen a few places here, advertising and so on let's have a quick click on it. And what we see here is Too Many Ads is one of the biggest things, so that's interesting.

The last piece I want to show you is a very brief look at how do each of these Banks score across our Journeys? If you look on the right we can see big spikes for blue which is our Citibank. They are doing very well on the extreme basics: Monitoring the Connectivity, Viewing My Account Balance, Paying Bills and Transferring Between Accounts. So that's where they're doing very well, and I think that like that's what others need to focus on getting those basics right before you start to expand out and include other things in your mix of attributes. Thank you, Glenn.

00:09:45 – Glenn: Great to get those insights my friend and it is so critical to focus on getting those foundational things right before you start working on the little micro changes that you can make across the board so, right on my friend and we look forward to talking to you all next month.