US Regional Banks – A Year In Review

Banking App Insight Sessions January 2023

Executive Summary

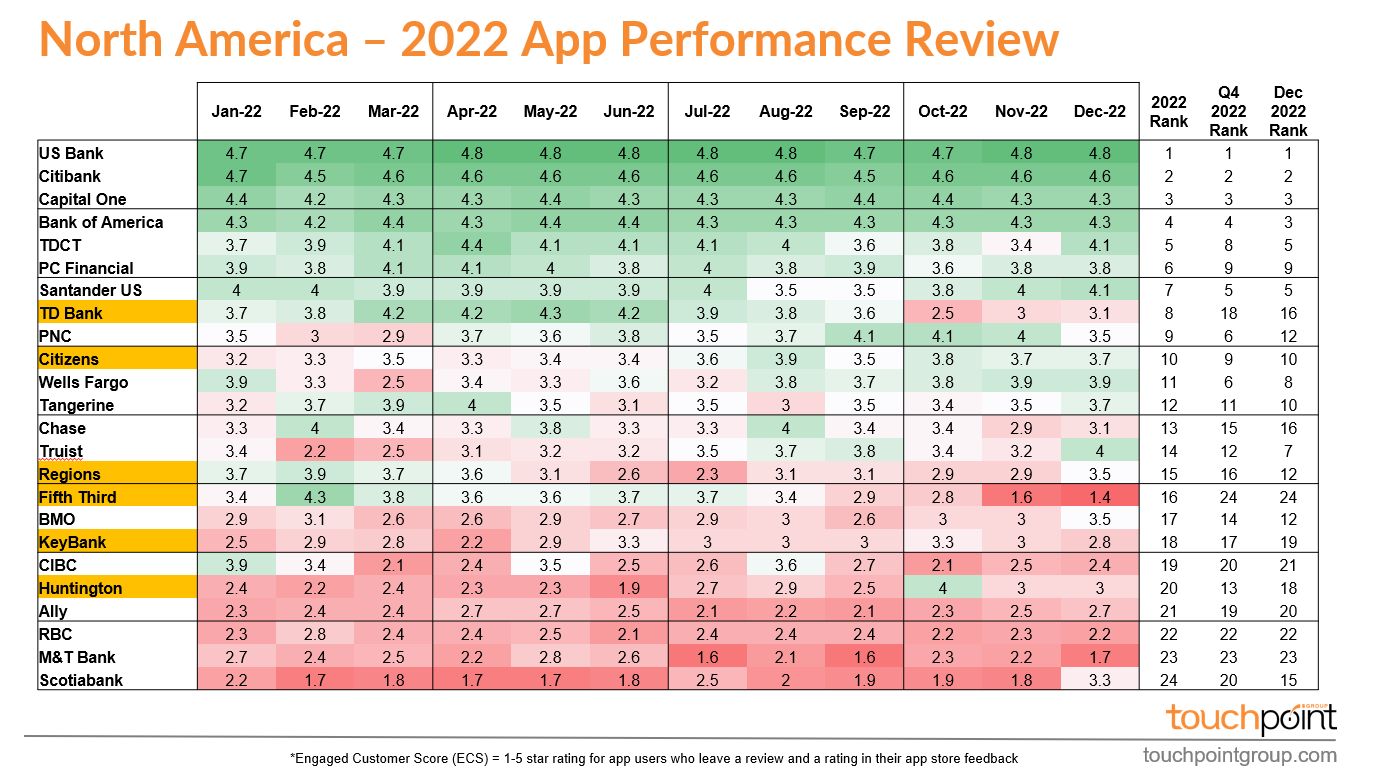

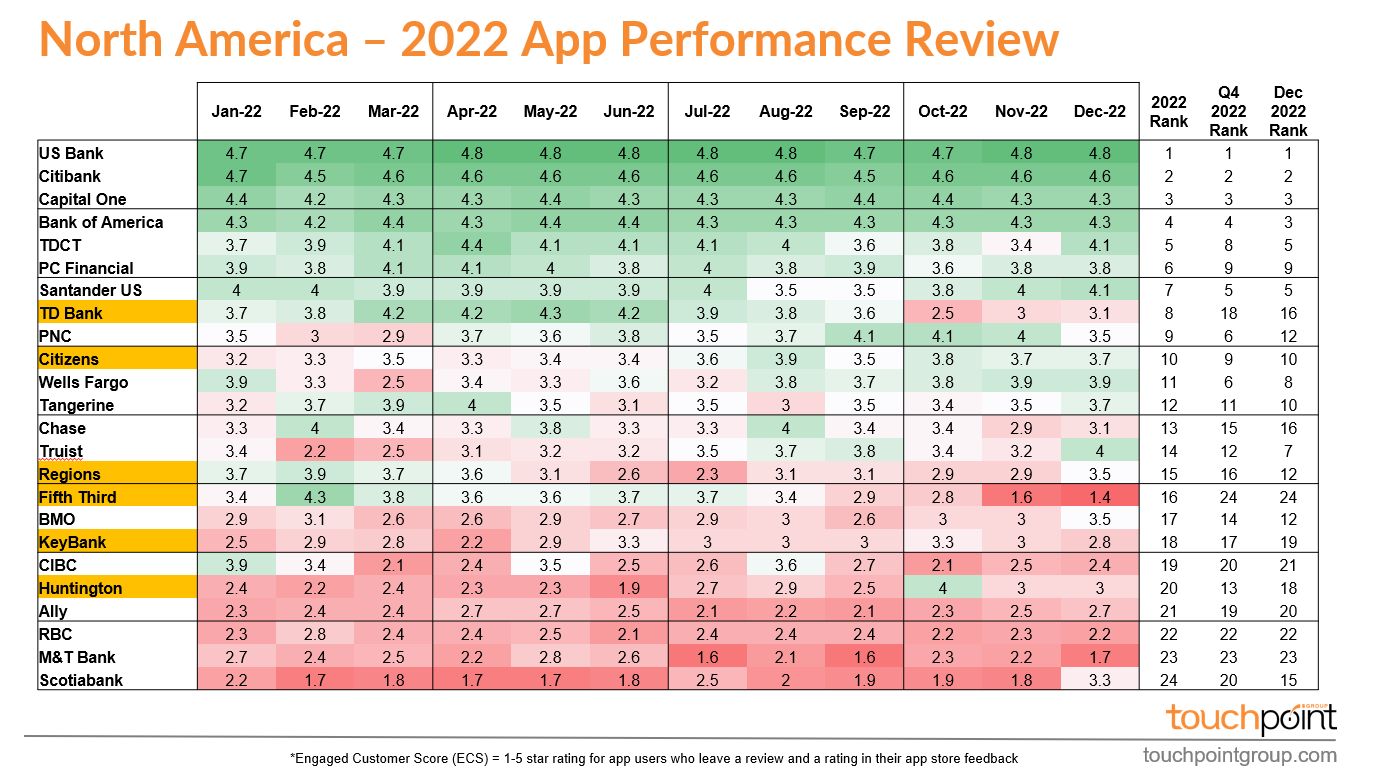

2022 was a year of changing fortunes for Regional Banking App performance. TD Bank takes out the overall best performing Regional Banking app award for 2022 with the best average Engaged Customer Scores (ECS) over the year. TD Bank however has slipped in the last quarter and where they have ranked as high as eighth in the entire US Market, they slipped to 12th in the latest ranking schedule produced for December 2022.

Another banking app to experience the highs and lows of direct feedback from customers contributing to the Engaged Customer Score Rankings is Fifth Third. In Feb 2022 Fifth Third had an ECS of 4.3 which placed it in aposition of 3rd outright in the entire US market and the #1 Regional Banking App. Since July 2022 we have observed a rapid decine in the Fifth Third banking app engaged customer score that aligns with a major release updating the user interface and the Fifth Third Customers clearly are not happy with it. From the high point of third in the entire US market FithThird has slumped to last, 24th out of the 24 major banks that Touchpoint monitors App feedback for insights.

Huntington started the year poorly with ECS scores consistently below 2.5 and even dipping down to 1.9 in June before we witnessed one of the most dramatic recoveries since monitoring ECS metrics began and hitting a hgh point in October 2022 of 4.0. Customer feedback indicating that many of the core journey issues had been resolved and the hard work the Huntington team had been putting in had finally paid off. A dip back down to an ECS of 3.0 to finish the year but Huntington still has to be one of the best recovery stories of the year. We are expecting to see further investment here in 2023 and more gradual improvements as the year goes on.

Citizens takes the consistency award for Regional Banking App performance in 2022 and while TD Bank had the highest overall average, Citizens has finished the year in the strongest position of all Regional Banking Apps in 10th place across the entire US market.

We expect to see big things in 2023 when it comes to investing in “In App Experience” as most institutions are becoming hyper aware, in the current economic climate, of cost control and mitigating churn risk. The better banks understand customers in app experiences and feedback the easier they can mitigate churn and reduce demand on call center operators.

We estimate for the US banks, an effective program being implemented to monitor and learn from customer feedback can have up to a 2% reduction in churn and 1-2% reduction in call centre costs (which can add up into the hundreds of millions of dollars saved or retained each year).

Touchpoint Group is a customer intelligence company utilizing advanced AI and natural language understanding in its proprietary analytics platform to analyze over a million banking app reviews each year in its global ECS index.

Touchpoint Group processes customer feedback data captured using internal customer experience platforms and sources. Data is updated daily, with insights available to identify issues for Operational teams, monthly reporting for Leadership teams, and a Mobile Customer Experience Analytics (MCXA) report published quarterly for Executive leaders to benchmark performance by category and against the best in banking app performance.

Video Transcript

0:05:00 – Glenn Marvin: Hello, welcome back to another Touchpoint Group Insight Session. It is 2023, and we're looking back at the 2022 year in review for the U.S Regional Banking category. Some tough times for the U.S Regional Banks there as far as performance goes, Tony, some little gains and some little wins, but I think the overarching story is it's been tough for them, right?

0:29:03 – Tony Patrick: Yeah, definitely. Thanks, Glenn. So, the U.S Regionals. It has been tough for them, there's been no major improvements but some are doing pretty well still. So, we just have to look at that from that perspective as well. So, TD Bank, Regions, Fifth Third, Citizens, Key Bank and Huntington. Let's have a look at how they've done across the year. So first of all, there's a lot of inconsistency so like one of the things we can see is even though for example, I use TD as an example they've done pretty well across the whole year but they've had some issues in the past quarter, so

from October to December we can see that. So, they need to pick themselves up in that sense.

One of the things that Citizens has done reasonably well they've actually averaging around between 3.2 and 3.5 at the start of the year and they've picked themselves up a bit near the end of the year so, you know, reasonably good and you're sitting around 3.75 later in the year. One of the things though which you can clearly see here is that there's one bank that's had an issue recently and we can see that Fifth Third has dropped away, and in fact, we'll show in a moment that the table across North America is that score in December is actually the lowest across all the 24 Banks. But that's connected to an app relaunch with it's the total revamp of the app in a sense. Now, one of the things about Fifth Third is we could see some things happening in August and September and then the relaunch happened probably around November, and we can see there it dropped away very fast. And so let's have a look at that though, and see what, you know, why has it impacted things.

So one of the things we're looking at this is just Fifth Third is what are the app releases? What's the app release cycle coming on here? So we can see version 4 is sitting there in November, that that's when we saw that large drop so, dropped away hard in November. Then we see version 4.01 coming through so, obviously some tweaks, some app updates to some extent but, that hasn't fixed things as we saw, it's remained low, it's remained at that low level. Then of course, there was an- we can see here when that new other release came through which was mid December and that's version 4.1 so it's obviously it's a more major release trying to adapt a few things. And that's hit mid-December and again we see December has not improved at all it's remained at that low level so version 4.1 hasn't fixed things so why is that so why hasn't it fixed those things so one of the things we can look at this is looking at Fifth Third in here so it's looking at what's the vibe? What's the sort of broad conversation going on?

We can see here it's about the New Update, the Horrible Update, New App, there's a few things about seeing the balance and so on. But again, it's just about the new app in general and not being uuser-friendlyand things like that. Look at let's look at it from a more sort of technical perspective around, you know, what are the major topics coming through? So they talk about Current App Version and the Previous App Version says, obviously the App Version is the issue here. So, one of the things that's coming through is it's not about Technical Issues, it's not about you know things breaking down. Essentially, it's about confusion and design. So, there's a few things going through there so again even if that version 4.1 that Fifth Third put through that might have fixed a few technical issues, but the design is fundamental, so you can't necessarily change that overnight. So, there needs to be possibly some communication to customers or just understanding where the Journeys for customers might be breaking down in this case. Be good to see what happens in January as customers get used to this, we do generally see this drop as a major release and a new functionality comes into play, let's see how that impacts in January.

What I'd like to do now though is just have a look at what we talked about before, which is having a look at the year in review. So what's happening across the whole year? One of the things we can see here and just looking at the Regionals. So these ones highlighted on the left, the Regionals aren't doing as well as some of these National Banks and Tier Ones. They're sitting, you know- the best is TD at eighth and TD is doing pretty well, so an award goes out to TD essentially, across the whole year for the US Regionals for doing well and actually leading in this category here. Although consistently they haven't done that well; they've actually dropped off in the past quarter. So, I can't give them an award for consistency in this case.

Now Citizens is interesting; Citizens started out you can see the sort of flow of a bit of red at the start of the year. Sitting below three and a half, but they have picked up at the start of the year so, that consistent growth is an award I can give out to Citizens because they have actually improved things across the year. From that sort of, you know, below three and a half to now actually for the second half of the Year being three and a half and above consistently, so very well done to them. Others we can see down the bottom here. Now, one of the things that's interesting is we can see the likes of, you know, Key Bank and Huntington and so on, they're sitting low but one of the things about we saw with Fifth Third, that it hasn't done that well recently and what we can actually see that in the rank. So we can see here across 2022 the rank is 16th so middle of the road to some extent, but out of the 24 Banks we're covering just here for North America, they're 24th in the last quarter and also 24th in December.

Obviously, they've hit that low point but room to improve as customers get used to those new changes. So, let's just have a look at the year in review in terms of what are the conversations? Where do each of these apps stand out? Now, I won't cover each of these in detail. Let's look at TD though which has lead in this category here.

So Good App Usability, Easy to Use... Easy to use apps, so although that we can see here a few of the Journeys are popping out like Poor Cheque Deposit feature is popping out a few times and the Zelle Payment feature has also popped out a few times as somewhere to improve a few things like app crashes. But, in general, we don't see sort of a standout of major issues going on here. So, very good.

Let's have a look at you know, one of the other ones near the top there like Citizens has actually improved across the year so, where do they- what do they look like in comparison to their competitors in here? So, easy to use, Good App Usability and so on. We also have in here just things popping up spontaneously like Good User Interface, they're done very well in here, but a few things are popping out that are negative. Like there's a few, you know, Forced to Log In Multiple Times, Forced to Reset Password. App Login Lockout, so there's a few things about logging in that need to be improved for them.

Let's have a look at the one Bank we're looking at now which is Fifth Third. So what are they -how are they standing out compared to these competitors? So what we can see here is that, we saw this before: Current App Version, Previous App Version so, this is now dominating their year in a sense, because f across the year they're doing reasonably well they've dropped off for that second half of the year.

Let's look at one more, which we've had a look at this in detail before, let's look at Huntington though let's see how Huntington's gone. One of the things about this particular view you can see is that, compared to others, we're seeing a few things popping out that are fairly negative that and, things like Poor App Check Deposit feature, things like App Colours popping out -interesting- but App Bugs and Crashes are also there as well compared to others, and Freezes and Blank Screen so, compared to others Huntington looks like the UI is reasonably good, that doesn't stand out, so they can actually improve on those things like Freezes and Crashing to then bring themselves up into 2023.

So, an interesting year for Regionals, they've got a lot to go up against for the U.S Nationals and Tier Ones but, you know, there's some positive news there as well. Thanks, Glenn.

8:47:00 – Glenn: Yeah, big year for many out there and if anybody would like a copy of that Ranking Chart with the 24 banks on it, feel free to sing out more than happy to send it out to you. And really looking forward to 2023, the theme that is coming through from a lot of the banks that we work with is at around cost savings and reducing customer churn. And utilising this data to improve that experience is going to play a Major Impact on reducing that churn and also things like reducing Call Center contact rates, which are then again reduces overheads. So, looking forward to seeing what happens as we progress through the year in 2023 and everybody have a great day.