This is the second in a series of blog posts focusing on the Touchpoint Ipiphany Mobile App Performance service. Touchpoint Group offers an in-depth analysis against chosen brands in your sector to uncover insights in market positioning, app performance and customer perception resulting in key opportunities to optimise and increase your app’s RoI. In this post, we delve into competitor analysis at a detailed level, expanding on topics covered in the JP Morgan Chase & Co case study.

What is Mobile App Competitor Analysis?

Competitor analysis is a comparison of product performance and app capabilities against a selection of key competitors at a granular level.

This is important because:

- It helps highlight strengths and weaknesses between apps in the market

- It allows you to determine opportunities to strengthen your product

- It highlights risks and/or weaknesses within competitor apps and your own

By using customer feedback from a public channel, you can gain raw insight into exactly how a user feels about the product and brand. The feedback can be tracked specifically to a set point in time, or even tracked over time, allowing you to measure against updates, product releases, and external market impacts. Without measuring publicly available data, there is no way to compare on an even level how you perform against your competitors.

This investigation into competitor analysis takes a more detailed view than that of benchmarking - visit our previous post to find out more about the importance of analysing and tracking the overall market position, and to discover how Ipiphany can help you benchmark your app.

How Ipiphany Helps You Perform a Competitor Analysis

We will continue to compare Tier 1 US bank JP Morgan Chase & Co’s app against four similar US-based banks: Citibank, Bank of America, and Wells Fargo. For this example, we’ve chosen to focus on four topics which are mentioned with high frequency, impacting a large number of customers from each bank and contributing churn in each customer base.

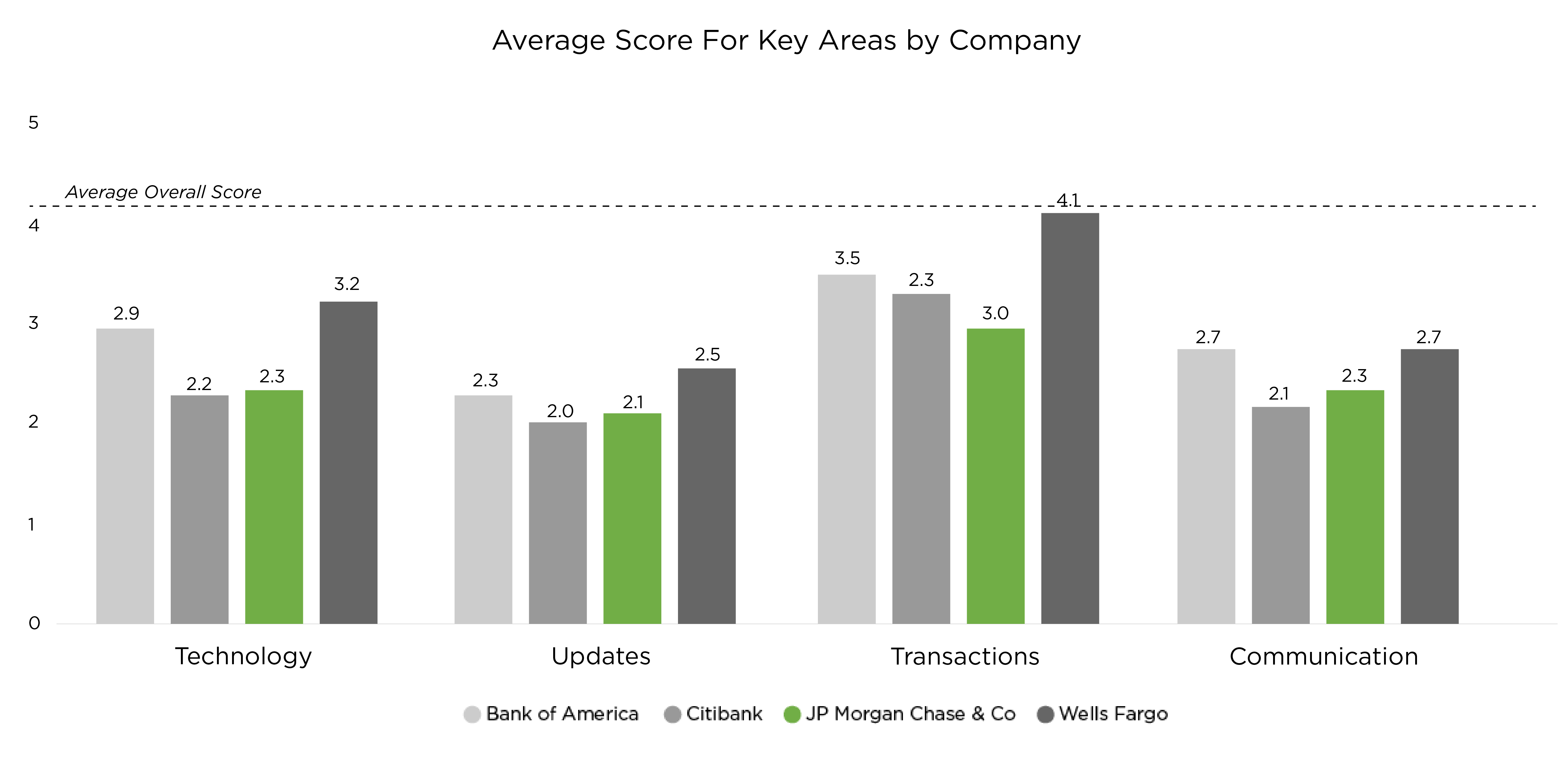

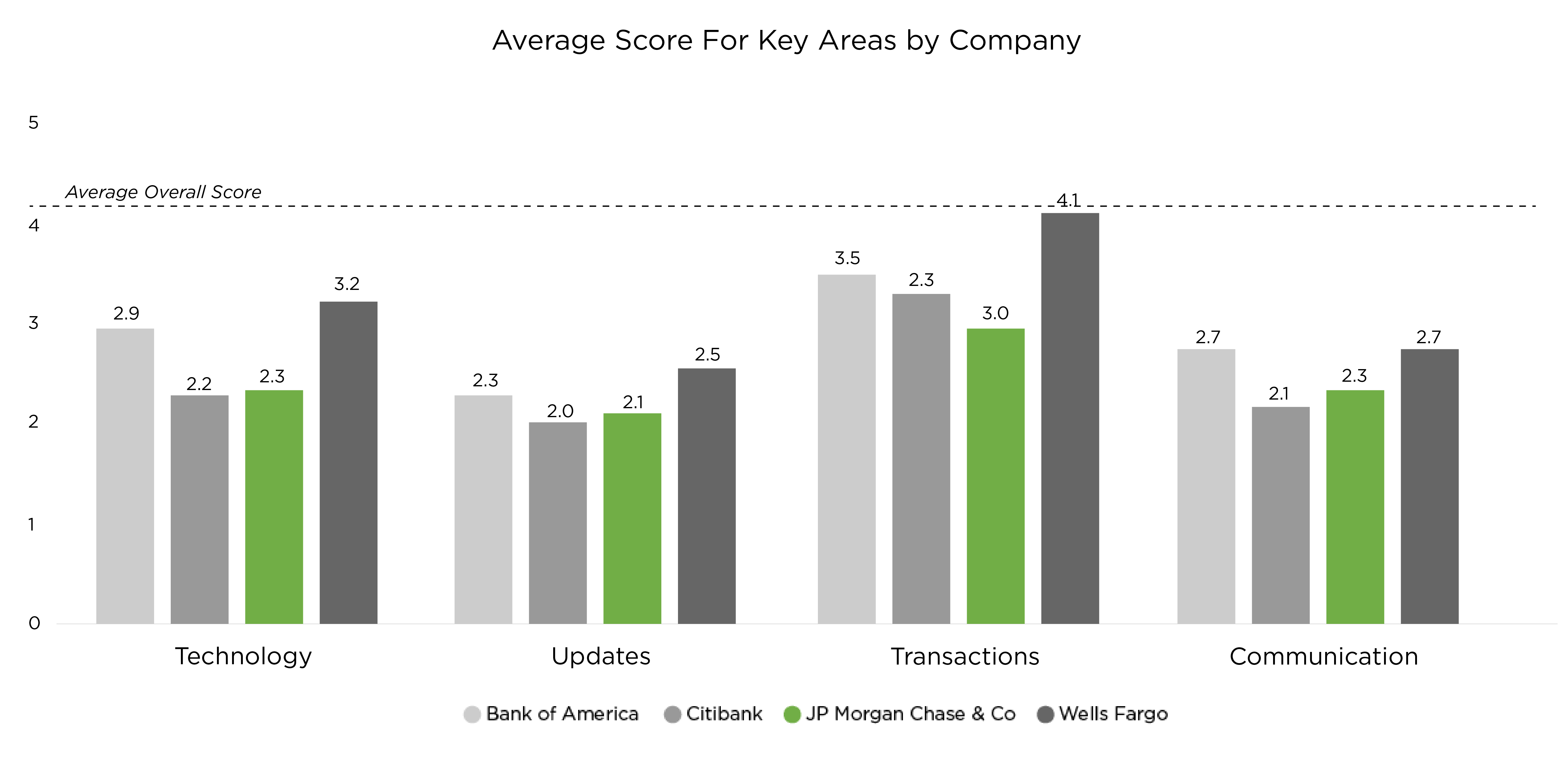

Using Ipiphany, we can investigate the ways in which customers discuss Technology, App Updates, In-App Transactions, and Communications, uncovering the driving factors behind the scores, and quantifying the impact of pain points on each bank’s score.

Insight-Driven Competitor Analysis

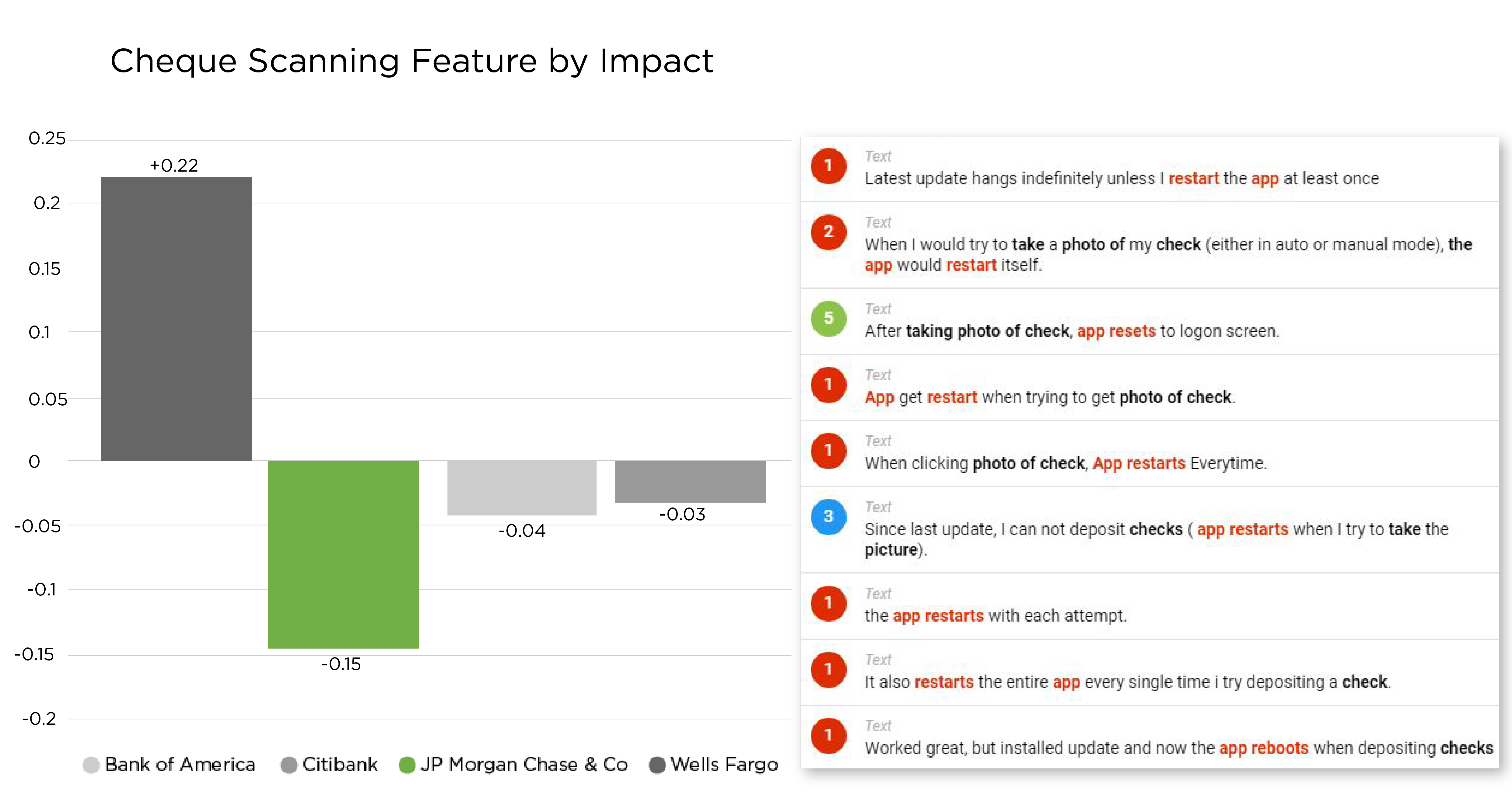

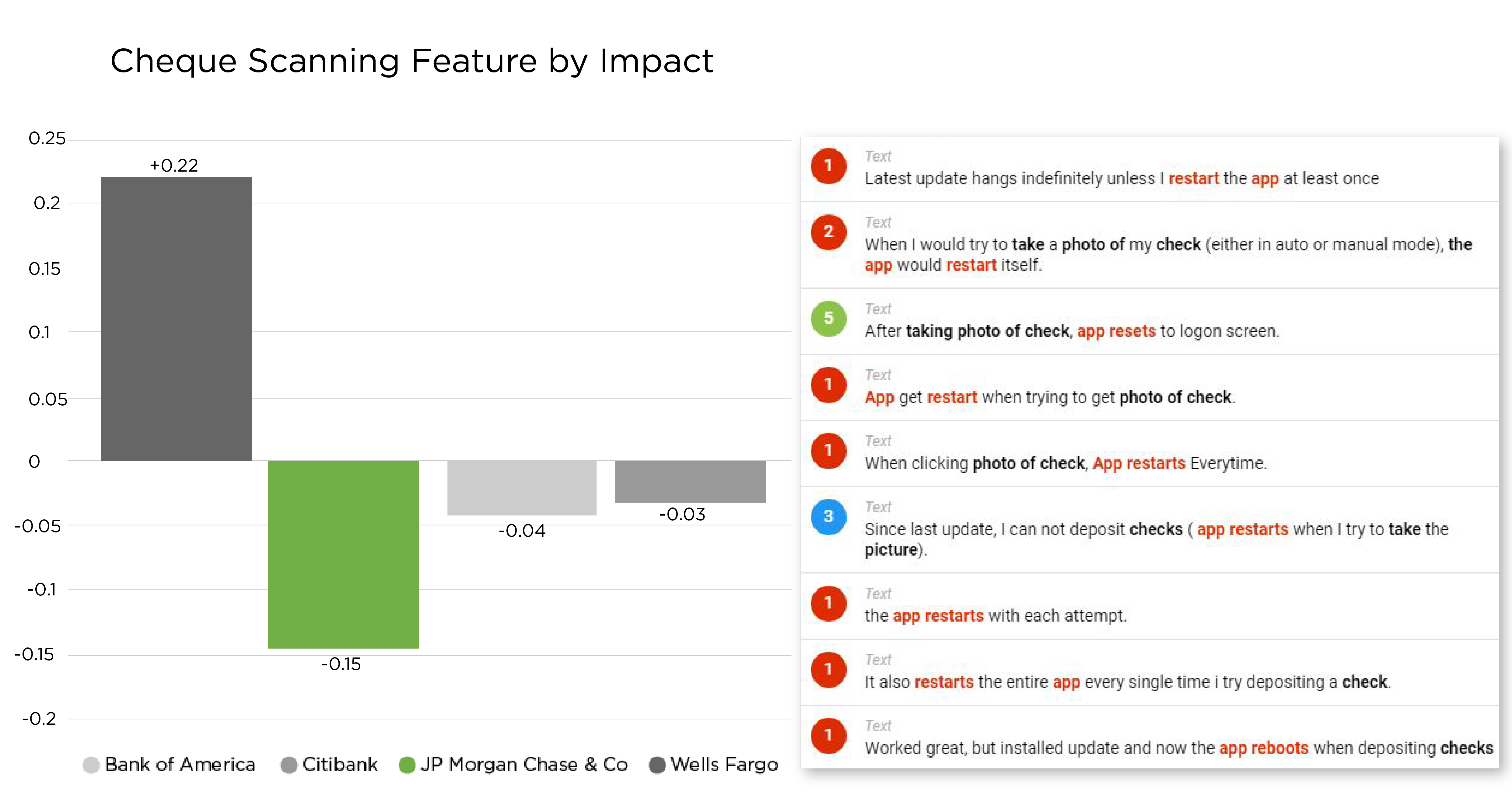

First, we investigated “Transactions” - these are any in-app transactions - transfers, bill pay services, or purchases - that customers discuss in their reviews. When we dive down within the topic of in-app transactions, we discovered that one of the features most responsible for driving scores for each bank was the cheque deposit feature.

This chart analyses the impact of reviews mentioning the cheque scanning feature on the overall score of the app. Mentions of the cheque scanning feature drive the overall score of Wells Fargo up by .22 points, whereas the same reviews for JP Morgan Chase & Co drive their score down by .15. To uncover the cause of this pain point, we performed a root cause analysis and discovered that JP Morgan Chase & Co’s customers frequently experience the app crashing when they attempt to take a photo of their cheque for deposit. By positioning your bank in comparison to competitors and analysing it at a granular level, you can uncover aspects of your app that may be causing churn and discover ways to improve your standing against competitors.

The “Technology” topic covers reviews specifically discussing the issues customers have with the app on various devices. As we delve deeper into this topic, we can use the ‘explain’ visualisation to easily see what aspects of the technology have the highest impact on app score.

The main pain points facing JP Morgan Chase & Co’s customers in this category are issues around the app fingerprint feature, password changes, the Face ID feature, and usability issues with the IOS operating system.

Using Ipiphany, we could then delve down into each of these topics to understand what drives them and how to fix them as we did for the “Technology” analysis, but for the sake of brevity in the following sections, we’ll focus on these at a high level.

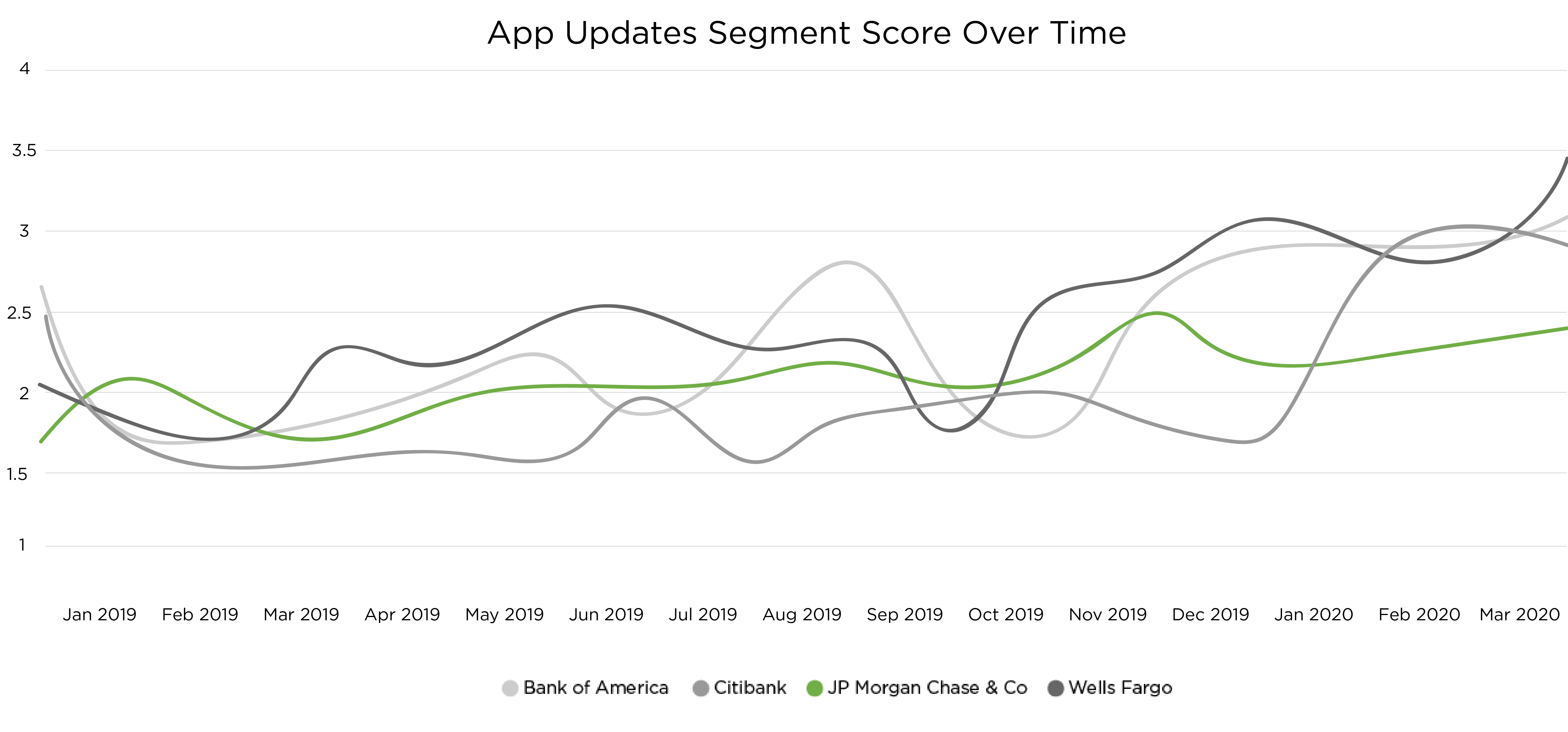

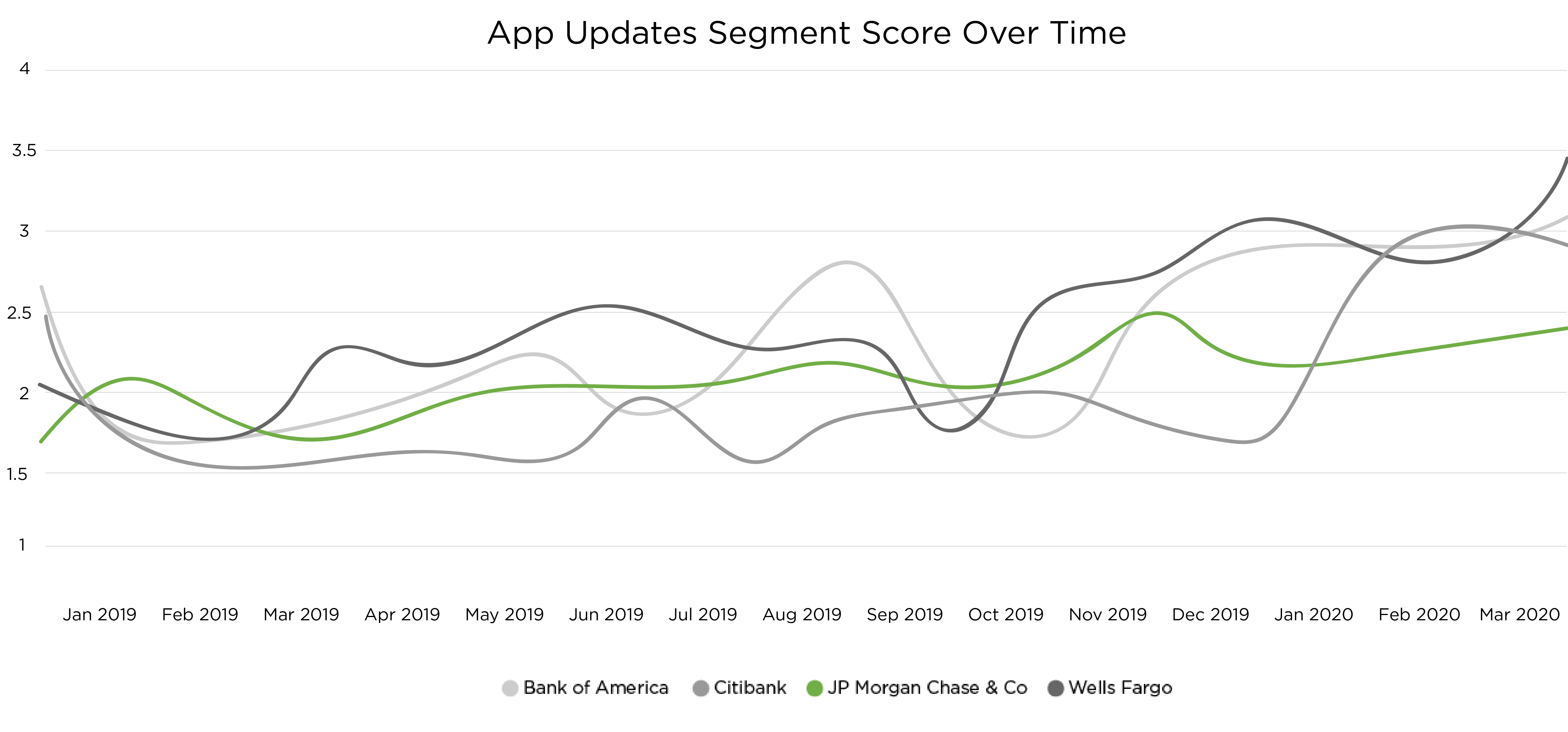

The “Updates” topic helps us understand how customers receive each app update as it is released. As we discovered in our Benchmarking investigation, the scores are extremely volatile over time. By filtering this down to only display the reviews that discuss app updates for each bank, we are able to understand that this volatility is inextricably linked to the updates themselves.

We can easily see the effects of the failed Bank of America app update in October 2019 covered in the benchmarking discussion, and the instability of the ratings across Wells Fargo and Citibank as well. JP Morgan Chase & Co is the only bank whose score remains fairly stable across the entire date range, although their overall score remains lower than all three competitors in 2020.

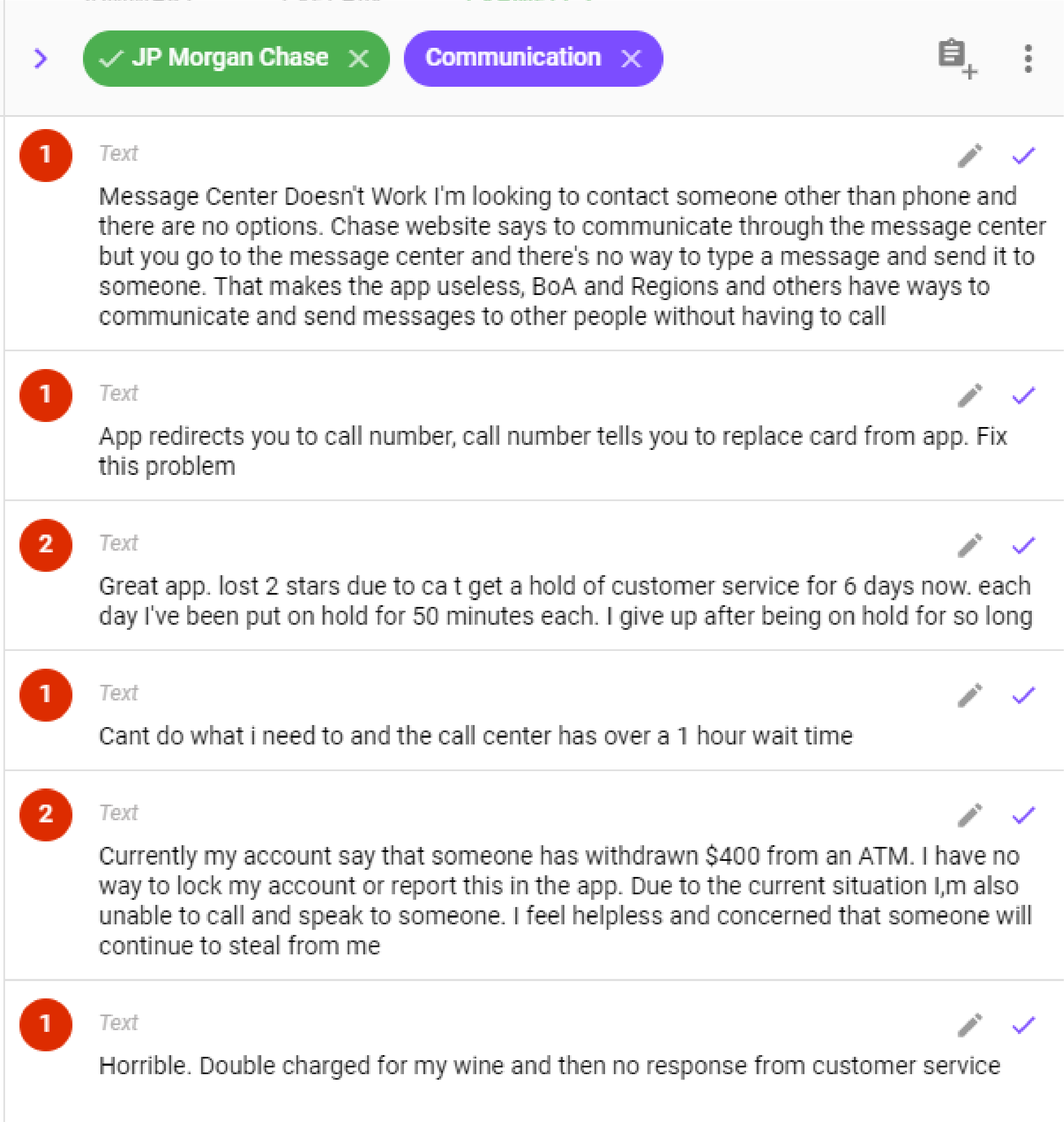

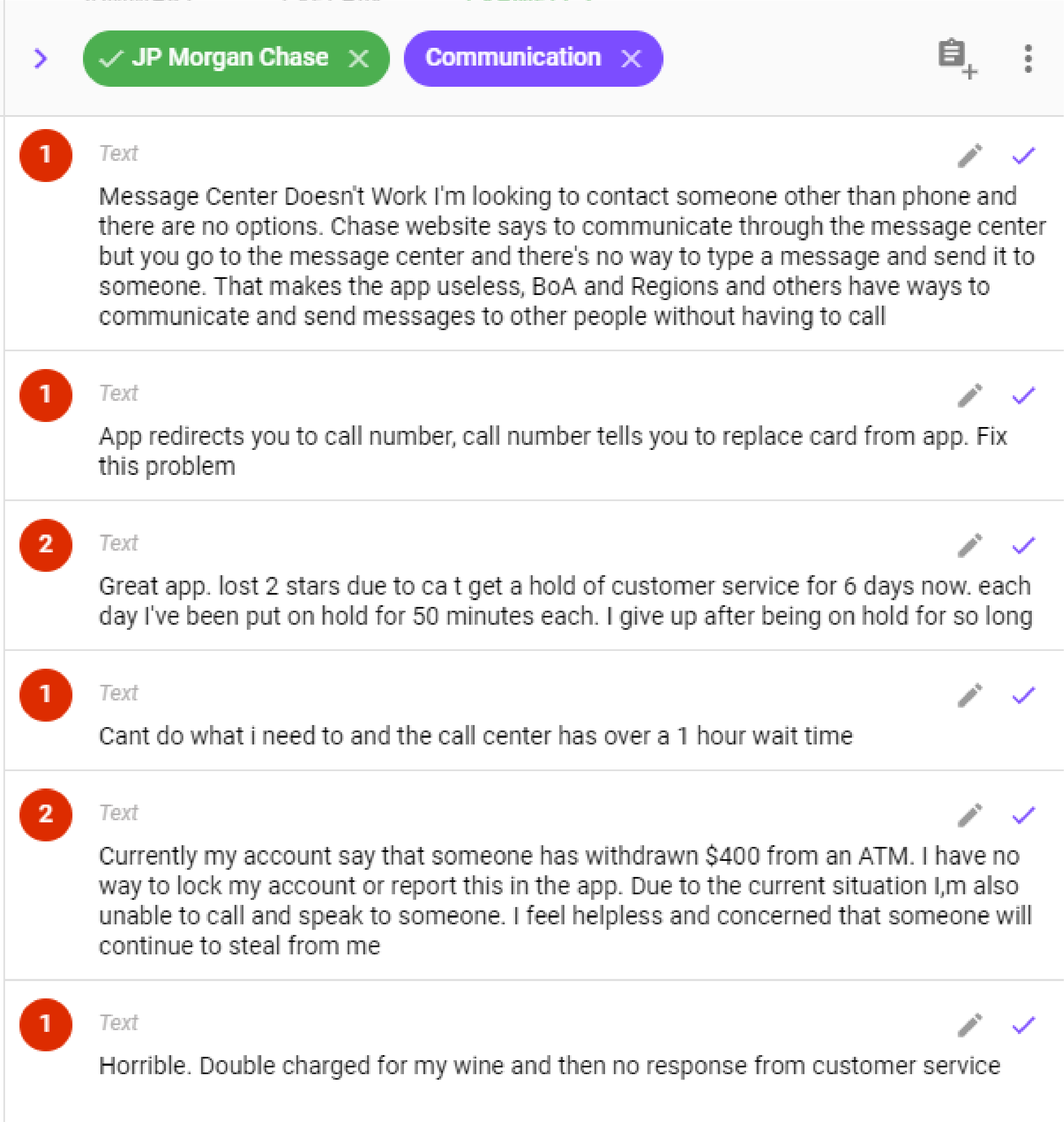

Last, the “Communication” topic covers off all communication channels that customers have with a bank via (or relating to) its app. These may come in the form of in-app chats, call centre interactions, or even web chats discussing the app. While the importance of analysing functional components of your app cannot be understated, this is a perfect exploration of the app’s position in the overall customer experience; unveiling information about how customers interact with their bank outside of the app.

Here are some examples of how customers of JP Morgan Chase & Co discuss their communications with the bank via its app:

A deeper analysis of the Communication topic might involve setting this feedback against a date range or customer segment to get a better understanding of the impact - Ipiphany’s powerful NLP allows for flexible analysis of any topic you might wish to explore further.

Without a clear, data-driven analysis of market positioning, it’s nearly impossible to make accurate predictions about how changes will impact ratings or position in the market. By undertaking a competitor analysis using open text feedback from app reviews, you’ll discover key areas where change can make the most impact, and find market niches that can be used for strategic decision making to drive app success.

Next week, we’ll dive further into the performance details of the JP Morgan Chase & Co app using our SURF Pillar Analysis, highlighting areas of high concern for app developers and applying customer feedback to uncover solutions. In the meantime, sign up to our newsletter and follow us on LinkedIn for the latest updates or schedule a demo using your app data to see how we can help you improve retention and measure market positioning.

Schedule a Demo

* Score will differ to the score found on App stores. This is a combined score from both Google Play & Apple App stores, any reviews not containing comments have been removed from this data set. The date range used for this analysis is January 2019 to April 2020.