Are you a part of the open banking revolution? While over 85% of banking customers report using mobile or internet-based tools to manage their finances, Open Banking is still unknown to the average consumer. Why? We’ve seen multiple studies outlining the impact that data transparency might have on established enterprise banks, but fewer investigations into how bank customers might feel about or react to this change. Using our AI Customer Analytics tool, Ipiphany, we analysed public review data from several leading banks who have made dedicated efforts to embrace open banking; some of the results might surprise you.

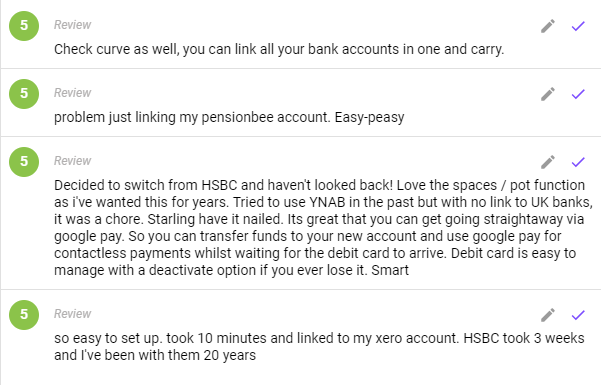

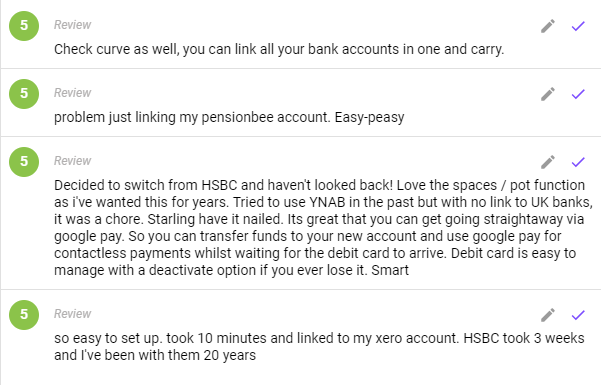

Open banking is designed to give you a clear, complete view of your finances. Using a regulated API link, a bank can share your account or transaction data with other financial services like budgeting tools, account management, and share traders. If you’re a customer of a bank using Open Banking, you could also view balances and transactions from multiple bank accounts from within a single banking app. Customers are very positive about this linking of accounts, payments, and financial service providers, so why has Open Banking faced slow adoption rates in established banks since its introduction in 2016 in the UK? Banks may be reluctant to implement a change that could make them appear less exclusive to their customers, or they could simply be unwilling to make changes to a system that has worked for them for decades.

Either way, our evidence suggests that banks which are willing to take the risk and introduce Open Banking APIs will reap the benefits as customers become accustomed to this higher level of financial clarity. As their expectations of their banks and financial service providers grow, those which do not keep up will ultimately be left behind.

The Evidence

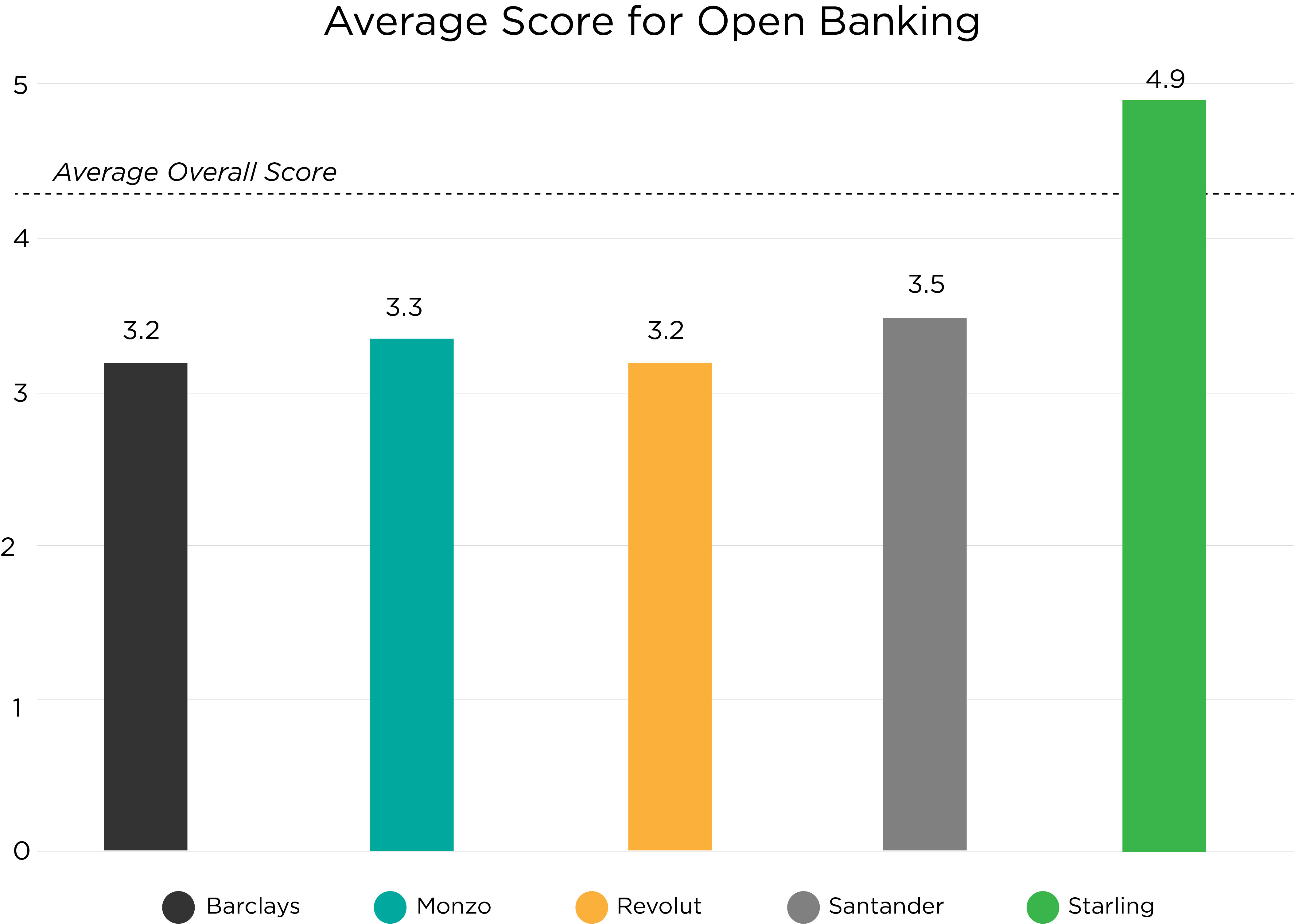

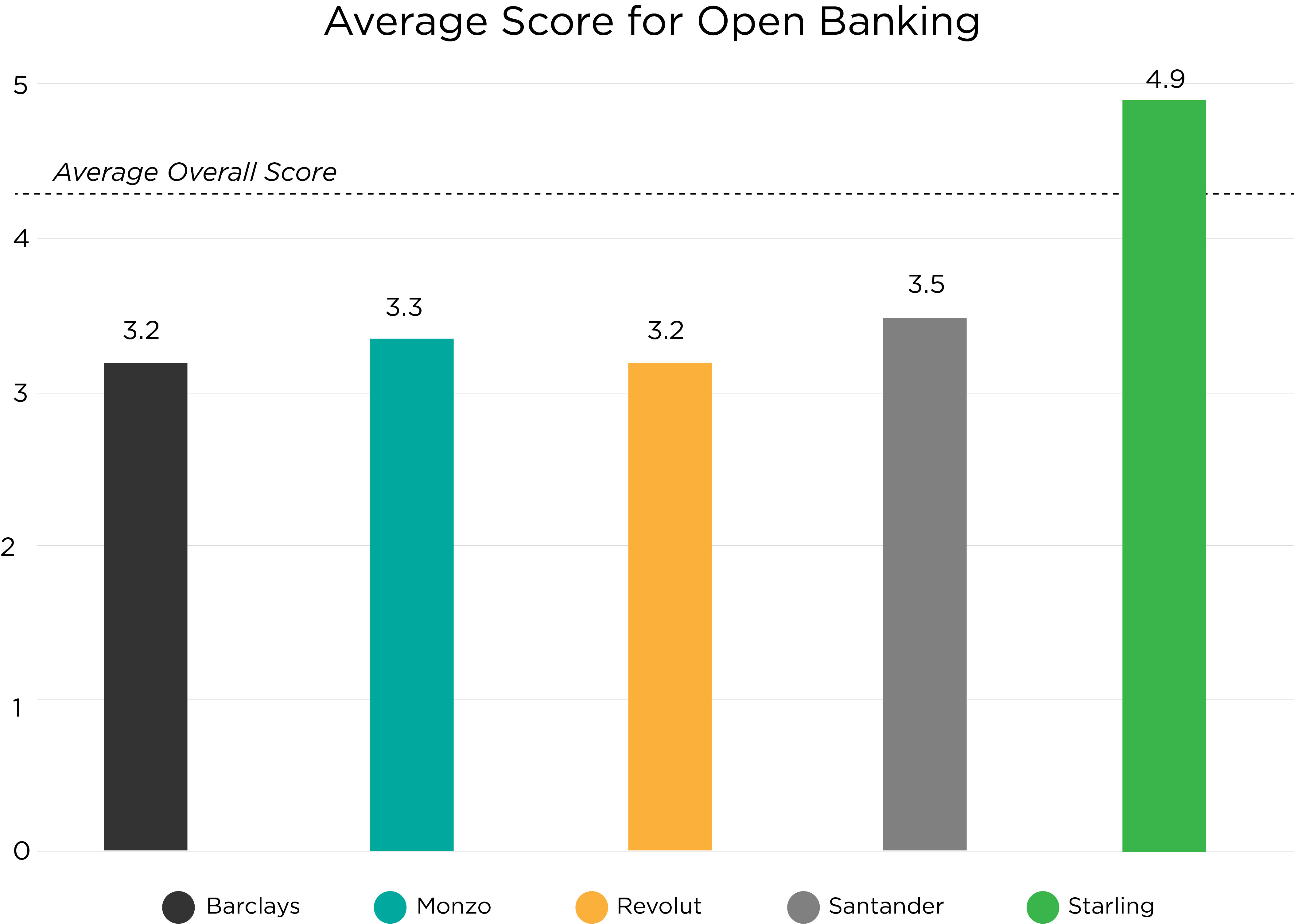

We chose a mix of tier 1 (Barclays, Santander, and Lloyd’s (not pictured) and disruptor banks (Revolut, Monzo, and Starling) to analyse, and the results are clear: Starling - winner of the 2019 Retail Banker International Global Award for Best Open Banking Strategy - stands out nearly a full 1.5 points above the rest.

Our AI, Ipiphany, can understand and categorise thousands of customer comments each second, so we were able to analyse over 100,000 public review comments from six leading UK banks to understand exactly how open banking impacted each bank’s customers.

Starling’s dedication to Open Banking supplements a long-standing history of listening to and acting on customer feedback. The evidence of this customer-centric approach is clear in their review data, especially when we compare it to other banks in the same category.

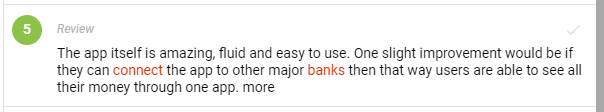

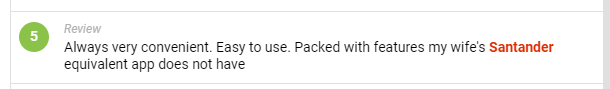

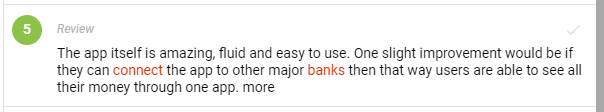

While Reviews discussing Open Banking with Starling are vastly positive, other banks are receiving clear requests from customers for a change in approach and offering, however no action is taken as the bank is unaware of the feedback. These customers struggle with clarity over which features of their app they can use with other accounts, the process of connecting with accounts, and generally find integration more difficult to achieve. In the example below, customers can’t find a way to link their other accounts, despite the bank in question having widely publicised that their app supports Open Banking:

The Revolution

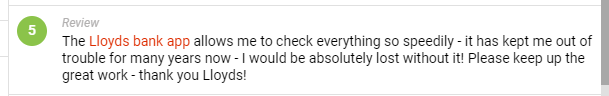

While we’ve found that Tier 1 banks are more reticent to adopt digital systems including Open Banking than their counterparts in the disruptor category, one Tier 1 bank stood out from the competition: In the review feedback data for Lloyds’ Bank, we found several customers who discussed having accounts with multiple banks preferring to access them through the Lloyds’ app because of its superior usability and features.

This example of customer-centric banking - the dedication to keeping the needs of the customer at the forefront of the strategic decision-making process - will be what enables early adopters to lead the Open Banking revolution. Starling and Lloyds emerge as clear winners in this category with a dedication to listening to and acting for the needs of their customers.

As provisions for Open Banking expand across the UK - and with its international debut in Australia in July of this year - it’s not a stretch to say that the revolution is already underway, and that customer-centric, data-driven decision making must prevail over the antiquated ways of thinking that are foundational in some organisations.

Ipiphany can help organisations of any size analyse customer feedback data to help inform strategic focus for Open Banking advancement and beyond. While it’s important to look to the market and benchmark against competitors and leaders, you’ll achieve a true and complete understanding of your customer experience by analysing your organisation’s internal feedback data. Contact us today to learn more about how Touchpoint Group can help.

Sources:

What is open banking

Retail Banker International: Awards