In the UK market, the Financial Conduct Authority's (FCA) introduction of Open Banking was designed to encourage competition in the financial services sector and encourage innovators to create novel methods of interacting with financial information. What started as a requirement to provide customers with easy access to their financial data has evolved into a race to create powerful and transparent integrations for customers across all their financial providers. It has also paved the way for fintech innovators to break into the market, offering services like budget and credit score monitoring apps, efficient online transactions, and even micro-donation platforms that round up daily transactions and donate to a customer’s favourite charity.

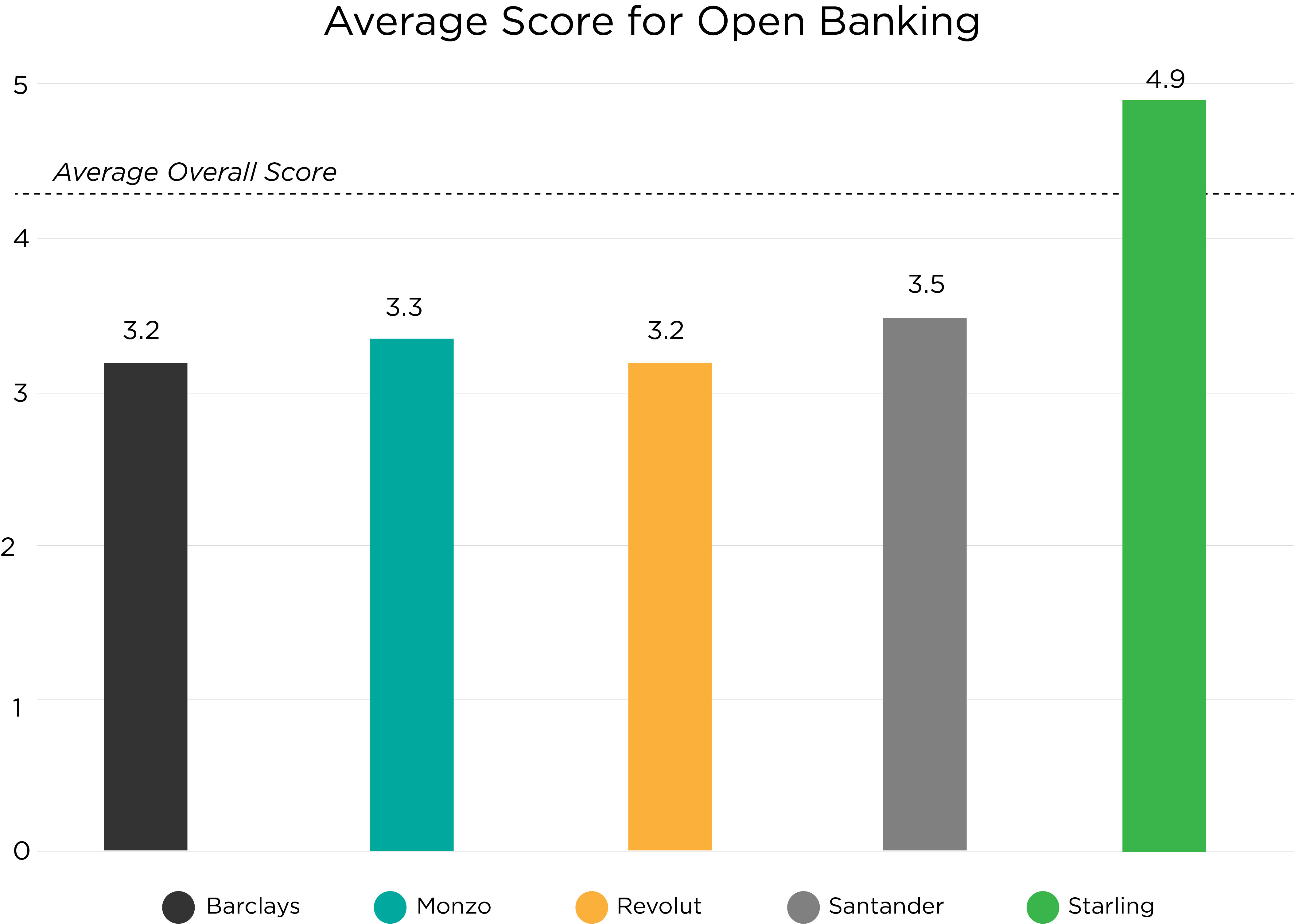

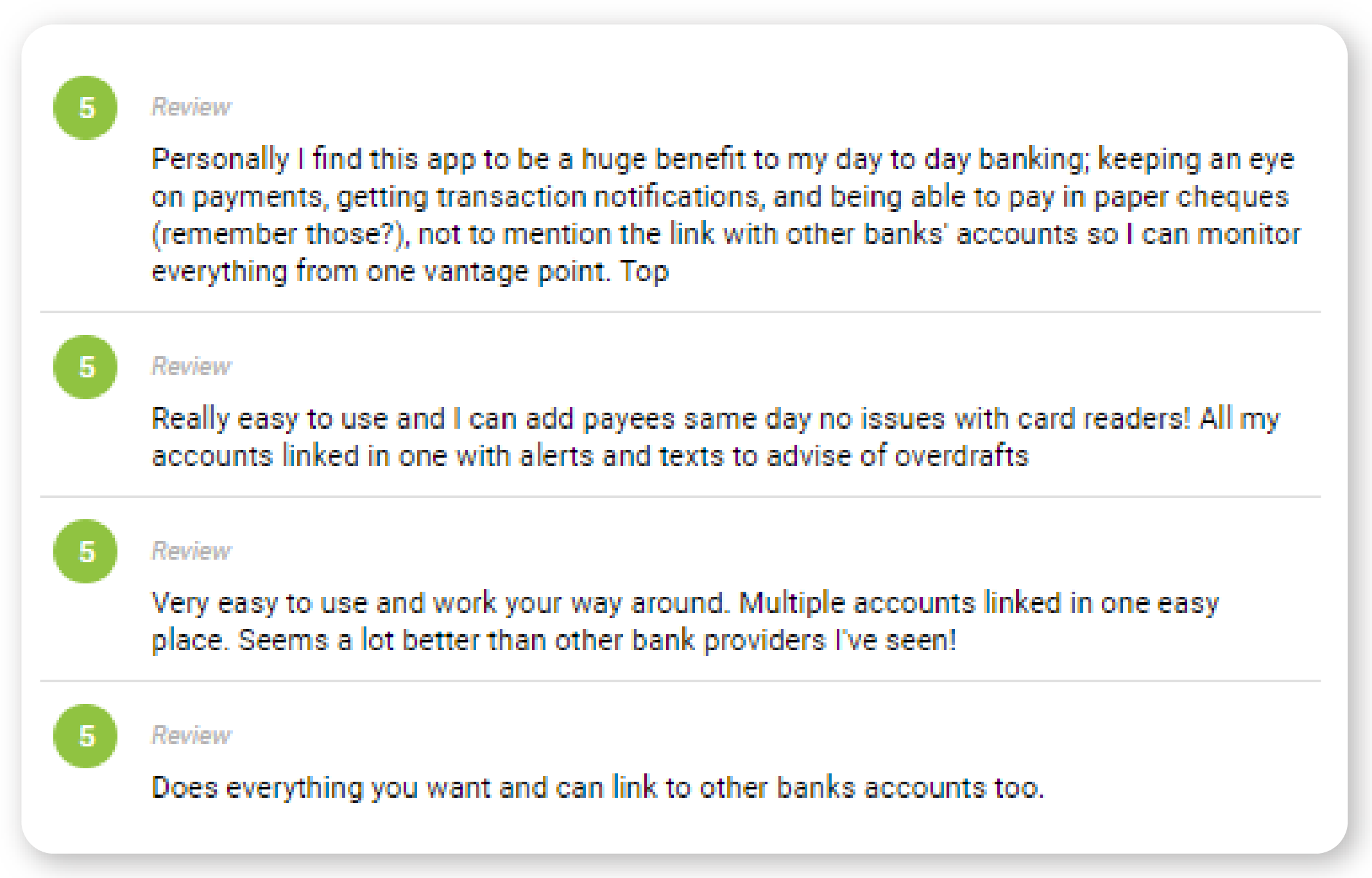

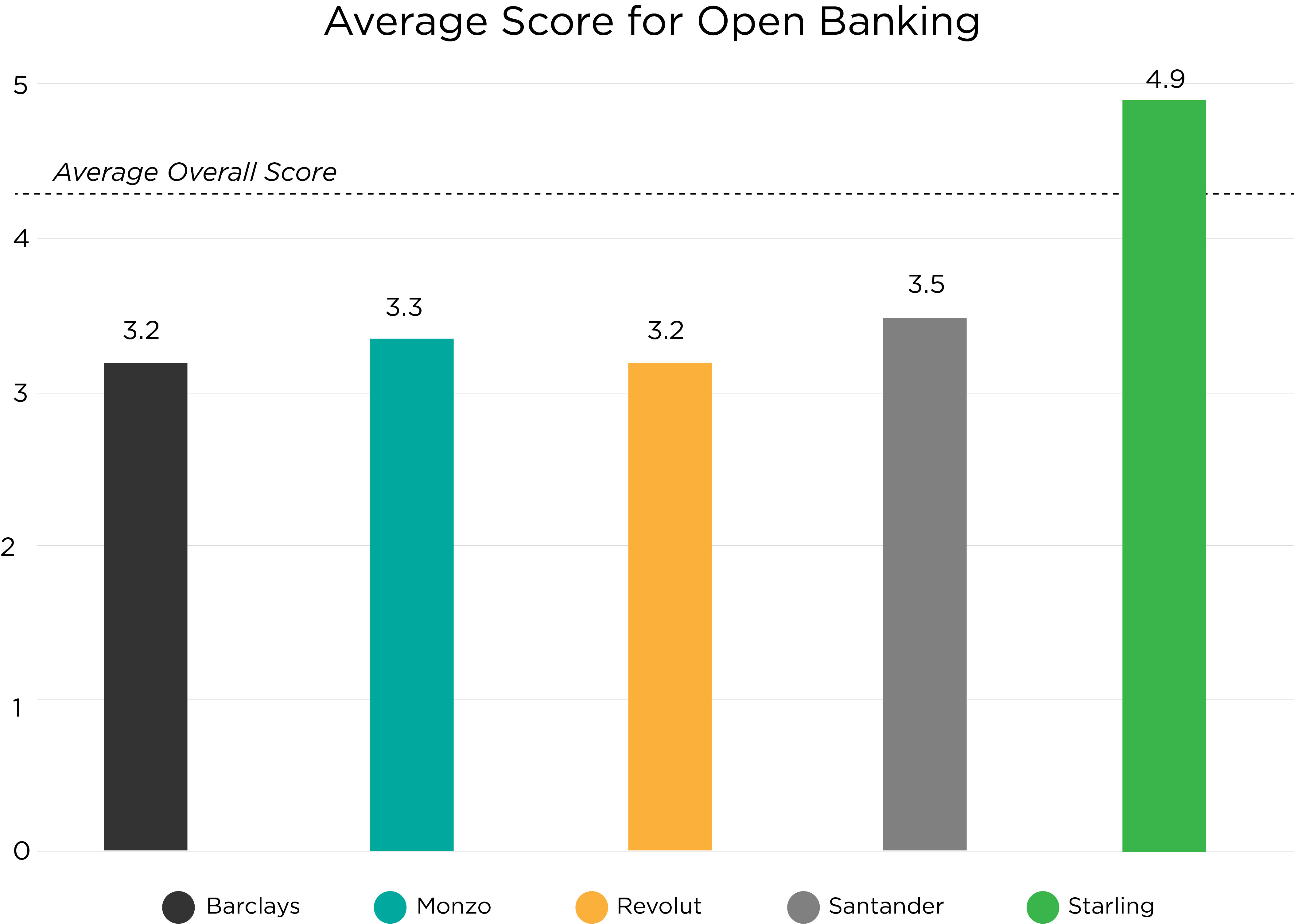

While established UK banks were initially reluctant to adopt customer-focused Open Banking practices, it has become clear in recent years that businesses on the forefront of innovation in this category see greater adoption, ease of use, and customer retention than laggards. Banks that have done the most to integrate with and advertise Open Banking see the best performance overall. For example, Starling Bank - winner of the 2019 Retail Banker International Global Award for Best Open Banking Strategy - performs the best against competitors Barclays, Monzo, Revolut, and Santander. The evidence in their public review data suggests that a customer-centric approach to open banking innovations contributes to this high level of success.

On the established banking scene, Lloyds customers report their preference for using the Lloyds app to view other bank accounts - a credit to customer-first implementation and Open Banking functionality that has allowed them to step ahead of competitors.

By comparison, Open Banking in the Australian market is still very much in its infancy and Australian banks have the opportunity to learn from the successes and failures of implementation in the UK market to inform their own practices. The regulatory compliance aspect of Open Banking is mandatory and implementation is expensive, so the question for banks becomes focused on coming up with the most effective way to recoup this cost. On the surface, the regulatory standard is the furthest thing from customer-centricity, but our research on the UK market suggests that pursuing customer centric improvements is the key to unlocking the earning potential of the millions of dollars spent achieving regulatory compliance.

In these early stages, the adoption of this customer-centric approach is critical to avoid losing market share to early adopters in established banks as well as neobanks. While a survey conducted by Nielsen last year reveals that only 50% of Australians know what a neobank is, trends in the UK indicate that this is likely to change quickly once Open Banking becomes widely implemented. Challengers in the fintech space with greater agility and a fresher approach to customer-centricity will begin sweeping up unhappy customers eager to move to a provider who can meet their ever-changing expectations, especially in the digital space.

How can this be avoided? The answer lies in customer feedback. Reviewing feedback data through an agile, customer-centric lens is the key to unlocking fresh, innovative ways to provide services for customers that offer marked business value. By analysing hundreds of thousands of text reviews for dozens of banks across the UK, we’re able to unlock critical insights on the performance and outcomes of Open Banking innovations which can be applied to the Australian market. This, compared with an in-depth analysis of customer data from within your organisation provides an incredible competitive advantage. Australian banks find themselves with a unique opportunity - being able to learn from the data of a market with well-established Open Banking practices and a vibrant challenger ecosystem is only the beginning. Implementing this knowledge towards improvements that drive revenue from satisfied customers sets the stage for a world of opportunity in Open Banking innovation.

Are you curious to learn more about the strengths and weaknesses of Open Banking implementation in your market? Get in touch to learn more about the insights in this UK data, and to get started analysing your own customer feedback data to make more informed business improvements to sharpen your competitive advantage.

Source: https://www.openbanking.org.uk/