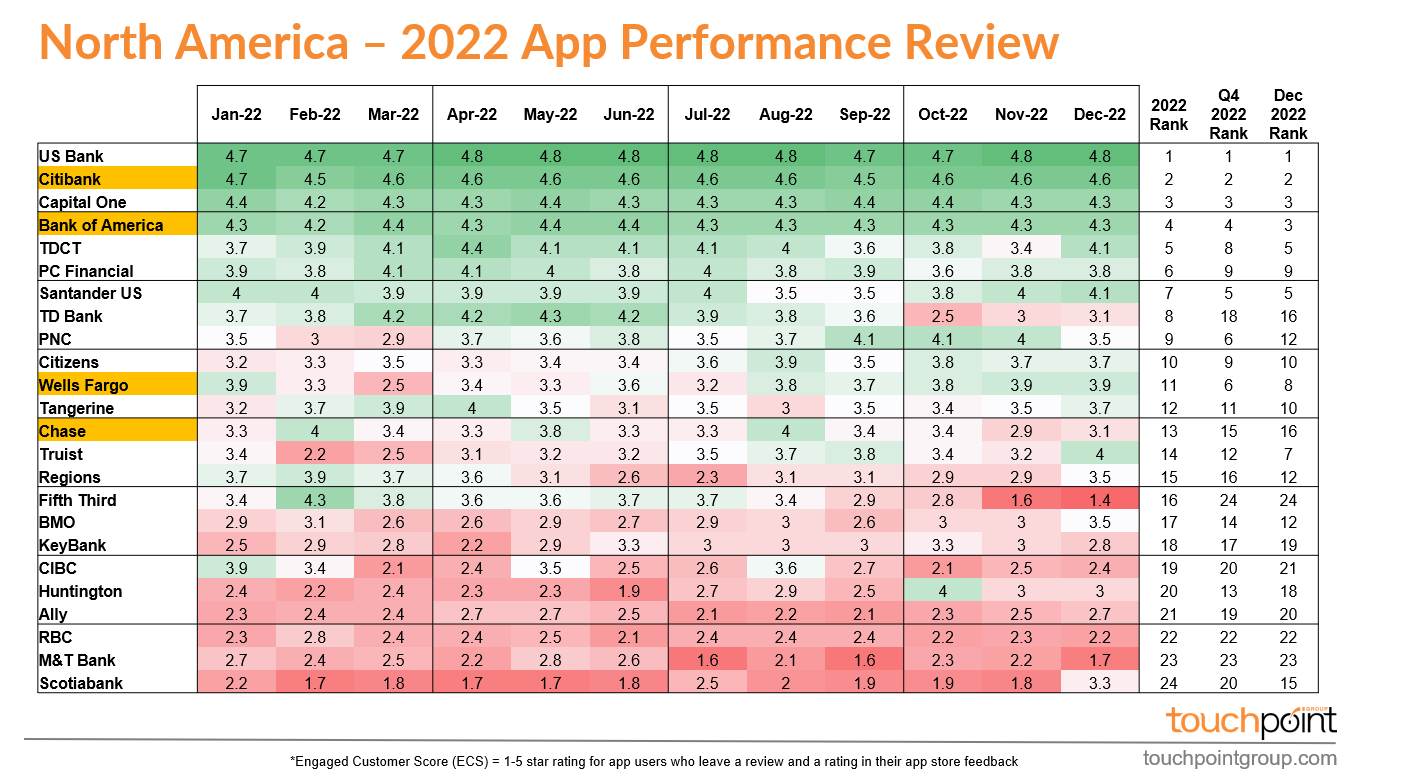

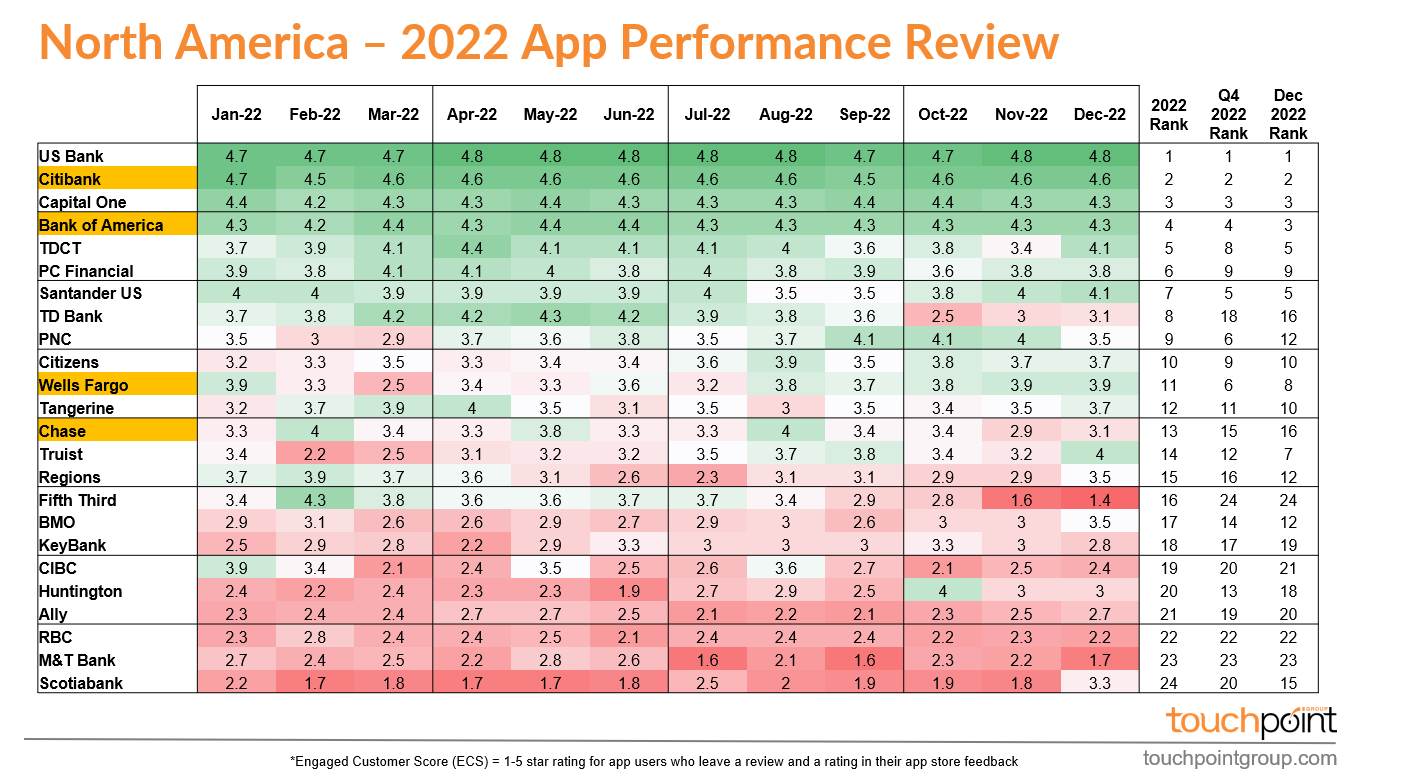

Citibank takes out the Number One Spot in the US Nationals market segment for 2022 in the Touchpoint group Engaged Customer Score (ECS) Rankings with an average ECS of 4.6 out of a possible 5.0.

This top performer also has been in the top two apps in the entire US market all year in 2022 - A very close second to US Bank. Looking at Citibank, it is easy to assume that everything is as good as it gets. However, we can see in the verbatim customer feedback that there is room to do even better, as the customers are great at picking up glitches that affect their journeys.

Citibank and Bank of America both get an award for consistency as their rankings and Engaged Customer Scores have stayed incredibly consistent over the year and have not been hit by the fluctuations of others.

Wells Fargo, for example, dropped from 3.9 to as low as 2.5 out of 5 in Feb after a major UI release. The good news for Wells Fargo is that they have gradually clawed their scores back up to an average of 3.9 again and finished the year strongly in 8th place overall.

We have seen dramatic score drops in other regions as well when major UI changes are implemented, so the Wells Fargo situation is not uncommon. Learnings we have found from these situations is that far more time, effort and frequency of communication needs to go into preparing customers for the changes and guiding them through as the overwhelming majority of negative feedback comes from users unhappy with navigation, useability, and unable to find or do things they could in previous versions.

We expect to see big things in 2023 when it comes to investing in “In-App Experience” as most institutions are becoming hyper-aware, in the current economic climate, of cost control and mitigating churn risk. The better banks understand customers in app experiences and feedback, the easier they can mitigate churn and reduce demand on call center operators.

We estimate for the US banks, an effective program being implemented to monitor and learn from customer feedback can have up to a 2% reduction in churn and a 1-2% reduction in call center costs (which can add up to the hundreds of millions of dollars saved or retained each year).

Touchpoint Group is a customer intelligence company utilizing advanced AI and natural language understanding in its proprietary analytics platform to analyze over a million banking app reviews each year in its global ECS index.

Touchpoint Group processes customer feedback data captured using internal customer experience platforms and sources. Data is updated daily, with insights available to identify issues for Operational teams, monthly reporting for Leadership teams, and a Mobile Customer Experience Analytics (MCXA) report published quarterly for Executive leaders to benchmark performance by category and against the best in banking app performance.

Video Transcript - US National Banks App Insights Session Nov 2022 Performance

00:00:05 - Glenn: Hello everybody and welcome to another Touchpoint Group Banking App Insight Session. We're looking at the November performance at the U.S National Banks and this month we're bringing in a new bank, USAA and we're focusing on Chase Bank and the inconsistently consistent challenges that they're facing in and around app versions and potentially what they need to do to sort these things out. Tony Patrick, welcome on board again my friend. Let's rip into it

00:00:36 - Tony: Brilliant thank you, Glenn. As I mentioned today U.S National. Citibank, Bank of America, Wells Fargo and Chase and our guest as Glenn mentioned is USAA so we'll have a quick look at them this week as well. So let's jump straight in and have a look. So one of the first few things we look at is the Engaged Customer Score. This uses anyone who's given both a score and a comment in either the App Store or the Google Play Store and allows us to get really, really detailed information and see changes as they happen…, potentially before any of these Banks actually see it in their internal data.

So we see some things very quickly in here. One of the things we can see-- so as I mentioned, USAA, let's have a brief look at them.

So the first time we've looked at them in this series and we can see that they've been consistent across 2022 at around 3 but we can see in September they dropped away dramatically.

USAA, dropped away from 3 to 2.3 October even further down to 1.7in November. That's a massive dip and that's the sort of thing they need to understand that very fast and get out of it.

Otherwise, it's going to last for months and months if they don't move out of that.

Now, one of the things I also want to have a quick look at is Wells Fargo.

Wells Fargo had the dip in February-March with a major release of the app around then and we can see there's been a gradual increase and now I can say that the engaged customer score is finally back to where they were. It's been a while, but they have done a good job they've actually increased a lot across that time, fixed a few things with releases and it's on track.

Wells Fargo are in a position now to take advantage of those UI changes they made and actually like potentially leap ahead even further than they were before. A good job to this point & it'd be great to see how they progress.

The focus today though is on Chase. Now, consistently inconsistent is a good way of describing this because you can see there, two months down, one month up, two months down, one month up, etc. So given that trend we expected them to jump up this time around but they've actually gone backwards. Chase has gone backwards from an engaged customer score of 3.3 and this point they've actually gone to 2.9 and it's the lowest they've been over the past year. So, what has happened there? Why has Chase dipped it down so much? Let's have a quick look.

Our SURF analysis is based on our SURF pillars. Now these are all pain points, so pain points around Security/Authentication, Usability, Reliability and Functionality. So, the lower this is, the better. You can see there the score has gone down in November for Chase and we can see there these pain points have increased across the board.

Sometimes what you end up seeing here is Authentication issues start to dominate, but in this case it isn't. We've got a 5.7 update 0.3 so it's slightly up but it's not a major increase.

The two things that have gone up are Reliability issues and Functionality issues, so definitely problems there coming through as to why that score's gone backwards.

So let's have a brief look at Functionality as an idea, we have what's inside that to have a look at what's going on there. Examples of customer comments relating to Functionality in November are:. "I can't transfer between accounts. I'm trying to cancel a duplicate bill pay you can't do it.", "I can't see my schedule payments, it takes 10 minutes to open"

So you see across the board there's lots of issues going on about various functions that don't work. Clearly some changes that have happened in the latest release that have caused that issue.

Obviously an increase in these pain points is bad. You want to keep this as low as you can. And we can see there in November that an increase across all four of those and as we saw in that previous chart there as well.

Let's have a brief look at App Releases, there's a lot going on in this chart here but what I can do is focus on various things. For example, if I look at look back in this period here goes from the start of September up until the end of November so it's a few months of releases week by week. And what I can see here is version 4.3.41 and that dominated around the week commencing 19th of September so, interesting.

One of the things I can see is there's across the board at any point in time there's lots and lots of apps being rated, lots of variations or versions of it being rated so that would be confusing. So why aren't customers actually updating their apps regularly? Are they not forced to? I'm not sure about how Chase works like that.

Obviously there's a lot of confusion going on. If you look at the week commencing the 7th of November you've got one, two, three, four versions at least of the app sitting there.

So, that's obviously confusing for the feedback you're getting and whatever else is going on. So one of the things I can actually see is that version 4.3.6.2 is the one that coincides with that downward trend. So obviously it's just problems with that.

Let's have a look at a bank from the UK as an example. This is NatWest out of the UK. This is their release cycle and look how neat that is, basically we're looking here at say the weak commencing the 12th of September, we have a release a version 7.2.2 and then basically it all the other version drops away, 7.2.1 drops away.

So customers are taking up this release as soon as it happens. So whether there's a more trust for NatWest or not I'm not sure. But they take that up and it moves along and then four weeks later we get another release popping through. Very neatly coming through four weeks later. It looks like the release cycle is four weeks, they don't release many things in between so they sort of they must do a lot of testing beforehand to get that right. So positive for NatWest but then obviously I'll go back and have a look at what we're doing with Chase and it's inconsistent here so I think they need to work out this cycle and how that works.

Let's have a look though at version 4.362 . First of all, let's have a look at a broad perspective about what's going on.

The major topics coming through from here, Support at Functional Suitability we'll look at that in a second what does that mean?

There's problems with the Mobile App Update, there's Poor User Interface, App Functions Poorly... there's all various things like Biometric ID is Not Working so you can see it's all red, it's probably the theme here, there's a lot of problems going on with this release.

So we're seeing very similar things we saw up front: "Doesn't show the running balance", "won't let me sign in", "it's broken again" they talk about the QA Department not testing it, so this person here which is probably common, then they're used to it not working when this new app release comes through, which is probably going back to that trust of those App Release so I think, you know.

Chase needs to build that trust again with the App Release to make sure they're getting that right and Chase needs to fix a few things particularly their release cycle to get up to this level.

00:10:09 - Glenn: Fantastic insights yet again, my friend, and look forward to January where we're going to be doing a look back 2022, a year in review.